What is Global Accounts Payable (AP) Recovery Audit Service Market?

The Global Accounts Payable (AP) Recovery Audit Service Market is a specialized sector focused on identifying and recovering overpayments made by businesses in their accounts payable processes. These services are crucial for organizations as they help in reclaiming funds that might have been lost due to errors, duplicate payments, or overlooked credits. The market encompasses a range of services provided by third-party firms that conduct thorough audits of a company's financial transactions. These audits are designed to scrutinize every aspect of the accounts payable process, ensuring that all payments are accurate and that any discrepancies are identified and rectified. The demand for AP recovery audit services is driven by the increasing complexity of financial transactions and the need for businesses to maintain financial accuracy and efficiency. Companies across various industries utilize these services to enhance their financial health by minimizing losses and improving cash flow. As businesses continue to expand globally, the need for effective AP recovery audit services becomes even more critical, making this market an essential component of modern financial management strategies.

Annual Service, Quarterly Service, Monthly Service in the Global Accounts Payable (AP) Recovery Audit Service Market:

In the Global Accounts Payable (AP) Recovery Audit Service Market, service frequency plays a significant role in determining the effectiveness and efficiency of the audit process. Annual services are typically chosen by organizations that prefer a comprehensive review of their accounts payable processes once a year. This approach allows businesses to conduct a thorough examination of their financial transactions over a 12-month period, identifying any discrepancies or overpayments that may have occurred. Annual audits are beneficial for companies with stable financial processes and fewer transactions, as they provide a detailed overview of the entire fiscal year. On the other hand, quarterly services offer a more frequent review, allowing businesses to identify and rectify errors on a quarterly basis. This approach is ideal for organizations with moderate transaction volumes, as it provides a balance between thoroughness and timeliness. Quarterly audits help in maintaining financial accuracy throughout the year, reducing the risk of accumulating significant overpayments. Monthly services, however, are designed for businesses with high transaction volumes and complex financial processes. These services provide continuous monitoring and immediate identification of discrepancies, ensuring that errors are addressed promptly. Monthly audits are particularly beneficial for large enterprises with dynamic financial operations, as they offer real-time insights into the accounts payable process. By choosing the appropriate service frequency, businesses can tailor their AP recovery audit strategy to align with their specific needs and operational dynamics, ultimately enhancing their financial management and efficiency.

SMEs, Large Enterprises in the Global Accounts Payable (AP) Recovery Audit Service Market:

The usage of Global Accounts Payable (AP) Recovery Audit Service Market varies significantly between Small and Medium-sized Enterprises (SMEs) and Large Enterprises, reflecting their distinct operational needs and financial complexities. For SMEs, AP recovery audit services are invaluable in managing limited resources and ensuring financial accuracy. These businesses often operate with smaller teams and may lack the extensive financial oversight present in larger organizations. By utilizing AP recovery audit services, SMEs can identify and recover overpayments, thereby improving their cash flow and financial stability. The audits help SMEs streamline their accounts payable processes, reduce errors, and enhance overall financial management. For Large Enterprises, the complexity and volume of financial transactions necessitate a more robust approach to AP recovery audits. These organizations often deal with intricate supply chains, multiple vendors, and high transaction volumes, increasing the likelihood of errors and overpayments. AP recovery audit services provide large enterprises with the tools to conduct comprehensive audits, ensuring financial accuracy and compliance. The services help in identifying discrepancies across various departments and locations, offering insights into potential areas of improvement. By leveraging these services, large enterprises can optimize their financial processes, reduce losses, and enhance operational efficiency. Both SMEs and large enterprises benefit from AP recovery audit services, but the scale and scope of their usage differ based on their unique financial landscapes and operational requirements.

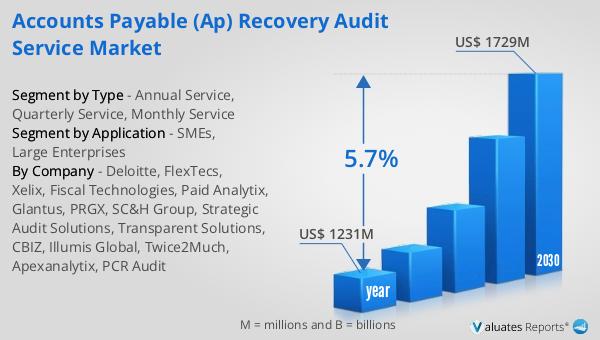

Global Accounts Payable (AP) Recovery Audit Service Market Outlook:

The global market for Accounts Payable (AP) Recovery Audit Service was valued at $1,231 million in 2023 and is anticipated to expand to a revised size of $1,729 million by 2030, reflecting a compound annual growth rate (CAGR) of 5.7% over the forecast period. This growth trajectory underscores the increasing importance of AP recovery audit services in the financial management landscape. As businesses strive for greater financial accuracy and efficiency, the demand for these services is expected to rise. The market's expansion is driven by the growing complexity of financial transactions and the need for organizations to maintain precise financial records. Companies across various industries are recognizing the value of AP recovery audits in identifying and recovering overpayments, thereby enhancing their financial health. The projected growth of the market highlights the critical role these services play in modern financial management strategies. As organizations continue to expand globally, the need for effective AP recovery audit services becomes even more pronounced, making this market an essential component of the financial services industry. The anticipated growth in market size reflects the increasing reliance on these services to optimize financial processes and improve cash flow management.

| Report Metric | Details |

| Report Name | Accounts Payable (AP) Recovery Audit Service Market |

| Accounted market size in year | US$ 1231 million |

| Forecasted market size in 2030 | US$ 1729 million |

| CAGR | 5.7% |

| Base Year | year |

| Forecasted years | 2025 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Deloitte, FlexTecs, Xelix, Fiscal Technologies, Paid Analytix, Glantus, PRGX, SC&H Group, Strategic Audit Solutions, Transparent Solutions, CBIZ, Illumis Global, Twice2Much, Apexanalytix, PCR Audit |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |