What is Global Magnesite and Brucite Market?

The global Magnesite and Brucite market is a significant segment within the broader minerals market, focusing on the extraction, processing, and utilization of magnesite and brucite minerals. Magnesite is a mineral composed primarily of magnesium carbonate (MgCO3), while brucite is a mineral form of magnesium hydroxide (Mg(OH)2). These minerals are essential due to their diverse applications across various industries, including construction, agriculture, chemicals, and refractories. The market for these minerals is driven by their unique properties, such as high thermal resistance, chemical stability, and ability to neutralize acids. The demand for magnesite and brucite is also influenced by their role in producing magnesium metal, which is crucial for lightweight alloys used in automotive and aerospace industries. The global market is characterized by a mix of large multinational corporations and smaller regional players, each contributing to the supply chain from mining to end-product manufacturing. The market dynamics are influenced by factors such as technological advancements, regulatory policies, and economic conditions in key producing and consuming regions.

Phanerocrystalline Magnesite, Cryptocrystalline Magnesite in the Global Magnesite and Brucite Market:

Phanerocrystalline magnesite and cryptocrystalline magnesite are two distinct forms of magnesite that differ primarily in their crystal structure and physical properties. Phanerocrystalline magnesite is characterized by its large, visible crystals that can be easily identified with the naked eye. This type of magnesite is typically found in hydrothermal veins and is often associated with other minerals such as quartz and calcite. The large crystal size of phanerocrystalline magnesite makes it suitable for applications that require high purity and specific crystal orientations, such as in the production of refractory materials and certain chemical processes. On the other hand, cryptocrystalline magnesite consists of very fine-grained crystals that are not visible to the naked eye. This form of magnesite is usually found in sedimentary deposits and is often associated with clay minerals. Cryptocrystalline magnesite is typically used in applications where fine particle size and high surface area are advantageous, such as in the production of caustic-calcined magnesia and as a filler material in various industrial processes. The global magnesite and brucite market sees a significant demand for both types of magnesite due to their unique properties and wide range of applications. The extraction and processing techniques for phanerocrystalline and cryptocrystalline magnesite differ, with the former often requiring more complex and energy-intensive methods due to the larger crystal sizes. In contrast, cryptocrystalline magnesite can often be processed using simpler and less energy-intensive techniques. The choice between phanerocrystalline and cryptocrystalline magnesite depends on the specific requirements of the end-use application, with factors such as purity, particle size, and crystal structure playing a crucial role in determining the suitability of each type. The market for these minerals is also influenced by the availability of high-quality deposits, with certain regions being known for their rich magnesite resources. For instance, China is a major producer of both phanerocrystalline and cryptocrystalline magnesite, with extensive deposits that cater to both domestic and international markets. The demand for magnesite is also driven by its role in environmental applications, such as in the treatment of wastewater and flue gas desulfurization, where its ability to neutralize acids and remove impurities is highly valued. The global market for magnesite and brucite is expected to continue growing, driven by increasing demand from various industries and the ongoing development of new applications and processing technologies.

Dead-burned Magnesia, Caustic-calcined Magnesia, Fused or Electrofused Magnesia, Others in the Global Magnesite and Brucite Market:

The global magnesite and brucite market finds extensive usage in several key areas, including dead-burned magnesia, caustic-calcined magnesia, fused or electrofused magnesia, and other specialized applications. Dead-burned magnesia, also known as refractory magnesia, is produced by calcining magnesite at very high temperatures, typically above 1500°C. This process results in a highly stable and dense material that is resistant to high temperatures and chemical attack, making it ideal for use in refractory linings for furnaces, kilns, and incinerators. Dead-burned magnesia is also used in the production of refractory bricks, which are essential for industries such as steelmaking, cement, and glass manufacturing. Caustic-calcined magnesia, on the other hand, is produced by calcining magnesite at lower temperatures, typically between 700°C and 1000°C. This results in a material with high reactivity and surface area, making it suitable for a wide range of applications, including as a raw material for the production of magnesium chemicals, as a desulfurization agent in flue gas treatment, and as a soil conditioner in agriculture. Fused or electrofused magnesia is produced by melting magnesite in an electric arc furnace, resulting in a highly pure and dense material with excellent thermal and electrical insulation properties. This type of magnesia is used in the production of high-performance refractory materials, electrical insulation components, and as a raw material for the production of magnesium oxide ceramics. In addition to these primary applications, magnesite and brucite are also used in a variety of other specialized applications. For example, they are used as flame retardants in plastics and rubber, as fillers in paints and coatings, and as additives in the production of specialty cements and concrete. The unique properties of magnesite and brucite, such as their high thermal stability, chemical resistance, and ability to neutralize acids, make them valuable materials for a wide range of industrial processes. The global market for magnesite and brucite is driven by the increasing demand for these materials in various end-use industries, as well as ongoing research and development efforts aimed at discovering new applications and improving processing techniques. As industries continue to seek materials that offer superior performance and sustainability, the demand for magnesite and brucite is expected to remain strong, with significant growth potential in emerging markets and new application areas.

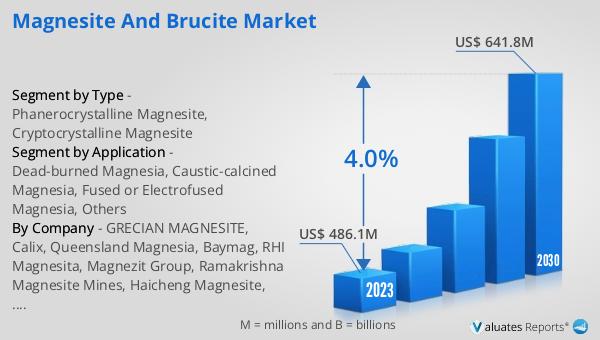

Global Magnesite and Brucite Market Outlook:

The global Magnesite and Brucite market is anticipated to grow significantly, with projections indicating it will reach approximately US$ 641.8 million by 2030, up from an estimated US$ 507.2 million in 2024. This growth corresponds to a compound annual growth rate (CAGR) of 4.0% during the period from 2024 to 2030. China stands out as the largest market for magnesite and brucite, commanding about 56% of the global market share. This dominance is attributed to China's extensive natural reserves, advanced processing capabilities, and high domestic demand driven by its robust industrial sector. Brazil follows as a distant second, accounting for around 5% of the market share. The significant gap between China and other countries highlights the strategic importance of China's magnesite and brucite resources on the global stage. The market dynamics are shaped by various factors, including technological advancements, regulatory policies, and economic conditions in key producing and consuming regions. The increasing demand for lightweight materials in automotive and aerospace industries, coupled with the growing need for high-performance refractory materials in steelmaking and other high-temperature processes, is expected to drive the market's growth. Additionally, the role of magnesite and brucite in environmental applications, such as wastewater treatment and flue gas desulfurization, further underscores their importance in addressing global sustainability challenges. As industries continue to evolve and seek innovative solutions, the global magnesite and brucite market is poised for sustained growth and development.

| Report Metric | Details |

| Report Name | Magnesite and Brucite Market |

| Accounted market size in 2024 | an estimated US$ 507.2 million |

| Forecasted market size in 2030 | US$ 641.8 million |

| CAGR | 4.0% |

| Base Year | 2024 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | GRECIAN MAGNESITE, Calix, Queensland Magnesia, Baymag, RHI Magnesita, Magnezit Group, Ramakrishna Magnesite Mines, Haicheng Magnesite, Liaoning Jinding Magnesite Group, Liaoning Wancheng Magnesium group, Liaoning BeiHai Industries Group, Houying Group, Xiyang Group, Magnezit Group JSC, Russian Mining Chemical, Garrison Minerals, Premier Magnesia, Dandong Jinyuan, Dandong Xinyang, Dandong C.L.M., Dandong Yongfeng, Dandong Xinda, Shanxi Tianbao |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |