What is Protective Films for Medical Equipment and Consumables - Global Market?

Protective films for medical equipment and consumables are specialized materials designed to safeguard medical devices and supplies from contamination, damage, and wear during storage, transportation, and use. These films are crucial in maintaining the sterility and integrity of medical products, ensuring they remain safe and effective for patient care. They are typically made from various polymers and are engineered to provide a barrier against moisture, dust, and other environmental factors that could compromise the quality of medical equipment. The global market for these protective films is driven by the increasing demand for advanced healthcare solutions, the rising prevalence of chronic diseases, and the growing emphasis on infection control in healthcare settings. As healthcare facilities strive to meet stringent regulatory standards and enhance patient safety, the adoption of protective films is expected to rise. These films are used across a wide range of medical devices and consumables, including surgical instruments, diagnostic equipment, and disposable medical supplies, highlighting their versatility and importance in the healthcare industry. The market is characterized by continuous innovation, with manufacturers developing new materials and technologies to improve the performance and sustainability of protective films.

Polyurethane Material, Polyethylene Material, Polypropylene Material, Others in the Protective Films for Medical Equipment and Consumables - Global Market:

Polyurethane, polyethylene, and polypropylene are among the most commonly used materials in the production of protective films for medical equipment and consumables, each offering unique properties that make them suitable for specific applications. Polyurethane films are known for their excellent elasticity, durability, and resistance to abrasion, making them ideal for applications where flexibility and strength are required. They provide a high level of protection against mechanical damage and are often used in situations where the film needs to conform to complex shapes or surfaces. Additionally, polyurethane films are breathable, allowing moisture vapor to pass through while keeping liquids and contaminants out, which is particularly beneficial in medical applications where maintaining a sterile environment is crucial. Polyethylene films, on the other hand, are valued for their lightweight nature, chemical resistance, and cost-effectiveness. They are widely used in the packaging of medical devices and consumables due to their ability to provide a reliable barrier against moisture and contaminants. Polyethylene films are also easy to process and can be produced in various thicknesses and forms, making them versatile for different medical applications. Polypropylene films offer a unique combination of strength, clarity, and resistance to chemicals and heat. These properties make them suitable for applications where transparency and durability are important, such as in the packaging of sterile medical supplies. Polypropylene films are also known for their low density, which contributes to their lightweight nature and ease of handling. In addition to these materials, other polymers and composites are also used in the production of protective films, each selected based on the specific requirements of the application. For instance, some films may incorporate antimicrobial agents to further enhance their protective capabilities, while others may be designed to be biodegradable to address environmental concerns. The choice of material is often influenced by factors such as the intended use of the film, the type of medical device or consumable being protected, and the regulatory standards that must be met. As the demand for protective films continues to grow, manufacturers are investing in research and development to create new materials and technologies that offer improved performance, sustainability, and cost-effectiveness. This ongoing innovation is expected to drive the evolution of the protective films market, providing healthcare providers with more effective solutions for safeguarding medical equipment and consumables.

Class I Medical Device, Class II Medical Device, Class III Medical Device in the Protective Films for Medical Equipment and Consumables - Global Market:

Protective films play a vital role in the medical industry by ensuring the safety and integrity of medical devices across different classes, namely Class I, Class II, and Class III medical devices. Class I medical devices are typically low-risk products that require minimal regulatory control. These include items like bandages, examination gloves, and handheld surgical instruments. Protective films for Class I devices are primarily used to maintain cleanliness and prevent contamination during storage and handling. They provide a basic barrier against dust, moisture, and other environmental factors, ensuring that these devices remain safe for use. In the case of Class II medical devices, which are moderate-risk products, protective films are used to offer a higher level of protection. Class II devices include items such as infusion pumps, surgical drapes, and diagnostic equipment. The protective films used for these devices are designed to provide a more robust barrier against contaminants, as well as mechanical protection to prevent damage during transportation and use. These films may also incorporate features such as antimicrobial properties to further enhance their protective capabilities. Class III medical devices are high-risk products that require the most stringent regulatory controls. These include life-supporting and life-sustaining devices such as pacemakers, heart valves, and implantable defibrillators. Protective films for Class III devices are engineered to meet the highest standards of safety and reliability. They provide a critical barrier against contamination and mechanical damage, ensuring that these devices function properly and safely when implanted or used in critical medical procedures. The films used for Class III devices are often subject to rigorous testing and quality control measures to ensure their effectiveness and compliance with regulatory requirements. Across all classes of medical devices, the use of protective films is essential in maintaining the sterility and functionality of the products, ultimately contributing to patient safety and the overall quality of healthcare delivery. As the medical industry continues to evolve, the demand for advanced protective films is expected to grow, driven by the need for more effective and reliable solutions to safeguard medical equipment and consumables.

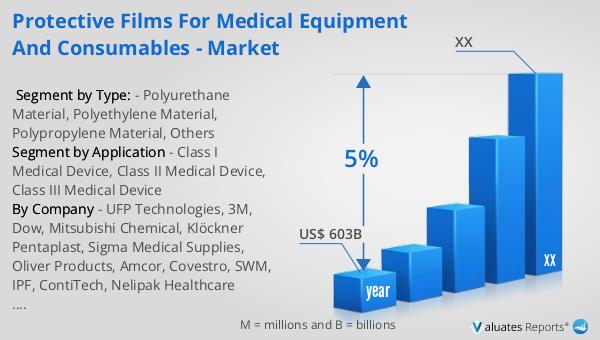

Protective Films for Medical Equipment and Consumables - Global Market Outlook:

Our research indicates that the global market for medical devices is projected to reach approximately $603 billion in 2023, with an anticipated growth rate of 5% annually over the next six years. This growth is driven by several factors, including the increasing prevalence of chronic diseases, advancements in medical technology, and the rising demand for healthcare services worldwide. As populations age and healthcare needs become more complex, the demand for medical devices is expected to rise, fueling the expansion of the market. Additionally, the ongoing focus on improving patient outcomes and enhancing the efficiency of healthcare delivery is driving innovation in the medical device sector, leading to the development of new and improved products. The protective films market, as a subset of the broader medical device market, is poised to benefit from these trends, as healthcare providers seek to ensure the safety and integrity of their equipment and consumables. With the growing emphasis on infection control and regulatory compliance, the adoption of protective films is likely to increase, further contributing to the market's growth. As the industry continues to evolve, manufacturers are expected to invest in research and development to create more advanced and sustainable protective film solutions, meeting the changing needs of healthcare providers and patients alike.

| Report Metric | Details |

| Report Name | Protective Films for Medical Equipment and Consumables - Market |

| Accounted market size in year | US$ 603 billion |

| CAGR | 5% |

| Base Year | year |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | UFP Technologies, 3M, Dow, Mitsubishi Chemical, Klöckner Pentaplast, Sigma Medical Supplies, Oliver Products, Amcor, Covestro, SWM, IPF, ContiTech, Nelipak Healthcare Packaging, Everlon, FSI Coating Technologies, Permali, Spectrum, Wiicare |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |