What is Global Commodity Trading, Transaction, and Risk Management (CTRM) Software Market?

Global Commodity Trading, Transaction, and Risk Management (CTRM) Software Market is a specialized sector within the broader software industry that focuses on providing solutions for managing the complexities of commodity trading. This market encompasses software tools designed to streamline the trading process, manage transactions, and mitigate risks associated with trading commodities such as oil, gas, metals, and agricultural products. These software solutions are crucial for traders, brokers, and companies involved in the commodity markets as they offer functionalities like trade capture, risk analysis, logistics, and regulatory compliance. The CTRM software market is driven by the need for efficiency, accuracy, and real-time data in trading operations. As global trade becomes more interconnected and complex, the demand for sophisticated software solutions that can handle large volumes of data and provide actionable insights is increasing. This market is characterized by continuous innovation, with vendors constantly enhancing their offerings to meet the evolving needs of the industry. The adoption of CTRM software helps organizations optimize their trading strategies, reduce operational risks, and improve decision-making processes, ultimately leading to better financial performance.

Cloud Based, Web Based in the Global Commodity Trading, Transaction, and Risk Management (CTRM) Software Market:

In the realm of Global Commodity Trading, Transaction, and Risk Management (CTRM) Software Market, cloud-based and web-based solutions have become increasingly prominent. Cloud-based CTRM software refers to solutions that are hosted on remote servers and accessed via the internet. This model offers several advantages, including scalability, flexibility, and cost-effectiveness. Businesses can easily scale their operations up or down based on demand without the need for significant upfront investments in hardware or infrastructure. Cloud-based solutions also facilitate real-time data access and collaboration, enabling traders and analysts to make informed decisions quickly. Moreover, the cloud model supports seamless updates and maintenance, ensuring that users always have access to the latest features and security enhancements. On the other hand, web-based CTRM software is accessed through a web browser, eliminating the need for complex installations or downloads. This approach provides users with the convenience of accessing the software from any device with an internet connection, enhancing mobility and flexibility. Web-based solutions are particularly beneficial for organizations with distributed teams or those that require remote access to trading data. Both cloud-based and web-based CTRM solutions are designed to enhance the efficiency and effectiveness of commodity trading operations. They offer robust features for trade capture, risk management, and compliance, helping organizations navigate the complexities of the global commodity markets. As the demand for real-time data and analytics continues to grow, the adoption of cloud-based and web-based CTRM software is expected to increase, providing businesses with the tools they need to stay competitive in a rapidly evolving market. These solutions are also instrumental in supporting digital transformation initiatives, enabling organizations to leverage advanced technologies such as artificial intelligence and machine learning to gain deeper insights into market trends and optimize their trading strategies. By embracing cloud-based and web-based CTRM software, companies can enhance their operational agility, reduce costs, and improve their overall trading performance.

Large Enterprises, SMEs in the Global Commodity Trading, Transaction, and Risk Management (CTRM) Software Market:

The usage of Global Commodity Trading, Transaction, and Risk Management (CTRM) Software Market varies significantly between large enterprises and small to medium-sized enterprises (SMEs). Large enterprises, with their extensive trading operations and complex supply chains, require robust CTRM solutions that can handle high volumes of transactions and provide comprehensive risk management capabilities. These organizations often deal with multiple commodities across various geographies, necessitating sophisticated software that can integrate seamlessly with their existing systems and provide real-time insights into market dynamics. For large enterprises, CTRM software is essential for optimizing trading strategies, managing regulatory compliance, and mitigating risks associated with price volatility and supply chain disruptions. The software enables them to streamline their operations, enhance decision-making processes, and improve overall efficiency. On the other hand, SMEs, with their more limited resources and simpler trading operations, benefit from CTRM software that is cost-effective and easy to implement. These businesses often prioritize solutions that offer scalability and flexibility, allowing them to grow their operations without incurring significant costs. For SMEs, CTRM software provides the tools needed to manage transactions, assess risks, and ensure compliance with industry regulations. It also helps them gain a competitive edge by providing access to real-time market data and analytics, enabling them to make informed trading decisions. By leveraging CTRM software, SMEs can enhance their operational efficiency, reduce risks, and improve their financial performance. Overall, the adoption of CTRM software in both large enterprises and SMEs is driven by the need to navigate the complexities of the global commodity markets and achieve sustainable growth.

Global Commodity Trading, Transaction, and Risk Management (CTRM) Software Market Outlook:

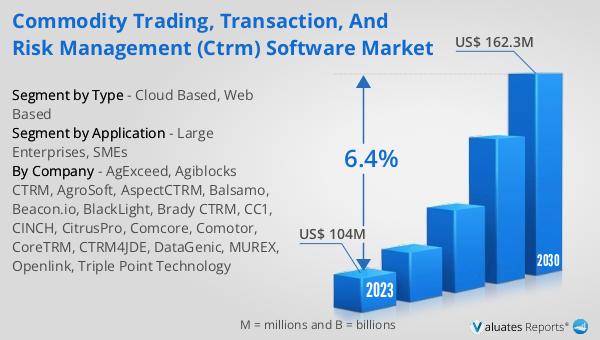

The outlook for the global Commodity Trading, Transaction, and Risk Management (CTRM) Software market indicates a promising growth trajectory. It is anticipated that the market will expand from a valuation of US$ 112 million in 2024 to reach approximately US$ 162.3 million by 2030. This growth is expected to occur at a Compound Annual Growth Rate (CAGR) of 6.4% over the forecast period. This upward trend reflects the increasing demand for sophisticated software solutions that can effectively manage the complexities of commodity trading. As businesses continue to seek ways to optimize their trading operations and mitigate risks, the adoption of CTRM software is likely to rise. The market's growth is also driven by the need for real-time data and analytics, which are essential for making informed trading decisions in a rapidly changing market environment. Additionally, the shift towards digital transformation and the adoption of advanced technologies such as artificial intelligence and machine learning are expected to further fuel the demand for CTRM software. As organizations strive to enhance their operational efficiency and improve their financial performance, the CTRM software market is poised for significant growth in the coming years.

| Report Metric | Details |

| Report Name | Commodity Trading, Transaction, and Risk Management (CTRM) Software Market |

| Accounted market size in 2024 | US$ 112 million |

| Forecasted market size in 2030 | US$ 162.3 million |

| CAGR | 6.4 |

| Base Year | 2024 |

| Forecasted years | 2025 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | AgExceed, Agiblocks CTRM, AgroSoft, AspectCTRM, Balsamo, Beacon.io, BlackLight, Brady CTRM, CC1, CINCH, CitrusPro, Comcore, Comotor, CoreTRM, CTRM4JDE, DataGenic, MUREX, Openlink, Triple Point Technology |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |