What is Mobile Payment Chip - Global Market?

Mobile payment chips are a crucial component of the global market, revolutionizing how transactions are conducted by enabling secure, contactless payments through mobile devices. These chips are embedded in smartphones, smartwatches, and other wearable devices, allowing users to make payments with a simple tap or wave. The technology behind mobile payment chips involves Near Field Communication (NFC), which facilitates the wireless exchange of data between the chip and a payment terminal. This innovation has gained significant traction due to its convenience, speed, and enhanced security features, such as encryption and tokenization, which protect sensitive financial information. As consumers increasingly embrace digital wallets and contactless payments, the demand for mobile payment chips continues to rise, driving growth in the global market. This trend is further fueled by the proliferation of smartphones and the expansion of digital payment infrastructures worldwide, making mobile payment chips an integral part of the modern financial ecosystem. The global market for these chips is characterized by rapid technological advancements and increasing competition among manufacturers, all striving to deliver more efficient, secure, and user-friendly solutions to meet the evolving needs of consumers and businesses alike.

Sleuth-6 Module, Sleuth-5 Module, Sleuth-4 Module in the Mobile Payment Chip - Global Market:

The Sleuth-6, Sleuth-5, and Sleuth-4 modules are integral components in the mobile payment chip market, each offering unique features and capabilities that cater to different segments of the global market. The Sleuth-6 module represents the latest advancement in mobile payment technology, designed to provide enhanced security and faster transaction processing. It incorporates cutting-edge encryption algorithms and biometric authentication features, such as fingerprint and facial recognition, ensuring that transactions are not only swift but also secure. This module is particularly favored by high-end smartphone manufacturers and financial institutions that prioritize security and user experience. On the other hand, the Sleuth-5 module strikes a balance between performance and cost-effectiveness. It is engineered to deliver reliable payment processing capabilities while maintaining affordability, making it an attractive option for mid-range devices and emerging markets. The Sleuth-5 module supports a wide range of payment applications and is compatible with various operating systems, ensuring seamless integration into different mobile platforms. Its versatility and cost-efficiency make it a popular choice among manufacturers looking to offer mobile payment solutions to a broader audience. Meanwhile, the Sleuth-4 module caters to entry-level devices and budget-conscious consumers. It provides essential mobile payment functionalities without the advanced features found in its more sophisticated counterparts. Despite its simplicity, the Sleuth-4 module ensures secure transactions through basic encryption protocols and supports contactless payments, making it suitable for markets where affordability is a key consideration. This module is often used in regions with developing digital payment infrastructures, where the primary goal is to introduce consumers to the convenience of mobile payments. Collectively, these modules illustrate the diverse landscape of the mobile payment chip market, where manufacturers strive to meet the varying demands of consumers and businesses across different economic and technological environments. As the global market continues to evolve, these modules will play a pivotal role in shaping the future of mobile payments, driving innovation, and expanding access to secure and convenient payment solutions worldwide.

Supermarket, Food, Retail, Entertainment Place, Others in the Mobile Payment Chip - Global Market:

Mobile payment chips have found extensive usage across various sectors, transforming the way transactions are conducted in supermarkets, food outlets, retail stores, entertainment venues, and beyond. In supermarkets, mobile payment chips facilitate quick and efficient checkouts, reducing wait times and enhancing the overall shopping experience. Customers can simply tap their smartphones or smartwatches at the payment terminal, eliminating the need for cash or physical cards. This not only speeds up the payment process but also minimizes physical contact, a feature that has become increasingly important in the wake of health concerns. In the food industry, mobile payment chips enable seamless transactions at restaurants, cafes, and food delivery services. Customers can easily pay for their meals using their mobile devices, streamlining the payment process and allowing for a more convenient dining experience. This technology also supports loyalty programs and digital receipts, providing added value to both consumers and businesses. In the retail sector, mobile payment chips are revolutionizing the shopping experience by offering contactless payment options that enhance security and convenience. Retailers can integrate mobile payment solutions into their point-of-sale systems, allowing customers to make purchases with a simple tap. This not only improves the speed of transactions but also reduces the risk of fraud, as mobile payment chips employ advanced encryption and tokenization techniques. Entertainment venues, such as cinemas, amusement parks, and concert halls, are also leveraging mobile payment chips to streamline ticket purchases and concession sales. Visitors can use their mobile devices to buy tickets, snacks, and merchandise, enhancing the overall experience and reducing the need for cash handling. Beyond these sectors, mobile payment chips are being adopted in various other areas, including transportation, healthcare, and education, where they facilitate secure and efficient transactions. In transportation, for instance, commuters can use mobile payment chips to pay for fares on buses, trains, and other public transit systems, simplifying the payment process and reducing the need for physical tickets. In healthcare, mobile payment chips enable patients to pay for services and prescriptions with ease, while in education, they support cashless transactions in cafeterias and bookstores. Overall, the widespread adoption of mobile payment chips across these diverse sectors underscores their versatility and the growing demand for secure, convenient, and contactless payment solutions in today's digital economy.

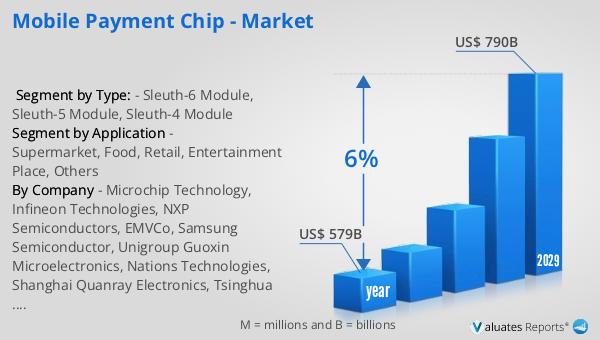

Mobile Payment Chip - Global Market Outlook:

The global semiconductor market, which includes mobile payment chips, was valued at approximately $579 billion in 2022. This market is projected to grow significantly, reaching around $790 billion by 2029, with a compound annual growth rate (CAGR) of 6% during the forecast period. This growth is driven by several factors, including the increasing demand for advanced electronic devices, the proliferation of the Internet of Things (IoT), and the expansion of digital payment infrastructures worldwide. As technology continues to evolve, the semiconductor industry is poised to play a crucial role in enabling innovations across various sectors, from consumer electronics to automotive and industrial applications. The rising adoption of mobile payment solutions is a key contributor to this growth, as consumers and businesses alike seek more efficient, secure, and convenient ways to conduct transactions. The integration of mobile payment chips into smartphones, wearables, and other connected devices is expected to drive further demand for semiconductors, as these chips require sophisticated processing capabilities and advanced security features. Additionally, the ongoing development of 5G networks and the increasing focus on artificial intelligence and machine learning applications are anticipated to create new opportunities for the semiconductor market, further fueling its expansion. As the global market continues to grow, manufacturers and stakeholders in the semiconductor industry will need to adapt to changing consumer preferences and technological advancements, ensuring that they remain competitive and capable of meeting the evolving needs of the digital economy.

| Report Metric | Details |

| Report Name | Mobile Payment Chip - Market |

| Accounted market size in year | US$ 579 billion |

| Forecasted market size in 2029 | US$ 790 billion |

| CAGR | 6% |

| Base Year | year |

| Forecasted years | 2024 - 2029 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Microchip Technology, Infineon Technologies, NXP Semiconductors, EMVCo, Samsung Semiconductor, Unigroup Guoxin Microelectronics, Nations Technologies, Shanghai Quanray Electronics, Tsinghua Tongfang, Shen Zhen Wasam Technology |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |