What is Third Party Due Diligence Service - Global Market?

Third-party due diligence services are essential in today's global market, providing businesses with a comprehensive evaluation of potential partners, suppliers, or clients. These services involve a thorough investigation into the background, financial health, legal standing, and overall reputation of third parties that a company might engage with. The primary goal is to mitigate risks associated with fraud, corruption, and non-compliance with regulations. By employing third-party due diligence, companies can ensure that their business relationships are built on a foundation of trust and transparency. This process typically includes verifying the third party's identity, assessing their financial stability, and evaluating their compliance with relevant laws and regulations. Additionally, it involves checking for any past involvement in illegal activities or unethical practices. In a global market where businesses are increasingly interconnected, third-party due diligence services help organizations navigate complex regulatory environments and protect their reputation. These services are crucial for maintaining ethical standards and ensuring that all parties involved in a business transaction are reliable and trustworthy. By conducting thorough due diligence, companies can make informed decisions and avoid potential pitfalls that could harm their operations or reputation.

Financial Third-Party Due Diligence Services, Tax Third-Party Due Diligence Services, Technical Third Party Due Diligence Services, Human Resources Third-Party Due Diligence Service, Others in the Third Party Due Diligence Service - Global Market:

Financial third-party due diligence services focus on evaluating the financial health and stability of a potential business partner. This involves analyzing financial statements, credit reports, and other financial documents to assess the third party's ability to meet its financial obligations. The goal is to identify any financial risks that could impact the business relationship. Tax third-party due diligence services, on the other hand, involve a detailed examination of a third party's tax compliance and history. This includes verifying their tax filings, payments, and any past issues with tax authorities. Ensuring tax compliance is crucial to avoid potential legal issues and financial penalties. Technical third-party due diligence services assess the technical capabilities and infrastructure of a potential partner. This involves evaluating their technology stack, cybersecurity measures, and overall technical expertise. The aim is to ensure that the third party can meet the technical requirements of the business relationship and that their systems are secure and reliable. Human resources third-party due diligence services focus on evaluating the workforce and HR practices of a potential partner. This includes assessing their hiring practices, employee turnover rates, and compliance with labor laws. The goal is to ensure that the third party has a stable and compliant workforce that can support the business relationship. Other types of third-party due diligence services may include environmental, social, and governance (ESG) assessments, which evaluate a third party's commitment to sustainable and ethical practices. These assessments are becoming increasingly important as businesses seek to align themselves with partners who share their values and commitment to sustainability. In the global market, third-party due diligence services are essential for mitigating risks and ensuring that business relationships are built on a foundation of trust and transparency. By conducting thorough due diligence, companies can make informed decisions and avoid potential pitfalls that could harm their operations or reputation. These services provide valuable insights into the financial, technical, and ethical standing of potential partners, helping businesses navigate complex regulatory environments and protect their reputation.

Client, Supplier, Outsourced Business Relationship, Business Partner, Others in the Third Party Due Diligence Service - Global Market:

The usage of third-party due diligence services in the global market spans various areas, including clients, suppliers, outsourced business relationships, business partners, and others. For clients, due diligence services help businesses understand the financial stability and reputation of potential clients before entering into a contract. This ensures that the client can meet their financial obligations and that the business relationship is built on trust. For suppliers, due diligence services are crucial in assessing the reliability and quality of the products or services provided. This involves evaluating the supplier's production capabilities, quality control processes, and compliance with industry standards. By conducting due diligence on suppliers, businesses can ensure a consistent supply chain and avoid potential disruptions. In outsourced business relationships, due diligence services help companies evaluate the capabilities and reliability of third-party service providers. This includes assessing their technical expertise, financial stability, and compliance with relevant regulations. By conducting thorough due diligence, businesses can ensure that their outsourced partners can deliver the required services and meet contractual obligations. For business partners, due diligence services provide valuable insights into the financial health, reputation, and compliance of potential partners. This helps businesses make informed decisions and avoid potential risks associated with fraud, corruption, or non-compliance. Other areas where third-party due diligence services are used include mergers and acquisitions, where due diligence is crucial in evaluating the financial and operational health of the target company. In the global market, third-party due diligence services are essential for mitigating risks and ensuring that business relationships are built on a foundation of trust and transparency. By conducting thorough due diligence, companies can make informed decisions and avoid potential pitfalls that could harm their operations or reputation. These services provide valuable insights into the financial, technical, and ethical standing of potential partners, helping businesses navigate complex regulatory environments and protect their reputation.

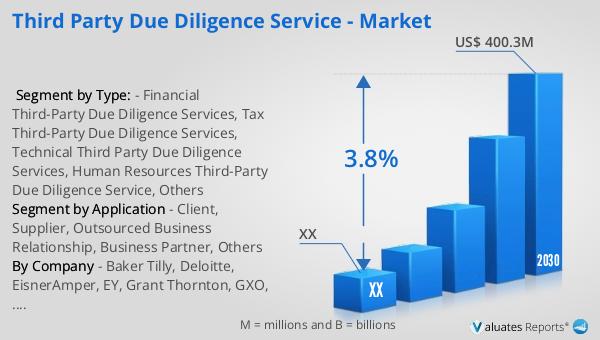

Third Party Due Diligence Service - Global Market Outlook:

The global market for third-party due diligence services was valued at approximately $290 million in 2023. It is projected to grow to an estimated $400.3 million by 2030, reflecting a compound annual growth rate (CAGR) of 3.8% during the forecast period from 2024 to 2030. This growth indicates an increasing demand for due diligence services as businesses seek to mitigate risks and ensure compliance in their operations. In North America, the market for third-party due diligence services was valued at $ million in 2023, with expectations to reach $ million by 2030. The CAGR for this region during the forecast period of 2024 through 2030 is projected at %. This growth is driven by the increasing complexity of regulatory environments and the need for businesses to protect their reputation and operations. As companies continue to expand globally, the demand for third-party due diligence services is expected to rise, providing valuable insights into the financial, technical, and ethical standing of potential partners. By conducting thorough due diligence, businesses can make informed decisions and avoid potential pitfalls that could harm their operations or reputation. These services are essential for navigating complex regulatory environments and ensuring that business relationships are built on a foundation of trust and transparency.

| Report Metric | Details |

| Report Name | Third Party Due Diligence Service - Market |

| Forecasted market size in 2030 | US$ 400.3 million |

| CAGR | 3.8% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Baker Tilly, Deloitte, EisnerAmper, EY, Grant Thornton, GXO, KPMG, Kroll, Licks Attorneys, Moss Adams, OneTrust, Refinitiv, Venminder |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |