What is Global Plasmid DNA Production Market?

The Global Plasmid DNA Production Market is a rapidly growing sector within the biotechnology and pharmaceutical industries. Plasmid DNA, which is a small, circular piece of DNA that can replicate independently of chromosomal DNA, is used extensively in gene therapy, genetic engineering, and vaccine development. The market for plasmid DNA production is driven by the increasing demand for gene therapies and the development of new vaccines, particularly in response to emerging infectious diseases. Additionally, advancements in biotechnology and molecular biology techniques have made the production of high-quality plasmid DNA more efficient and cost-effective. This has led to a surge in research and development activities, further fueling the market's growth. Companies involved in plasmid DNA production are focusing on scaling up their manufacturing capabilities and improving the quality of their products to meet the growing demand. The market is also witnessing increased collaboration between academic institutions and commercial entities to accelerate the development of new therapies and vaccines. Overall, the Global Plasmid DNA Production Market is poised for significant growth in the coming years, driven by technological advancements and the increasing need for innovative medical solutions.

Preclinical Plasmid, Clinical Plasmid, Commercial Plasmid in the Global Plasmid DNA Production Market:

Preclinical plasmids, clinical plasmids, and commercial plasmids are three key categories within the Global Plasmid DNA Production Market, each serving distinct purposes in the development and application of genetic therapies and vaccines. Preclinical plasmids are primarily used in the early stages of research and development. They are essential for conducting in vitro and in vivo studies to evaluate the safety, efficacy, and potential therapeutic benefits of new genetic constructs. These plasmids are often used in animal models to gather preliminary data before advancing to human trials. The production of preclinical plasmids requires stringent quality control measures to ensure that they meet the necessary standards for research purposes. Clinical plasmids, on the other hand, are used in human clinical trials. These plasmids must adhere to even stricter regulatory guidelines and quality standards to ensure patient safety. Clinical plasmids are produced under Good Manufacturing Practices (GMP) conditions, which involve rigorous testing for purity, potency, and consistency. The data obtained from clinical trials using these plasmids are crucial for gaining regulatory approval for new therapies. Commercial plasmids are used in the production of approved gene therapies and vaccines that are available on the market. These plasmids must meet the highest quality standards and are produced in large quantities to meet commercial demand. The production process for commercial plasmids involves advanced bioprocessing techniques and large-scale manufacturing facilities. Companies producing commercial plasmids often invest heavily in quality assurance and regulatory compliance to ensure that their products are safe and effective for widespread use. The transition from preclinical to clinical to commercial plasmids involves a complex and highly regulated process that requires significant expertise and resources. Each stage of plasmid production plays a critical role in the development and commercialization of new genetic therapies and vaccines, ultimately contributing to the growth and advancement of the Global Plasmid DNA Production Market.

Commercial, Academic Research, Others in the Global Plasmid DNA Production Market:

The Global Plasmid DNA Production Market finds extensive usage across various sectors, including commercial, academic research, and other specialized areas. In the commercial sector, plasmid DNA is primarily used in the development and production of gene therapies and vaccines. Companies involved in biotechnology and pharmaceuticals rely on high-quality plasmid DNA to create innovative treatments for a range of diseases, including genetic disorders, cancers, and infectious diseases. The commercial application of plasmid DNA also extends to the production of recombinant proteins and monoclonal antibodies, which are essential for various therapeutic and diagnostic purposes. The demand for plasmid DNA in the commercial sector is driven by the need for effective and safe medical solutions, leading to significant investments in research and development, as well as large-scale manufacturing capabilities. In academic research, plasmid DNA is a fundamental tool for studying gene function, regulation, and expression. Researchers use plasmids to manipulate genes in various model organisms, such as bacteria, yeast, and mammalian cells, to gain insights into biological processes and disease mechanisms. Plasmid DNA is also used in the development of new genetic engineering techniques, such as CRISPR-Cas9, which have revolutionized the field of molecular biology. Academic institutions often collaborate with commercial entities to translate their research findings into practical applications, further driving the demand for high-quality plasmid DNA. Other specialized areas where plasmid DNA is used include agricultural biotechnology, where it is employed to create genetically modified crops with improved traits, such as resistance to pests and diseases, and enhanced nutritional content. Plasmid DNA is also used in environmental biotechnology for bioremediation purposes, where genetically engineered microorganisms are used to clean up pollutants and contaminants. Additionally, plasmid DNA plays a role in the development of veterinary medicines and vaccines, contributing to the health and well-being of animals. The versatility and wide-ranging applications of plasmid DNA make it an indispensable tool in various fields, driving the growth of the Global Plasmid DNA Production Market. The continuous advancements in biotechnology and molecular biology techniques are expected to further expand the potential uses of plasmid DNA, leading to new and innovative applications across different sectors.

Global Plasmid DNA Production Market Outlook:

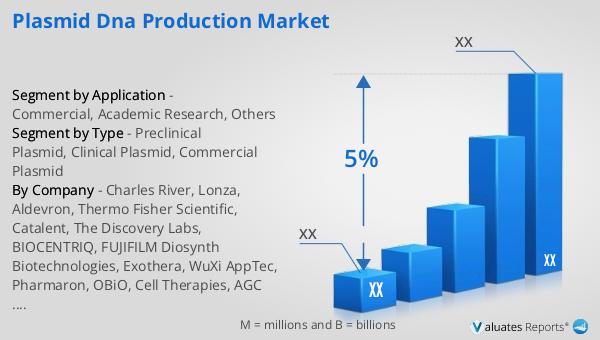

The global pharmaceutical market was valued at approximately 1475 billion USD in 2022, and it is projected to grow at a compound annual growth rate (CAGR) of 5% over the next six years. In comparison, the chemical drug market has shown a steady increase, rising from 1005 billion USD in 2018 to an estimated 1094 billion USD in 2022. This growth in the pharmaceutical market is indicative of the increasing demand for innovative medical solutions and the continuous advancements in drug development and biotechnology. The rise in the chemical drug market highlights the ongoing need for traditional pharmaceuticals alongside the emerging biopharmaceuticals. The expanding market size reflects the global efforts to address various health challenges, including chronic diseases, infectious diseases, and genetic disorders. Companies within the pharmaceutical industry are investing heavily in research and development to create new therapies and improve existing treatments. The growth in both the pharmaceutical and chemical drug markets underscores the importance of continued innovation and collaboration between different sectors to meet the evolving healthcare needs of the global population. Overall, the market outlook for the pharmaceutical and chemical drug industries remains positive, driven by technological advancements and the increasing demand for effective and safe medical treatments.

| Report Metric | Details |

| Report Name | Plasmid DNA Production Market |

| CAGR | 5% |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Charles River, Lonza, Aldevron, Thermo Fisher Scientific, Catalent, The Discovery Labs, BIOCENTRIQ, FUJIFILM Diosynth Biotechnologies, Exothera, WuXi AppTec, Pharmaron, OBiO, Cell Therapies, AGC Biologics, Cytiva, Helixmith, ThermoGenesis, Anemocyte, CBM, Bio Elpida, Genezen, CCRM, RoslinCT, GenScript ProBio, Oxford BioMedica, Porton Pharma Solutions |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |