What is Global 2,6-Naphthalene Dicarboxylic Acid Market?

The Global 2,6-Naphthalene Dicarboxylic Acid Market revolves around the production, distribution, and utilization of 2,6-Naphthalene Dicarboxylic Acid (NDCA), a chemical compound primarily used in the manufacture of high-performance polymers. NDCA is a crucial raw material in the production of polyethylene naphthalate (PEN) and other specialty polymers, which are known for their superior thermal and mechanical properties. These polymers are extensively used in various industries, including packaging, electronics, and automotive, due to their excellent barrier properties, high strength, and resistance to chemicals and heat. The market for NDCA is driven by the growing demand for these high-performance materials, particularly in regions with advanced manufacturing sectors. The global market is characterized by a few key players who dominate production and supply, ensuring the availability of high-purity NDCA to meet the stringent requirements of end-use applications. As industries continue to seek materials that offer enhanced performance and sustainability, the demand for NDCA is expected to remain robust, supporting the growth of the global market.

≥99%, <99% in the Global 2,6-Naphthalene Dicarboxylic Acid Market:

In the Global 2,6-Naphthalene Dicarboxylic Acid Market, the purity levels of NDCA play a significant role in determining its suitability for various applications. NDCA with a purity of ≥99% is considered high-grade and is preferred for applications that demand superior performance and reliability. This high-purity NDCA is essential in the production of polyethylene naphthalate (PEN), a high-performance polymer used in advanced packaging, electronics, and automotive industries. The high purity ensures that the polymer exhibits excellent thermal stability, mechanical strength, and barrier properties, making it ideal for demanding applications. On the other hand, NDCA with a purity of <99% is typically used in less critical applications where the stringent performance characteristics of high-purity NDCA are not required. This lower-purity NDCA can be used in the production of other specialty polymers and resins that do not require the same level of performance as PEN. The choice between ≥99% and <99% NDCA depends on the specific requirements of the end-use application, with high-purity NDCA being favored for applications that demand the highest levels of performance and reliability. The availability of different purity levels allows manufacturers to select the most appropriate grade of NDCA for their specific needs, ensuring that they can achieve the desired balance of performance and cost. As the demand for high-performance materials continues to grow, the market for both high-purity and lower-purity NDCA is expected to expand, driven by the diverse range of applications that these materials can support.

PEN, PBN, Others in the Global 2,6-Naphthalene Dicarboxylic Acid Market:

The usage of Global 2,6-Naphthalene Dicarboxylic Acid Market in various applications such as PEN, PBN, and others highlights the versatility and importance of this chemical compound. Polyethylene naphthalate (PEN) is one of the primary applications of NDCA, where it is used to produce high-performance polymers with excellent thermal and mechanical properties. PEN is widely used in the packaging industry for its superior barrier properties, which help to extend the shelf life of packaged goods. It is also used in the electronics industry for the production of flexible printed circuits and other components that require high thermal stability and mechanical strength. In the automotive industry, PEN is used in the manufacture of various components that need to withstand high temperatures and harsh environments. Polybutylene naphthalate (PBN) is another important application of NDCA. PBN is a high-performance polymer that offers excellent mechanical properties, chemical resistance, and thermal stability. It is used in a variety of applications, including automotive parts, electrical components, and industrial machinery. The superior properties of PBN make it an ideal material for applications that require high strength and durability. In addition to PEN and PBN, NDCA is also used in the production of other specialty polymers and resins. These materials are used in a wide range of applications, including coatings, adhesives, and sealants, where they provide enhanced performance and reliability. The versatility of NDCA and its ability to improve the properties of various polymers make it a valuable material in many industries. As the demand for high-performance materials continues to grow, the usage of NDCA in these applications is expected to increase, supporting the growth of the global market.

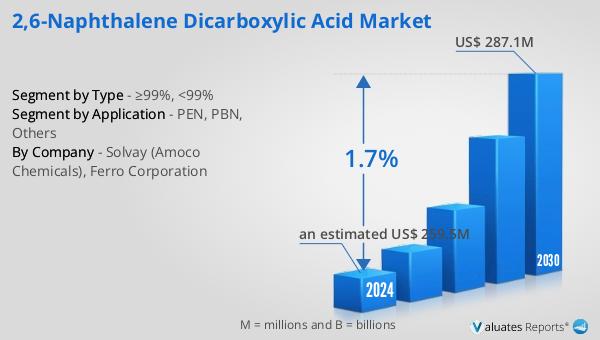

Global 2,6-Naphthalene Dicarboxylic Acid Market Outlook:

The global 2,6-Naphthalene Dicarboxylic Acid market is anticipated to grow from an estimated US$ 259.5 million in 2024 to US$ 287.1 million by 2030, reflecting a compound annual growth rate (CAGR) of 1.7% during the forecast period from 2024 to 2030. In 2019, Ferro Corporation held a dominant market share of 94.74%, underscoring its significant influence and leadership in the market. This projection indicates a steady growth trajectory for the market, driven by the increasing demand for high-performance polymers and specialty materials across various industries. The market's expansion is supported by the continuous advancements in manufacturing technologies and the growing emphasis on sustainability and performance in material selection. As industries seek materials that offer enhanced properties and reliability, the demand for 2,6-Naphthalene Dicarboxylic Acid is expected to remain strong, contributing to the overall growth of the market.

| Report Metric | Details |

| Report Name | 2,6-Naphthalene Dicarboxylic Acid Market |

| Accounted market size in 2024 | an estimated US$ 259.5 million |

| Forecasted market size in 2030 | US$ 287.1 million |

| CAGR | 1.7% |

| Base Year | 2024 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Solvay (Amoco Chemicals), Ferro Corporation |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |