What is Global Industrial EDI Ultrapure Water System Market?

The Global Industrial EDI Ultrapure Water System Market revolves around the production and utilization of ultrapure water systems that employ Electrodeionization (EDI) technology. These systems are crucial in industries where the highest levels of water purity are required, such as electronics, pharmaceuticals, and power generation. EDI technology combines ion exchange resins and electricity to remove ionized and ionizable species from water, producing ultrapure water without the need for chemical regeneration. This method is not only efficient but also environmentally friendly, as it reduces the need for hazardous chemicals. The market for these systems is expanding due to the increasing demand for high-purity water in various industrial applications. As industries continue to advance technologically, the need for ultrapure water systems becomes more critical, driving the growth of the Global Industrial EDI Ultrapure Water System Market.

Less than 10 m3/h, 10-30 m3/h, More than 30 m3/h in the Global Industrial EDI Ultrapure Water System Market:

The Global Industrial EDI Ultrapure Water System Market can be segmented based on the flow rate capacity of the systems, namely Less than 10 m3/h, 10-30 m3/h, and More than 30 m3/h. Systems with a flow rate of Less than 10 m3/h are typically used in smaller-scale operations or facilities where the demand for ultrapure water is relatively low. These systems are ideal for laboratories, small pharmaceutical companies, and niche electronics manufacturers. They offer the advantage of being compact and cost-effective, making them suitable for businesses that do not require large volumes of ultrapure water. On the other hand, systems with a flow rate of 10-30 m3/h cater to medium-sized operations. These are commonly found in mid-sized electronics manufacturing plants, medium-scale pharmaceutical production facilities, and smaller power plants. The 10-30 m3/h systems strike a balance between capacity and cost, providing a reliable supply of ultrapure water without the need for extensive infrastructure. Finally, systems with a flow rate of More than 30 m3/h are designed for large-scale industrial operations. These are essential in large electronics manufacturing plants, major pharmaceutical production facilities, and large power generation plants. The high capacity of these systems ensures a continuous and reliable supply of ultrapure water, which is critical for maintaining the stringent quality standards required in these industries. The demand for high-capacity systems is driven by the need for efficiency and the ability to support large-scale production processes. Each of these segments plays a vital role in the overall market, catering to the diverse needs of various industries that rely on ultrapure water for their operations.

Electronics, Pharmaceuticals, Power, Others in the Global Industrial EDI Ultrapure Water System Market:

The usage of Global Industrial EDI Ultrapure Water Systems spans several critical industries, including Electronics, Pharmaceuticals, Power, and others. In the electronics industry, ultrapure water is essential for the manufacturing of semiconductors, microchips, and other electronic components. The presence of any impurities in the water can lead to defects in the products, making ultrapure water systems indispensable for ensuring the highest quality standards. In the pharmaceutical industry, ultrapure water is used in the production of medications, vaccines, and other healthcare products. The stringent regulations governing pharmaceutical manufacturing require the use of ultrapure water to prevent contamination and ensure the safety and efficacy of the products. In the power industry, ultrapure water is used in the cooling systems of power plants, particularly in nuclear and thermal power plants. The high purity of the water helps prevent corrosion and scaling in the equipment, thereby enhancing the efficiency and longevity of the power plants. Other industries that utilize ultrapure water systems include food and beverage production, where ultrapure water is used in the preparation of certain products, and research laboratories, where it is used in various experimental procedures. The versatility and critical importance of ultrapure water systems across these industries underscore their significance in maintaining the quality and safety of products and processes.

Global Industrial EDI Ultrapure Water System Market Outlook:

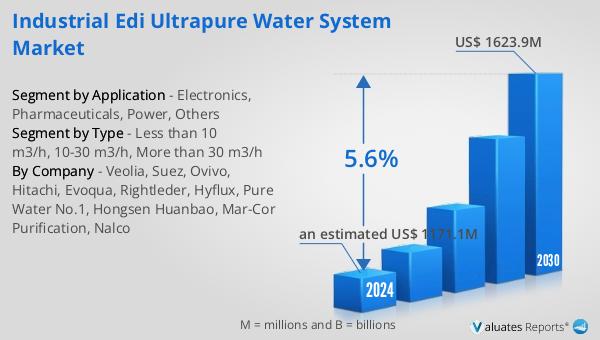

The global Industrial EDI Ultrapure Water System market is anticipated to grow significantly, reaching an estimated value of US$ 1623.9 million by 2030, up from US$ 1171.1 million in 2024, with a compound annual growth rate (CAGR) of 5.6% during the period from 2024 to 2030. The market is dominated by the top three players, who collectively account for about 50% of the total global market. China emerges as the largest consumer market for Industrial EDI Ultrapure Water Systems, representing approximately 24% of the global consumption, followed by North America and Japan. When it comes to the types of systems, those with a flow rate of 10-30 m3/h constitute the largest segment, holding a 50% share of the market. This data highlights the growing demand and significant market presence of EDI ultrapure water systems across various regions and industries.

| Report Metric | Details |

| Report Name | Industrial EDI Ultrapure Water System Market |

| Accounted market size in 2024 | an estimated US$ 1171.1 million |

| Forecasted market size in 2030 | US$ 1623.9 million |

| CAGR | 5.6% |

| Base Year | 2024 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Veolia, Suez, Ovivo, Hitachi, Evoqua, Rightleder, Hyflux, Pure Water No.1, Hongsen Huanbao, Mar-Cor Purification, Nalco |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |