What is Digital and Crypto Currency - Global Market?

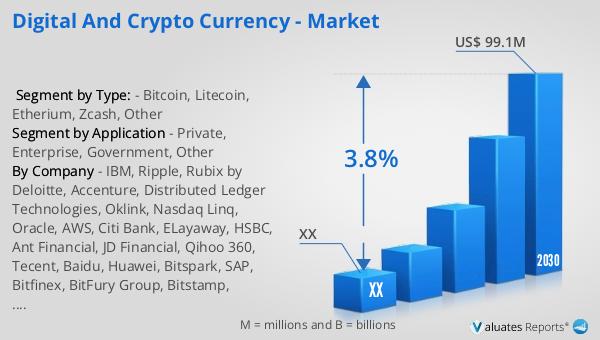

Digital and cryptocurrency markets have become a significant part of the global financial landscape, offering a new way to conduct transactions and store value. Digital currency refers to any currency that is available exclusively in digital form, not in physical form like paper money or coins. Cryptocurrencies, a subset of digital currencies, use cryptography for security and operate on decentralized networks based on blockchain technology. This technology ensures transparency and security, making it difficult for transactions to be altered once recorded. The global market for digital and cryptocurrencies is vast and continually evolving, driven by technological advancements, increasing adoption, and regulatory developments. As of 2023, the market was valued at approximately US$ 76 million, with projections indicating growth to US$ 99.1 million by 2030. This growth is fueled by the increasing acceptance of cryptocurrencies as a legitimate form of payment and investment, as well as the development of new applications and services that leverage blockchain technology. The market's expansion is also supported by the growing interest from institutional investors and the integration of cryptocurrencies into traditional financial systems. Despite challenges such as regulatory uncertainties and market volatility, the digital and cryptocurrency market continues to attract attention and investment from around the world.

Bitcoin, Litecoin, Etherium, Zcash, Other in the Digital and Crypto Currency - Global Market:

Bitcoin, Litecoin, Ethereum, Zcash, and other cryptocurrencies each play unique roles in the global digital currency market. Bitcoin, the first and most well-known cryptocurrency, was created in 2009 by an anonymous person or group known as Satoshi Nakamoto. It introduced the concept of a decentralized digital currency, allowing peer-to-peer transactions without the need for intermediaries like banks. Bitcoin's popularity and market dominance have made it a benchmark for other cryptocurrencies. Its limited supply of 21 million coins and its use as a store of value have earned it the nickname "digital gold." Litecoin, created by Charlie Lee in 2011, is often referred to as the silver to Bitcoin's gold. It was designed to offer faster transaction times and a different hashing algorithm, making it more accessible for everyday transactions. Litecoin's faster block generation time and lower transaction fees make it a popular choice for smaller transactions. Ethereum, launched in 2015 by Vitalik Buterin, introduced the concept of smart contracts, which are self-executing contracts with the terms of the agreement directly written into code. This innovation has enabled the development of decentralized applications (dApps) and has positioned Ethereum as a leading platform for blockchain-based projects. Ethereum's native currency, Ether, is used to power these applications and pay for transaction fees on the network. Zcash, launched in 2016, focuses on privacy and anonymity. It uses advanced cryptographic techniques to offer users the option of "shielded" transactions, which hide the sender, recipient, and transaction amount on the blockchain. This emphasis on privacy has made Zcash a popular choice for users who prioritize confidentiality. Beyond these well-known cryptocurrencies, there are thousands of other digital currencies, each with its own unique features and use cases. Some, like Ripple (XRP), focus on facilitating cross-border payments, while others, like Cardano (ADA) and Polkadot (DOT), aim to improve upon the scalability and interoperability of blockchain networks. The diversity of cryptocurrencies reflects the wide range of applications and innovations within the digital currency space. As the market continues to grow, new cryptocurrencies and blockchain projects are likely to emerge, further expanding the possibilities and potential of this dynamic industry.

Private, Enterprise, Government, Other in the Digital and Crypto Currency - Global Market:

The usage of digital and cryptocurrency in various sectors such as private, enterprise, government, and others is transforming traditional financial systems and creating new opportunities. In the private sector, individuals use cryptocurrencies for a variety of purposes, including investment, remittances, and online purchases. The decentralized nature of cryptocurrencies allows users to have greater control over their finances, reducing reliance on traditional banking systems. This is particularly beneficial in regions with limited access to banking services, where cryptocurrencies can provide an alternative means of financial inclusion. Enterprises are increasingly exploring the use of digital currencies to streamline operations and reduce costs. Blockchain technology, which underpins cryptocurrencies, offers enhanced security, transparency, and efficiency in transactions. Businesses are leveraging these benefits to improve supply chain management, facilitate cross-border payments, and enhance customer loyalty programs. Some companies are even accepting cryptocurrencies as a form of payment, catering to a growing demographic of tech-savvy consumers. Governments around the world are also recognizing the potential of digital currencies and blockchain technology. Some are exploring the development of central bank digital currencies (CBDCs) to modernize their financial systems and improve monetary policy implementation. CBDCs could offer a secure and efficient means of payment, while also providing governments with greater control over the money supply. Additionally, blockchain technology is being used to enhance transparency and efficiency in public services, such as land registration and voting systems. In other areas, digital currencies are being used to support charitable donations, facilitate peer-to-peer lending, and enable new forms of fundraising, such as initial coin offerings (ICOs) and security token offerings (STOs). These applications demonstrate the versatility and potential of digital currencies to drive innovation and create new economic opportunities. As the global market for digital and cryptocurrencies continues to evolve, their usage across various sectors is likely to expand, offering new possibilities for individuals, businesses, and governments alike.

Digital and Crypto Currency - Global Market Outlook:

The global market for digital and cryptocurrencies was valued at approximately US$ 76 million in 2023. This market is expected to grow significantly, reaching an estimated size of US$ 99.1 million by 2030. This growth represents a compound annual growth rate (CAGR) of 3.8% during the forecast period from 2024 to 2030. The increasing adoption of digital currencies as a legitimate form of payment and investment is a key driver of this growth. As more individuals and businesses recognize the benefits of cryptocurrencies, such as lower transaction costs, faster processing times, and enhanced security, the demand for these digital assets is expected to rise. Additionally, the development of new applications and services that leverage blockchain technology is likely to contribute to the market's expansion. Institutional investors are also playing a significant role in the growth of the digital currency market, as they seek to diversify their portfolios and capitalize on the potential of this emerging asset class. The integration of cryptocurrencies into traditional financial systems is further supporting market growth, as it provides greater legitimacy and accessibility for digital currencies. Despite challenges such as regulatory uncertainties and market volatility, the global market for digital and cryptocurrencies is poised for continued growth, driven by technological advancements and increasing acceptance worldwide.

| Report Metric | Details |

| Report Name | Digital and Crypto Currency - Market |

| Forecasted market size in 2030 | US$ 99.1 million |

| CAGR | 3.8% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | IBM, Ripple, Rubix by Deloitte, Accenture, Distributed Ledger Technologies, Oklink, Nasdaq Linq, Oracle, AWS, Citi Bank, ELayaway, HSBC, Ant Financial, JD Financial, Qihoo 360, Tecent, Baidu, Huawei, Bitspark, SAP, Bitfinex, BitFury Group, Bitstamp, Coinbase, Coinsecure, Litecoin, OKEX Fintech Company, Poloniex, Unocoin Technologies Private |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |