What is Strategic Trading Robot - Global Market?

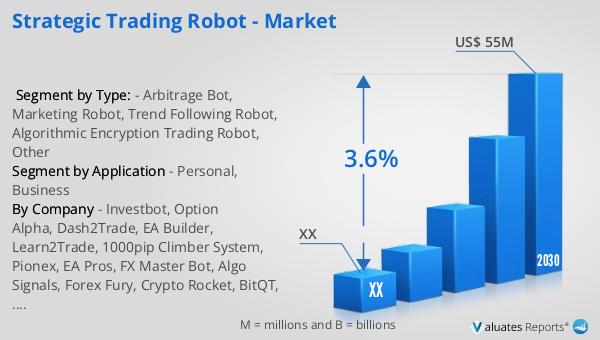

Strategic Trading Robots are sophisticated software programs designed to automate trading decisions in financial markets. These robots use complex algorithms and data analysis to execute trades at optimal times, aiming to maximize profits and minimize risks. The global market for these robots is growing as more traders and investors seek automated solutions to enhance their trading strategies. In 2023, the market was valued at approximately US$ 43 million, and it is projected to grow to US$ 55 million by 2030, with a compound annual growth rate (CAGR) of 3.6% from 2024 to 2030. This growth is driven by advancements in technology, increasing demand for efficient trading solutions, and the rising popularity of algorithmic trading. Strategic Trading Robots offer several advantages, including the ability to process large volumes of data quickly, execute trades without emotional bias, and operate 24/7, which is particularly beneficial in the fast-paced world of financial markets. As these robots become more sophisticated, they are expected to play an increasingly important role in both personal and institutional trading strategies, providing users with a competitive edge in the global market.

Arbitrage Bot, Marketing Robot, Trend Following Robot, Algorithmic Encryption Trading Robot, Other in the Strategic Trading Robot - Global Market:

Arbitrage Bots are a type of Strategic Trading Robot that capitalize on price discrepancies across different markets or exchanges. These bots are programmed to identify and exploit these differences, buying low in one market and selling high in another, often within seconds. This type of trading requires high-speed execution and precise timing, which is where the automation of arbitrage bots becomes invaluable. They can operate across multiple markets simultaneously, ensuring that traders can take advantage of fleeting opportunities that human traders might miss. Marketing Robots, on the other hand, are designed to analyze market trends and consumer behavior to optimize marketing strategies. These robots can process vast amounts of data to identify patterns and predict future trends, allowing businesses to tailor their marketing efforts more effectively. By automating these processes, companies can save time and resources while increasing their marketing efficiency. Trend Following Robots are another category of Strategic Trading Robots that focus on identifying and following market trends. These robots use technical analysis to determine the direction of the market and execute trades that align with these trends. The goal is to ride the wave of market momentum, buying when prices are rising and selling when they are falling. This strategy can be highly profitable, but it also requires careful risk management to avoid significant losses during market reversals. Algorithmic Encryption Trading Robots are a more advanced type of trading robot that incorporates encryption technology to secure trading data and transactions. These robots are particularly useful in markets where data security is a major concern, such as cryptocurrency trading. By encrypting data, these robots ensure that sensitive information is protected from cyber threats, providing traders with peace of mind. Other types of Strategic Trading Robots include those that focus on specific trading strategies, such as scalping, swing trading, or market making. Each of these robots is designed to execute a particular strategy, using algorithms to analyze market conditions and make informed trading decisions. As the global market for Strategic Trading Robots continues to grow, we can expect to see even more specialized robots being developed to meet the diverse needs of traders and investors.

Personal, Business in the Strategic Trading Robot - Global Market:

Strategic Trading Robots are used in various areas, including personal and business trading, to enhance efficiency and profitability. For personal use, these robots offer individual traders the ability to automate their trading strategies, allowing them to participate in the financial markets without needing to constantly monitor market conditions. This is particularly beneficial for those who may not have the time or expertise to trade manually. By using a Strategic Trading Robot, personal traders can set specific parameters and let the robot execute trades on their behalf, ensuring that they do not miss out on potential opportunities. Additionally, these robots can help personal traders manage their risk by setting stop-loss orders and other risk management tools, providing a level of protection against significant losses. In a business context, Strategic Trading Robots are used by financial institutions, hedge funds, and other investment firms to optimize their trading operations. These robots can process large volumes of data quickly and accurately, allowing businesses to make informed trading decisions based on real-time market information. By automating the trading process, businesses can reduce the potential for human error and increase their trading efficiency. Furthermore, Strategic Trading Robots can operate 24/7, enabling businesses to take advantage of trading opportunities around the clock. This is particularly important in global markets, where trading occurs across different time zones. By using these robots, businesses can ensure that they are always in a position to capitalize on market movements, regardless of the time of day. Overall, the use of Strategic Trading Robots in both personal and business contexts offers numerous benefits, including increased efficiency, reduced risk, and the ability to capitalize on market opportunities in real-time.

Strategic Trading Robot - Global Market Outlook:

The global market for Strategic Trading Robots was valued at approximately US$ 43 million in 2023, and it is anticipated to grow to a revised size of US$ 55 million by 2030. This growth represents a compound annual growth rate (CAGR) of 3.6% during the forecast period from 2024 to 2030. The increasing demand for automated trading solutions, coupled with advancements in technology, is driving this growth. As more traders and investors recognize the benefits of using Strategic Trading Robots, such as increased efficiency, reduced risk, and the ability to capitalize on market opportunities in real-time, the market is expected to continue expanding. These robots offer a competitive edge by processing large volumes of data quickly and executing trades without emotional bias, which is particularly important in the fast-paced world of financial markets. As the technology behind these robots continues to evolve, we can expect to see even more sophisticated solutions being developed to meet the diverse needs of traders and investors. The projected growth of the Strategic Trading Robot market highlights the increasing importance of automation in trading and the potential for these robots to revolutionize the way we approach financial markets.

| Report Metric | Details |

| Report Name | Strategic Trading Robot - Market |

| Forecasted market size in 2030 | US$ 55 million |

| CAGR | 3.6% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Investbot, Option Alpha, Dash2Trade, EA Builder, Learn2Trade, 1000pip Climber System, Pionex, EA Pros, FX Master Bot, Algo Signals, Forex Fury, Crypto Rocket, BitQT, BinBot Pro, GPS Forex, Forex Robot Factory, RoboFore |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |