What is Global SME Insurance Market?

The Global SME Insurance Market refers to the insurance products and services specifically designed for Small and Medium-sized Enterprises (SMEs) around the world. SMEs are businesses with a limited number of employees and a relatively small amount of revenue compared to larger corporations. These businesses often face unique risks and challenges that require tailored insurance solutions. The global SME insurance market encompasses a wide range of insurance types, including property insurance, liability insurance, business interruption insurance, and more. These insurance products help SMEs mitigate risks associated with their operations, such as damage to property, legal liabilities, and loss of income due to unforeseen events. The market is driven by the increasing awareness among SMEs about the importance of risk management and the growing availability of customized insurance products. Additionally, advancements in technology have made it easier for insurance providers to offer more personalized and efficient services to SMEs. Overall, the global SME insurance market plays a crucial role in supporting the sustainability and growth of small and medium-sized businesses worldwide.

Insurance for Non-employing, Insurance for 1-9 Employees, Insurance for above 10 Employees in the Global SME Insurance Market:

Insurance for non-employing businesses, those with 1-9 employees, and those with more than 10 employees each have distinct needs and considerations within the Global SME Insurance Market. Non-employing businesses, which are typically sole proprietorships or partnerships without any employees, often require basic insurance coverage such as general liability insurance and property insurance. These policies protect against common risks like property damage, theft, and third-party claims. For businesses with 1-9 employees, the insurance needs become more complex. In addition to general liability and property insurance, these businesses may need workers' compensation insurance to cover medical expenses and lost wages for employees injured on the job. They might also consider professional liability insurance, especially if they provide specialized services that could lead to claims of negligence or errors. As businesses grow and have more than 10 employees, their insurance requirements expand further. Larger SMEs often need comprehensive coverage that includes business interruption insurance, which compensates for lost income during periods when the business cannot operate due to covered events like natural disasters. They may also require employment practices liability insurance to protect against claims related to wrongful termination, discrimination, or harassment. Additionally, larger SMEs might invest in cyber liability insurance to safeguard against data breaches and cyber-attacks, which can have significant financial and reputational impacts. The insurance needs of SMEs vary widely based on their size, industry, and specific risks, making it essential for these businesses to work closely with insurance providers to tailor coverage to their unique circumstances.

in the Global SME Insurance Market:

The Global SME Insurance Market serves a variety of applications, each addressing specific risks and needs of small and medium-sized enterprises. One of the primary applications is property insurance, which protects the physical assets of a business, such as buildings, equipment, and inventory, from risks like fire, theft, and natural disasters. This type of insurance is crucial for SMEs that rely heavily on their physical assets to operate. Another important application is liability insurance, which covers legal liabilities arising from third-party claims of bodily injury, property damage, or personal injury. This is particularly important for businesses that interact frequently with customers, clients, or the public, as it helps protect against potentially costly lawsuits. Business interruption insurance is another key application, providing financial support to SMEs when they are unable to operate due to covered events. This insurance helps cover lost income and ongoing expenses, ensuring that the business can recover and resume operations more quickly. Additionally, professional liability insurance, also known as errors and omissions insurance, is essential for service-based SMEs. It protects against claims of negligence, errors, or omissions in the services provided, which can be particularly important for businesses in fields like consulting, legal, or medical services. Cyber liability insurance is becoming increasingly important as SMEs rely more on digital technologies. This insurance covers the costs associated with data breaches, cyber-attacks, and other cyber-related incidents, helping to mitigate the financial and reputational damage that can result from such events. Finally, workers' compensation insurance is a critical application for SMEs with employees, covering medical expenses and lost wages for employees who are injured or become ill due to their work. Each of these applications addresses specific risks and needs, making the Global SME Insurance Market a vital resource for small and medium-sized businesses seeking to protect their operations and ensure long-term success.

Global SME Insurance Market Outlook:

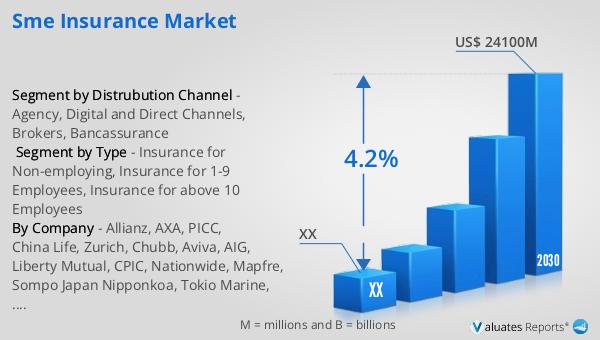

The global market for SME Insurance was estimated to be worth US$ 18,010 million in 2023 and is projected to reach a revised size of US$ 24,100 million by 2030, with a compound annual growth rate (CAGR) of 4.2% during the forecast period from 2024 to 2030. The Americas hold the largest market share, accounting for over 32% of the global market. Within this market, insurance for non-employing businesses is the largest segment, representing more than 70% of the market share. Additionally, the agency distribution channel is the most significant, holding a share of over 57%. These figures highlight the substantial growth potential and the critical role of SME insurance in supporting small and medium-sized enterprises across various regions. The increasing awareness of risk management and the availability of tailored insurance products are key drivers of this market. As SMEs continue to recognize the importance of protecting their assets and operations, the demand for specialized insurance solutions is expected to grow, further fueling the expansion of the global SME insurance market.

| Report Metric | Details |

| Report Name | SME Insurance Market |

| Forecasted market size in 2030 | US$ 24100 million |

| CAGR | 4.2% |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Distrubution Channel |

|

| By Region |

|

| By Company | Allianz, AXA, PICC, China Life, Zurich, Chubb, Aviva, AIG, Liberty Mutual, CPIC, Nationwide, Mapfre, Sompo Japan Nipponkoa, Tokio Marine, Hanover Insurance, Hiscox |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |