What is Global Financial Payment Cards Market?

The Global Financial Payment Cards Market refers to the worldwide industry that encompasses the production, distribution, and usage of payment cards. These cards are essential tools in modern financial transactions, allowing individuals and businesses to conduct transactions without the need for cash. The market includes various types of cards such as credit cards, debit cards, bank cards, and purchasing cards, each serving different purposes and offering unique features. The growth of this market is driven by the increasing adoption of digital payment methods, advancements in technology, and the rising demand for secure and convenient payment solutions. As economies continue to digitize, the reliance on financial payment cards is expected to increase, providing a seamless and efficient way to manage finances. The market is characterized by continuous innovation, with companies striving to enhance security features and user experience. This dynamic environment presents numerous opportunities for growth and development, making the Global Financial Payment Cards Market a vital component of the global financial ecosystem.

Bank Cards, Credit Cards, Debit Cards, Purchasing Cards, Other in the Global Financial Payment Cards Market:

Bank cards are a broad category of financial payment cards issued by banks and financial institutions, allowing users to access their bank accounts and perform transactions. These cards can be used for withdrawing cash from ATMs, making purchases at retail outlets, and conducting online transactions. Bank cards are typically linked directly to the user's bank account, providing a convenient way to manage finances without carrying cash. Credit cards, on the other hand, offer a line of credit to the cardholder, enabling them to borrow funds up to a certain limit for purchases or cash advances. The cardholder is required to pay back the borrowed amount, usually with interest, within a specified period. Credit cards are popular due to their flexibility, rewards programs, and the ability to build credit history. Debit cards are similar to bank cards but are directly linked to the user's checking account. When a purchase is made using a debit card, the amount is immediately deducted from the account balance. Debit cards offer the convenience of cashless transactions without the risk of accumulating debt, making them a preferred choice for many consumers. Purchasing cards, also known as procurement cards, are used by businesses to streamline the purchasing process and manage expenses. These cards are typically issued to employees for business-related expenses, allowing companies to track and control spending more effectively. Purchasing cards help reduce paperwork, improve efficiency, and provide detailed transaction data for better financial management. Other types of financial payment cards include prepaid cards, which are preloaded with a specific amount of money and can be used for transactions until the balance is depleted. Prepaid cards are often used as gift cards or for budgeting purposes, offering a secure and convenient alternative to cash. Each type of card within the Global Financial Payment Cards Market serves a unique purpose, catering to the diverse needs of consumers and businesses worldwide. The market continues to evolve with technological advancements, offering enhanced security features such as EMV chips, contactless payments, and mobile wallet integration. These innovations aim to provide a seamless and secure payment experience, driving the adoption of financial payment cards across the globe.

Personal use, Business use in the Global Financial Payment Cards Market:

The usage of Global Financial Payment Cards Market extends to both personal and business applications, offering a wide range of benefits and conveniences. For personal use, financial payment cards provide individuals with a secure and efficient way to manage their finances. Credit cards, for instance, allow consumers to make purchases without immediate cash outlay, offering the flexibility to pay over time. This can be particularly useful for managing large expenses or emergencies. Additionally, many credit cards offer rewards programs, cashback, and other incentives, making them an attractive option for personal finance management. Debit cards, on the other hand, provide a straightforward way to access funds directly from a bank account, ensuring that spending is limited to available funds and helping individuals avoid debt. Prepaid cards offer another layer of financial control, allowing users to load a specific amount of money onto the card for budgeting purposes. These cards are often used by parents to provide allowances to children or by individuals looking to manage their spending more effectively. For business use, financial payment cards play a crucial role in streamlining operations and managing expenses. Purchasing cards, for example, are widely used by companies to facilitate business-related transactions, reducing the need for petty cash and minimizing administrative burdens. These cards provide detailed transaction records, enabling businesses to track expenses accurately and improve financial reporting. Corporate credit cards are another essential tool for businesses, offering a line of credit to manage cash flow and finance operations. They are often used for travel expenses, office supplies, and other business-related purchases, providing convenience and flexibility. Additionally, financial payment cards can help businesses build credit history, which is vital for securing loans and financing future growth. The integration of advanced technologies such as contactless payments and mobile wallets further enhances the usability of financial payment cards in both personal and business contexts. These innovations offer a seamless payment experience, reducing transaction times and enhancing security. As the Global Financial Payment Cards Market continues to grow, the adoption of these cards in personal and business applications is expected to increase, driven by the demand for secure, efficient, and convenient payment solutions.

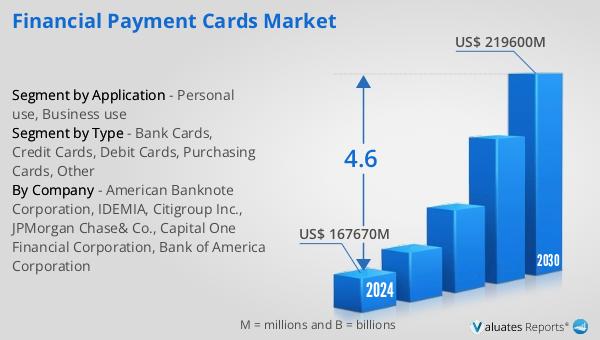

Global Financial Payment Cards Market Outlook:

The outlook for the Global Financial Payment Cards Market indicates a promising growth trajectory. The market is anticipated to expand from a valuation of $167,670 million in 2024 to $219,600 million by 2030. This growth is expected to occur at a Compound Annual Growth Rate (CAGR) of 4.6% over the forecast period. This upward trend reflects the increasing reliance on digital payment methods and the continuous advancements in payment card technologies. The market's expansion is driven by several factors, including the growing demand for secure and convenient payment solutions, the proliferation of e-commerce, and the rising adoption of contactless payment technologies. As consumers and businesses alike seek more efficient ways to manage transactions, the role of financial payment cards becomes increasingly significant. The market's growth also underscores the importance of innovation in enhancing security features and user experience, ensuring that payment cards remain a vital component of the global financial landscape. As the market evolves, stakeholders are likely to focus on developing new products and services that cater to the diverse needs of consumers and businesses, further driving the adoption of financial payment cards worldwide.

| Report Metric | Details |

| Report Name | Financial Payment Cards Market |

| Accounted market size in 2024 | US$ 167670 million |

| Forecasted market size in 2030 | US$ 219600 million |

| CAGR | 4.6 |

| Base Year | 2024 |

| Forecasted years | 2025 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| Segment by Region |

|

| By Company | American Banknote Corporation, IDEMIA, Citigroup Inc., JPMorgan Chase& Co., Capital One Financial Corporation, Bank of America Corporation |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |