What is Global Run-flat Tire Market?

The global run-flat tire market is a specialized segment within the broader tire industry, focusing on tires that can continue to perform even after a puncture or loss of air pressure. These tires are designed to allow a vehicle to be driven for a limited distance at a reduced speed, typically around 50 miles at 50 mph, even when they are completely deflated. This feature provides significant safety and convenience benefits, as it reduces the risk of accidents caused by sudden tire blowouts and eliminates the need for immediate roadside tire changes. Run-flat tires are particularly popular in high-performance and luxury vehicles, where safety and reliability are paramount. They are also increasingly being adopted in mainstream vehicles as manufacturers seek to enhance the overall safety and convenience of their offerings. The market for run-flat tires is driven by advancements in tire technology, increasing consumer awareness about vehicle safety, and stringent safety regulations in various regions. As a result, the global run-flat tire market is expected to continue growing, with manufacturers investing in research and development to improve the performance and durability of these tires.

Self-Supporting, Support Ring System in the Global Run-flat Tire Market:

Run-flat tires come in two main types: self-supporting and support ring systems. Self-supporting run-flat tires have reinforced sidewalls that can support the weight of the vehicle even when the tire is deflated. This design allows the tire to maintain its shape and continue to function, providing the driver with enough time to reach a service station or a safe location. The reinforced sidewalls are typically made from a combination of rubber compounds and other materials that enhance their strength and durability. On the other hand, support ring systems use a ring of hard rubber or another resilient material that is mounted on the wheel inside the tire. When the tire loses air pressure, the vehicle's weight is transferred to the support ring, allowing the tire to continue to function. This system is often used in larger vehicles, such as SUVs and trucks, where the additional support is necessary to handle the increased weight. Both types of run-flat tires offer distinct advantages and are chosen based on the specific needs and preferences of the vehicle manufacturer and the end consumer. Self-supporting run-flat tires are generally lighter and more versatile, making them suitable for a wide range of vehicles. They also tend to provide a more comfortable ride compared to support ring systems, as the reinforced sidewalls can absorb some of the impacts from road irregularities. However, they may not be as effective in handling the weight of larger vehicles, which is where support ring systems come into play. Support ring systems, while heavier and potentially less comfortable, offer superior performance in terms of load-bearing capacity and durability. They are particularly well-suited for vehicles that frequently carry heavy loads or operate in challenging driving conditions. The choice between self-supporting and support ring systems ultimately depends on various factors, including the type of vehicle, driving conditions, and consumer preferences. Manufacturers continue to innovate in both areas, developing new materials and designs to enhance the performance and reliability of run-flat tires. As the technology evolves, we can expect to see even more advanced run-flat tire solutions that offer improved safety, comfort, and convenience for drivers around the world.

Replacement, Original Equipment in the Global Run-flat Tire Market:

The global run-flat tire market serves two primary segments: replacement and original equipment. In the replacement market, run-flat tires are purchased by consumers to replace their existing tires, either due to wear and tear or as an upgrade for enhanced safety and performance. This segment is driven by the growing awareness of the benefits of run-flat tires, such as the ability to continue driving after a puncture and the elimination of the need for a spare tire. Consumers who prioritize safety and convenience are increasingly opting for run-flat tires when it comes time to replace their old tires. Additionally, the replacement market is influenced by the availability of run-flat tires for a wide range of vehicle models, making it easier for consumers to find suitable options for their specific needs. On the other hand, the original equipment segment involves the installation of run-flat tires on new vehicles by manufacturers. This segment is driven by the automotive industry's focus on enhancing vehicle safety and performance. Many high-end and luxury vehicle manufacturers have adopted run-flat tires as standard equipment, recognizing the added value they provide to consumers. The original equipment market is also influenced by regulatory requirements and safety standards in various regions, which encourage the use of advanced tire technologies. As a result, more mainstream vehicle manufacturers are beginning to offer run-flat tires as an option or standard feature on their new models. The interplay between the replacement and original equipment segments is crucial for the overall growth of the run-flat tire market. As more new vehicles are equipped with run-flat tires, the replacement market is likely to see increased demand as these tires eventually need to be replaced. Conversely, the popularity of run-flat tires in the replacement market can drive manufacturers to include them as standard equipment on new vehicles, creating a positive feedback loop that supports market expansion. Both segments benefit from ongoing advancements in tire technology, which continue to improve the performance, durability, and affordability of run-flat tires. As consumer awareness and acceptance of run-flat tires grow, the market is expected to see sustained growth in both the replacement and original equipment segments.

Global Run-flat Tire Market Outlook:

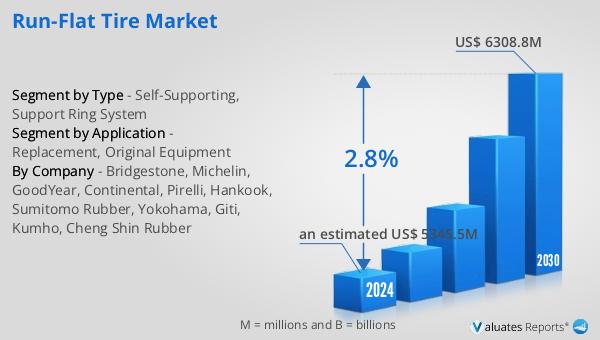

The global run-flat tire market is anticipated to grow from an estimated $5,345.5 million in 2024 to approximately $6,308.8 million by 2030, reflecting a compound annual growth rate (CAGR) of 2.8% during this period. Europe currently holds the largest share of the market, accounting for about 39%, followed by North America, which represents around 31% of the market. The top three companies in the industry collectively hold approximately 47% of the market share. This growth is driven by several factors, including advancements in tire technology, increasing consumer awareness about vehicle safety, and stringent safety regulations in various regions. The European market's dominance can be attributed to the region's strong automotive industry and the high adoption rate of advanced safety features in vehicles. North America's significant market share is also due to similar factors, including a robust automotive sector and a growing emphasis on vehicle safety. The concentration of market share among the top three companies highlights the competitive nature of the industry and the importance of innovation and quality in maintaining market leadership. As the market continues to evolve, these leading companies are likely to play a crucial role in driving further advancements in run-flat tire technology and expanding their adoption across different vehicle segments.

| Report Metric | Details |

| Report Name | Run-flat Tire Market |

| Accounted market size in 2024 | an estimated US$ 5345.5 million |

| Forecasted market size in 2030 | US$ 6308.8 million |

| CAGR | 2.8% |

| Base Year | 2024 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Bridgestone, Michelin, GoodYear, Continental, Pirelli, Hankook, Sumitomo Rubber, Yokohama, Giti, Kumho, Cheng Shin Rubber |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |