What is Global Seniors Travel Insurance Market?

The Global Seniors Travel Insurance Market is a specialized segment of the insurance industry that caters to the unique needs of older travelers. As people age, they often face increased health risks and may require more comprehensive coverage when traveling. This market provides insurance policies specifically designed to cover medical emergencies, trip cancellations, lost luggage, and other travel-related issues for seniors. These policies are tailored to address the higher likelihood of medical incidents and other travel disruptions that older adults might encounter. The market has grown significantly due to the increasing number of seniors who are traveling, either for leisure or to visit family and friends. With the aging global population and the rising trend of senior travel, the demand for specialized travel insurance products has surged. Companies in this market offer a range of plans that can be customized based on the traveler's age, health condition, and travel itinerary, ensuring that seniors can travel with peace of mind knowing they are adequately protected.

Single Trip Coverage, Annual Multi Trip Coverage in the Global Seniors Travel Insurance Market:

Single Trip Coverage and Annual Multi-Trip Coverage are two primary types of travel insurance plans available in the Global Seniors Travel Insurance Market. Single Trip Coverage is designed for seniors who plan to take one trip within a specified period. This type of coverage is ideal for those who travel infrequently or have a specific destination and duration in mind. It typically covers medical emergencies, trip cancellations, lost luggage, and other unforeseen events that may occur during that single trip. The coverage starts when the trip begins and ends when the traveler returns home. On the other hand, Annual Multi-Trip Coverage is suitable for seniors who travel multiple times a year. This type of insurance provides coverage for an unlimited number of trips within a 12-month period. It is a cost-effective option for frequent travelers as it eliminates the need to purchase a new policy for each trip. Annual Multi-Trip Coverage offers the same benefits as Single Trip Coverage, including medical emergencies, trip cancellations, and lost luggage, but it provides continuous protection throughout the year. Both types of coverage can be customized to include additional benefits such as coverage for pre-existing medical conditions, adventure sports, and higher coverage limits. The choice between Single Trip and Annual Multi-Trip Coverage depends on the travel habits and needs of the senior traveler. For instance, a senior who plans to visit multiple destinations or has family living abroad may find Annual Multi-Trip Coverage more convenient and economical. In contrast, a senior who takes one significant vacation a year may prefer the simplicity and specificity of Single Trip Coverage. Insurance providers in this market understand the diverse needs of senior travelers and offer flexible plans to ensure they are adequately protected, regardless of their travel frequency.

50-60 Years Old, 60-70 Years Old, Above 70 Years Old in the Global Seniors Travel Insurance Market:

The usage of Global Seniors Travel Insurance Market varies significantly across different age groups, namely 50-60 years old, 60-70 years old, and above 70 years old. For the 50-60 years old group, travel insurance is often used to cover unexpected medical expenses, trip cancellations, and lost luggage. This age group is generally healthier and more active, so they may also seek coverage for adventure sports and activities. They are likely to travel for both leisure and business, and their insurance needs reflect a balance between comprehensive medical coverage and protection against travel disruptions. For the 60-70 years old group, the focus shifts more towards medical coverage. As health risks increase with age, this group is more concerned about potential medical emergencies while traveling. They may require coverage for pre-existing medical conditions and higher coverage limits for medical expenses. This age group is also likely to travel for leisure, often to visit family or explore new destinations. Their travel insurance needs are more specific, with a greater emphasis on health-related coverage. For those above 70 years old, travel insurance becomes even more critical. This age group faces the highest health risks and is most likely to require medical attention while traveling. Insurance policies for this group often include comprehensive medical coverage, including emergency medical evacuation and repatriation. They may also need coverage for long-term stays, as they might spend extended periods visiting family or staying in warmer climates. Additionally, this age group may require assistance services, such as help with travel arrangements and medical referrals. Insurance providers in the Global Seniors Travel Insurance Market offer tailored plans to meet the unique needs of each age group, ensuring that seniors can travel with confidence and peace of mind.

Global Seniors Travel Insurance Market Outlook:

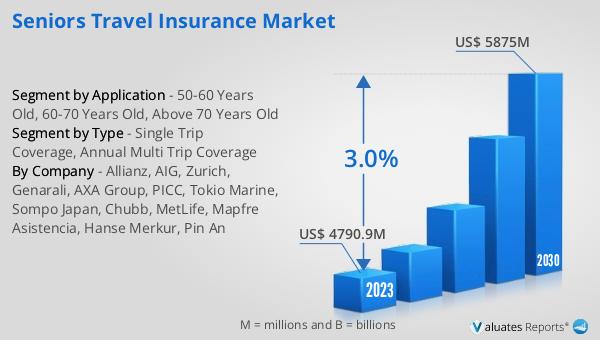

The global Seniors Travel Insurance market was valued at US$ 4790.9 million in 2023 and is anticipated to reach US$ 5875 million by 2030, witnessing a CAGR of 3.0% during the forecast period 2024-2030. This market growth reflects the increasing demand for specialized travel insurance products for seniors, driven by the rising number of older adults who are traveling. As the global population ages, more seniors are seeking travel insurance that caters to their specific needs, including coverage for medical emergencies, trip cancellations, and other travel-related issues. The market's steady growth rate indicates a strong and sustained interest in these products, as seniors prioritize their health and safety while traveling. Insurance providers are continuously innovating and expanding their offerings to meet the evolving needs of senior travelers, ensuring that they have access to comprehensive and reliable coverage. This positive market outlook underscores the importance of travel insurance for seniors and highlights the ongoing opportunities for growth and development in this sector.

| Report Metric | Details |

| Report Name | Seniors Travel Insurance Market |

| Accounted market size in 2023 | US$ 4790.9 million |

| Forecasted market size in 2030 | US$ 5875 million |

| CAGR | 3.0% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Allianz, AIG, Zurich, Genarali, AXA Group, PICC, Tokio Marine, Sompo Japan, Chubb, MetLife, Mapfre Asistencia, Hanse Merkur, Pin An |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |