What is Global A2P SMS and CPaaS in BFSI Market?

Global A2P SMS (Application-to-Person Short Message Service) and CPaaS (Communications Platform as a Service) are integral components in the BFSI (Banking, Financial Services, and Insurance) market. A2P SMS refers to messages sent from an application to a mobile user, often used for notifications, alerts, and marketing messages. CPaaS, on the other hand, is a cloud-based platform that allows businesses to integrate real-time communication features like voice, video, and messaging into their applications without needing to build backend infrastructure. In the BFSI sector, these technologies are crucial for enhancing customer engagement, improving security through two-factor authentication, and streamlining communication processes. They enable banks, financial institutions, and insurance companies to deliver timely information, such as transaction alerts, policy updates, and promotional offers, directly to customers' mobile devices. This not only improves customer experience but also helps in building trust and loyalty. The integration of A2P SMS and CPaaS in BFSI operations is a testament to the growing importance of digital communication in the financial industry, as it seeks to meet the evolving needs of tech-savvy consumers.

A2P SMS, CPaaS in the Global A2P SMS and CPaaS in BFSI Market:

A2P SMS and CPaaS are pivotal in the BFSI market, offering a range of benefits that enhance communication and operational efficiency. A2P SMS is widely used for sending automated messages from businesses to customers, such as transaction alerts, OTPs (One-Time Passwords), and promotional messages. This form of communication is highly effective due to its direct nature and high open rates, ensuring that critical information reaches customers promptly. In the BFSI sector, A2P SMS is essential for maintaining security and providing real-time updates, which are crucial for customer satisfaction and trust. CPaaS, on the other hand, provides a comprehensive platform for integrating various communication channels, including voice, video, and messaging, into existing applications. This allows BFSI companies to offer seamless and personalized customer experiences. For instance, a bank can use CPaaS to enable video calls with customer service representatives, providing a more interactive and engaging support experience. Additionally, CPaaS facilitates the automation of routine tasks, such as appointment scheduling and customer inquiries, freeing up valuable resources and improving efficiency. The combination of A2P SMS and CPaaS in the BFSI market not only enhances communication but also supports the digital transformation efforts of financial institutions, enabling them to stay competitive in a rapidly evolving landscape.

Bank, Finance Company, Insurance Company in the Global A2P SMS and CPaaS in BFSI Market:

In the BFSI market, the usage of Global A2P SMS and CPaaS is particularly prominent in banks, finance companies, and insurance companies, each leveraging these technologies to improve their operations and customer interactions. Banks utilize A2P SMS to send transaction alerts, fraud notifications, and account updates to customers, ensuring they are informed about their financial activities in real-time. This not only enhances security but also builds trust with customers by keeping them informed and engaged. CPaaS enables banks to integrate communication features into their mobile apps, allowing customers to easily contact support, receive personalized offers, and access financial services on the go. Finance companies, on the other hand, use A2P SMS to communicate loan approvals, payment reminders, and promotional offers to customers. This helps in maintaining a strong relationship with clients and encourages timely payments. CPaaS allows finance companies to offer interactive customer support through voice and video calls, improving customer satisfaction and retention. Insurance companies leverage A2P SMS to send policy updates, renewal reminders, and claim status notifications to policyholders. This ensures that customers are always informed about their insurance policies and can take timely action when needed. CPaaS enables insurance companies to provide virtual consultations and support, making it easier for customers to get assistance and information without visiting a physical office. Overall, the integration of A2P SMS and CPaaS in the BFSI market enhances communication, improves customer experience, and supports the digital transformation of financial institutions.

Global A2P SMS and CPaaS in BFSI Market Outlook:

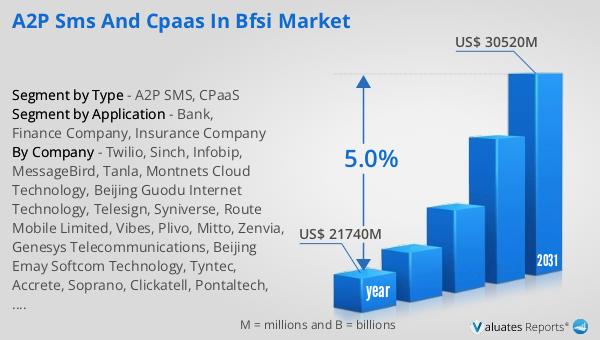

The global market for A2P SMS and CPaaS in the BFSI sector was valued at US$ 21,740 million in 2024 and is anticipated to grow to a revised size of US$ 30,520 million by 2031, reflecting a compound annual growth rate (CAGR) of 5.0% during the forecast period. This growth is indicative of the increasing reliance on digital communication solutions in the financial industry. According to data from the Ministry of Industry and Information Technology of China, the cumulative revenue of telecommunications services in 2022 was 1.58 trillion, marking an 8% increase over the previous year. This data underscores the expanding role of telecommunications in facilitating efficient and secure communication in the BFSI market. As financial institutions continue to embrace digital transformation, the demand for A2P SMS and CPaaS solutions is expected to rise, driven by the need for enhanced customer engagement, improved security, and streamlined operations. The integration of these technologies into BFSI operations not only supports the industry's growth but also ensures that financial institutions can meet the evolving needs of their customers in an increasingly digital world.

| Report Metric | Details |

| Report Name | A2P SMS and CPaaS in BFSI Market |

| Accounted market size in year | US$ 21740 million |

| Forecasted market size in 2031 | US$ 30520 million |

| CAGR | 5.0% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Twilio, Sinch, Infobip, MessageBird, Tanla, Montnets Cloud Technology, Beijing Guodu Internet Technology, Telesign, Syniverse, Route Mobile Limited, Vibes, Plivo, Mitto, Zenvia, Genesys Telecommunications, Beijing Emay Softcom Technology, Tyntec, Accrete, Soprano, Clickatell, Pontaltech, Beijing Chuangshimandao Science and Technology, FotryTwo, AMD Telecom S.A, TXTImpact, Vonage, 3Cinteractive, ClearSky Technologies |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |