What is Global Estate Planning Service Market?

The Global Estate Planning Service Market is a comprehensive sector that provides individuals and families with the tools and guidance necessary to manage their assets and ensure their wishes are honored after their passing. This market encompasses a wide range of services, including the creation of wills, trusts, and other legal documents that outline how a person's estate should be handled. Estate planning is not just for the wealthy; it is a crucial process for anyone who wants to ensure their assets are distributed according to their wishes, minimize taxes, and avoid legal complications for their heirs. The market is driven by an increasing awareness of the importance of estate planning, as well as the growing complexity of financial portfolios and family structures. As people live longer and accumulate more assets, the demand for professional estate planning services continues to rise, making it a vital component of financial planning for individuals across the globe.

Wills, Will Trusts, Lifetime Trusts, Lasting Power of Attorney, Others in the Global Estate Planning Service Market:

In the realm of the Global Estate Planning Service Market, several key components play a crucial role in ensuring that individuals' wishes are respected and their assets are managed effectively. Wills are perhaps the most well-known element of estate planning. They are legal documents that specify how a person's assets should be distributed after their death. A will can also appoint guardians for minor children and name an executor to manage the estate. Will Trusts, on the other hand, are established through a will and come into effect upon the individual's death. They are designed to manage and protect assets for beneficiaries, often providing more control over how and when assets are distributed. Lifetime Trusts, also known as living trusts, are created during a person's lifetime and can be used to manage assets both before and after death. They offer flexibility and can help avoid the probate process, which can be lengthy and costly. Lasting Power of Attorney is another critical component, allowing individuals to appoint someone to make decisions on their behalf if they become incapacitated. This ensures that financial and healthcare decisions are made according to their wishes. Other elements of estate planning may include healthcare directives, which outline medical preferences, and various types of insurance policies that provide financial security for beneficiaries. Each of these components plays a vital role in the estate planning process, offering peace of mind and ensuring that individuals' wishes are honored.

Married with Children, Blended Family, Single with Children, Others in the Global Estate Planning Service Market:

The Global Estate Planning Service Market serves a diverse range of family structures, each with unique needs and considerations. For those who are married with children, estate planning is essential to ensure that both the spouse and children are provided for in the event of a parent's death. This often involves creating wills and trusts that specify how assets should be distributed and appointing guardians for minor children. Blended families, which may include children from previous relationships, face additional complexities. Estate planning in these cases must carefully consider the needs and rights of all family members, often requiring more detailed and customized plans to ensure fairness and prevent disputes. Single individuals with children also benefit significantly from estate planning, as it allows them to designate guardians for their children and ensure that their assets are used to support their children's future. For others, such as those without children or with unique family dynamics, estate planning can focus on charitable giving, supporting extended family members, or ensuring that specific personal wishes are fulfilled. In all these scenarios, the Global Estate Planning Service Market provides the tools and expertise needed to navigate the complexities of modern family structures and ensure that individuals' wishes are respected and their loved ones are cared for.

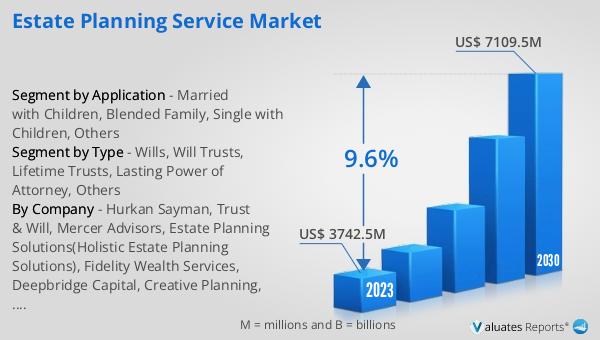

Global Estate Planning Service Market Outlook:

The outlook for the Global Estate Planning Service Market is promising, with significant growth anticipated in the coming years. In 2024, the market was valued at approximately US$ 4,456 million. By 2031, it is expected to expand to a revised size of US$ 8,391 million, reflecting a compound annual growth rate (CAGR) of 9.6% during the forecast period. This growth is driven by several factors, including an increasing awareness of the importance of estate planning, the growing complexity of financial portfolios, and the diverse needs of modern family structures. As more individuals recognize the benefits of professional estate planning services, the demand for these services is expected to rise. This expansion presents opportunities for service providers to innovate and offer tailored solutions that meet the unique needs of their clients. The market's growth also underscores the importance of estate planning as a critical component of financial planning, ensuring that individuals' wishes are honored and their loved ones are cared for.

| Report Metric | Details |

| Report Name | Estate Planning Service Market |

| Accounted market size in year | US$ 4456 million |

| Forecasted market size in 2031 | US$ 8391 million |

| CAGR | 9.6% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Hurkan Sayman, Trust & Will, Mercer Advisors, Estate Planning Solutions(Holistic Estate Planning Solutions), Fidelity Wealth Services, Deepbridge Capital, Creative Planning, Mariner Wealth Advisors, LegalShield, Coastal Wealth Management, NerdWallet, Evelyn Partners, Perpetual Guardian, BNP Paribas Fortis, ArentFox Schiff, Charles Schwab, Downing, Redwood Financial, Northwestern Mutual, Legacy Assurance Plan, Servus Credit Unio, Homrich Berg, WealthCounse, Ingenious, St. James's Place, Vedder Price, Broadway Financial Planning, Shumaker, Thrivent, IOOF, Withum, Strategic Estate Planning Services, Key Retirement Solutions, Triple Point, WITHERS, Vanguard, Sun Life, Rosemont, Carson Wealth Management, EP Wealth Advisors, TIAA, KPMG |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |