What is Rideshare Insurance - Global Market?

Rideshare insurance is a specialized type of coverage designed to protect drivers who use their personal vehicles for ridesharing services like Uber and Lyft. Traditional personal auto insurance policies often do not cover accidents or incidents that occur while the vehicle is being used for commercial purposes, such as ridesharing. This gap in coverage can leave drivers vulnerable to significant financial risks. Rideshare insurance fills this gap by providing coverage during the periods when the driver is logged into the rideshare app but has not yet accepted a ride, as well as during the ride itself. The global market for rideshare insurance is growing as more people turn to ridesharing as a flexible source of income. Insurance companies are responding by offering tailored policies that address the unique risks associated with ridesharing. These policies can vary widely in terms of coverage and cost, depending on factors such as the driver's location, the rideshare company they work for, and their driving history. As the rideshare industry continues to expand globally, the demand for rideshare insurance is expected to increase, prompting further innovation and competition among insurance providers.

Single Insurance, Comprehensive Insurance in the Rideshare Insurance - Global Market:

Single insurance and comprehensive insurance are two types of coverage options available within the rideshare insurance market. Single insurance typically refers to a policy that provides coverage for a specific period or event, such as a single ride or a specific time frame when the driver is logged into the rideshare app. This type of insurance is often more affordable and can be a good option for drivers who only occasionally use their vehicle for ridesharing. It provides basic coverage that can protect against liability and damage during the specified period, but it may not offer the same level of protection as a more comprehensive policy. On the other hand, comprehensive insurance offers broader coverage that includes protection for a wide range of incidents and scenarios. This type of policy is designed to cover not only the periods when the driver is actively engaged in ridesharing but also when the vehicle is being used for personal purposes. Comprehensive insurance can include coverage for collision, theft, vandalism, and other risks that a driver might face. It is generally more expensive than single insurance but offers greater peace of mind and financial protection. In the global market, the choice between single and comprehensive insurance often depends on the driver's needs, budget, and the level of risk they are willing to assume. Insurance providers are increasingly offering flexible options that allow drivers to customize their coverage based on their specific circumstances. This flexibility is crucial in a market where the needs of drivers can vary significantly depending on factors such as location, frequency of ridesharing, and the rideshare platform they use. As the rideshare industry continues to evolve, insurance companies are likely to develop even more innovative products to meet the changing needs of drivers. This could include policies that offer dynamic pricing based on real-time data, such as the driver's location, time of day, and driving behavior. Such innovations could make rideshare insurance more accessible and affordable for a wider range of drivers, further fueling the growth of the global market.

Personal, Business in the Rideshare Insurance - Global Market:

Rideshare insurance plays a crucial role in both personal and business contexts within the global market. For personal use, rideshare insurance provides an essential safety net for drivers who use their vehicles for both personal and commercial purposes. Traditional personal auto insurance policies often exclude coverage for incidents that occur while the vehicle is being used for ridesharing, leaving drivers exposed to significant financial risks. Rideshare insurance bridges this gap by offering coverage during the periods when the driver is logged into the rideshare app but has not yet accepted a ride, as well as during the ride itself. This ensures that drivers are protected against liability and damage, regardless of whether they are using their vehicle for personal errands or transporting passengers for a rideshare company. In a business context, rideshare insurance is vital for companies that operate fleets of vehicles for ridesharing services. These companies need to ensure that their drivers and vehicles are adequately covered to protect against potential liabilities and financial losses. Rideshare insurance provides comprehensive coverage that can include protection for collision, theft, vandalism, and other risks that a business might face. This type of insurance is essential for maintaining the financial stability and reputation of a rideshare company, as it ensures that both drivers and passengers are protected in the event of an accident or other incident. In the global market, the demand for rideshare insurance is driven by the growing popularity of ridesharing services and the increasing number of people who rely on them for transportation. As more individuals and businesses enter the rideshare industry, the need for specialized insurance products that address the unique risks associated with ridesharing is expected to grow. Insurance providers are responding to this demand by offering a range of flexible and customizable policies that cater to the diverse needs of drivers and companies. This includes options for dynamic pricing based on real-time data, as well as policies that offer varying levels of coverage depending on the driver's location, frequency of ridesharing, and the rideshare platform they use. As the rideshare industry continues to expand globally, the role of rideshare insurance in both personal and business contexts is likely to become even more significant, driving further innovation and competition among insurance providers.

Rideshare Insurance - Global Market Outlook:

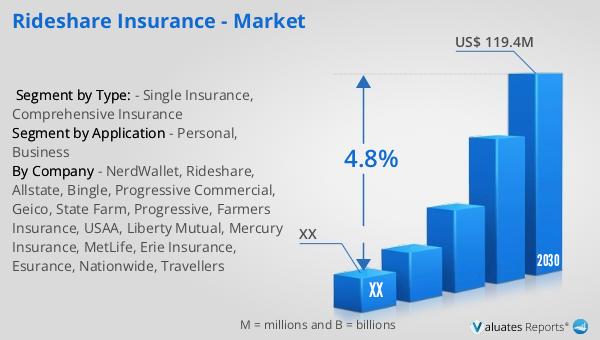

The global market for rideshare insurance was valued at approximately $86 million in 2023. Looking ahead, it is projected to grow to a revised size of $119.4 million by 2030, reflecting a compound annual growth rate (CAGR) of 4.8% over the forecast period from 2024 to 2030. This growth is indicative of the increasing demand for rideshare insurance as more people engage in ridesharing activities, either as drivers or passengers. The rideshare industry has seen significant expansion in recent years, with more individuals opting for flexible work opportunities and more consumers choosing ridesharing services for their transportation needs. As a result, the need for specialized insurance products that cater to the unique risks associated with ridesharing has become more pronounced. Insurance providers are responding to this demand by developing innovative products that offer tailored coverage options for drivers and companies involved in the rideshare industry. This includes policies that provide coverage during the periods when the driver is logged into the rideshare app but has not yet accepted a ride, as well as during the ride itself. As the rideshare industry continues to grow and evolve, the global market for rideshare insurance is expected to expand, driven by the increasing number of people who rely on ridesharing services and the need for comprehensive coverage that addresses the unique risks associated with this mode of transportation.

| Report Metric | Details |

| Report Name | Rideshare Insurance - Market |

| Forecasted market size in 2030 | US$ 119.4 million |

| CAGR | 4.8% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | NerdWallet, Rideshare, Allstate, Bingle, Progressive Commercial, Geico, State Farm, Progressive, Farmers Insurance, USAA, Liberty Mutual, Mercury Insurance, MetLife, Erie Insurance, Esurance, Nationwide, Travellers |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |