What is Global Automotive Electronic Rearview Mirror Chip Market?

The Global Automotive Electronic Rearview Mirror Chip Market refers to the industry focused on the production and distribution of semiconductor chips used in electronic rearview mirrors for vehicles. These chips are integral components that enable advanced functionalities such as digital displays, camera integration, and enhanced safety features. The market encompasses a wide range of activities, including research and development, manufacturing, and sales of these specialized chips. The demand for these chips is driven by the increasing adoption of advanced driver-assistance systems (ADAS) and the growing trend towards vehicle automation. As automotive manufacturers strive to enhance safety and convenience, the need for sophisticated electronic rearview mirror systems continues to rise, thereby fueling the growth of this market. The market is characterized by rapid technological advancements and intense competition among key players, who are constantly innovating to offer more efficient and cost-effective solutions.

10nm, 22nm, 28nm, Others in the Global Automotive Electronic Rearview Mirror Chip Market:

In the context of the Global Automotive Electronic Rearview Mirror Chip Market, the terms 10nm, 22nm, 28nm, and others refer to the different process nodes or manufacturing technologies used to produce these semiconductor chips. The "nm" stands for nanometer, which is a unit of measurement that indicates the size of the transistors on the chip. Smaller nanometer sizes generally mean more advanced technology, allowing for more transistors to be packed into a smaller space, which can enhance the performance and efficiency of the chip. The 10nm process node is one of the most advanced and is used to create chips that offer high performance and low power consumption. These chips are ideal for applications that require fast processing speeds and efficient energy use, such as high-end automotive systems with complex functionalities. The 22nm process node, while not as advanced as the 10nm, still offers a good balance between performance and cost. Chips produced using this technology are often used in mid-range automotive applications where cost-effectiveness is a key consideration. The 28nm process node is older and less advanced compared to the 10nm and 22nm nodes, but it is still widely used due to its reliability and lower production costs. Chips made with the 28nm technology are typically found in entry-level automotive systems where high performance is not as critical. Other process nodes, which may include 14nm, 16nm, and 32nm, among others, offer varying levels of performance and cost benefits. Each of these process nodes has its own set of advantages and disadvantages, and the choice of which to use often depends on the specific requirements of the automotive application. For instance, a high-end luxury car with advanced driver-assistance systems might use a 10nm chip to ensure top-notch performance and efficiency, while a more budget-friendly vehicle might opt for a 28nm chip to keep costs down. The continuous evolution of semiconductor manufacturing technologies means that newer, more advanced process nodes are constantly being developed, pushing the boundaries of what is possible in automotive electronics. As a result, the Global Automotive Electronic Rearview Mirror Chip Market is a dynamic and rapidly changing industry, with manufacturers constantly seeking to adopt the latest technologies to stay competitive.

Car, SUV in the Global Automotive Electronic Rearview Mirror Chip Market:

The usage of Global Automotive Electronic Rearview Mirror Chips in cars and SUVs is becoming increasingly prevalent as automotive manufacturers strive to enhance safety, convenience, and overall driving experience. In cars, these chips are used to power electronic rearview mirrors that offer a range of advanced features. For instance, they enable the integration of digital displays that can show real-time video feeds from rearview cameras, providing drivers with a clearer and wider field of vision compared to traditional mirrors. This is particularly useful in situations where visibility is compromised, such as during nighttime driving or in adverse weather conditions. Additionally, these chips support features like blind-spot detection and lane departure warnings, which are crucial for preventing accidents and ensuring driver safety. In SUVs, the application of these chips is even more significant due to the larger size and higher driving position of these vehicles. Electronic rearview mirrors powered by these chips can help mitigate the blind spots that are more pronounced in SUVs, thereby enhancing safety. Moreover, the chips enable the integration of multiple camera feeds, providing a comprehensive view of the vehicle's surroundings. This is particularly beneficial for off-road driving, where obstacles and uneven terrain can pose significant challenges. The chips also support advanced functionalities like automatic dimming, which reduces glare from headlights of trailing vehicles, and customizable display settings, allowing drivers to adjust the mirror's view according to their preferences. Furthermore, the use of these chips in both cars and SUVs aligns with the broader trend towards vehicle automation and the development of autonomous driving technologies. By enabling advanced driver-assistance systems (ADAS), these chips play a crucial role in the transition towards fully autonomous vehicles. They facilitate real-time data processing and decision-making, which are essential for the safe and efficient operation of self-driving cars and SUVs. As a result, the demand for these chips is expected to grow as more automotive manufacturers incorporate ADAS and autonomous driving features into their vehicles. Overall, the usage of Global Automotive Electronic Rearview Mirror Chips in cars and SUVs is a testament to the ongoing advancements in automotive technology and the industry's commitment to enhancing safety and convenience for drivers.

Global Automotive Electronic Rearview Mirror Chip Market Outlook:

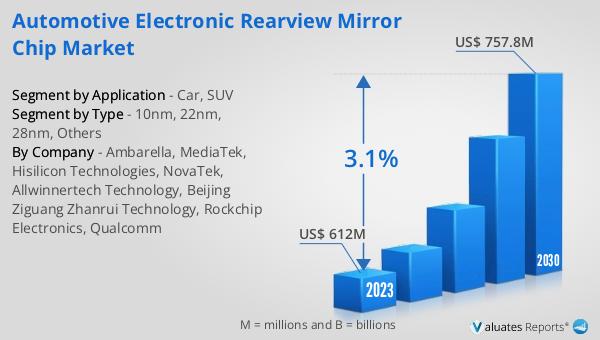

The global Automotive Electronic Rearview Mirror Chip market was valued at US$ 612 million in 2023 and is anticipated to reach US$ 757.8 million by 2030, witnessing a CAGR of 3.1% during the forecast period from 2024 to 2030. This market outlook highlights the steady growth trajectory of the industry, driven by the increasing adoption of advanced driver-assistance systems (ADAS) and the growing trend towards vehicle automation. The valuation of US$ 612 million in 2023 underscores the significant demand for these specialized chips, which are integral to the functionality of modern electronic rearview mirrors. As automotive manufacturers continue to innovate and incorporate more sophisticated technologies into their vehicles, the market for these chips is expected to expand further. The projected market size of US$ 757.8 million by 2030 reflects the industry's potential for growth and the increasing importance of these chips in enhancing vehicle safety and convenience. The compound annual growth rate (CAGR) of 3.1% indicates a steady and sustained increase in market demand, driven by technological advancements and the rising adoption of ADAS and autonomous driving features. This growth is also supported by the continuous evolution of semiconductor manufacturing technologies, which enable the production of more efficient and cost-effective chips. Overall, the market outlook for the global Automotive Electronic Rearview Mirror Chip market is positive, with significant opportunities for growth and innovation in the coming years.

| Report Metric | Details |

| Report Name | Automotive Electronic Rearview Mirror Chip Market |

| Accounted market size in 2023 | US$ 612 million |

| Forecasted market size in 2030 | US$ 757.8 million |

| CAGR | 3.1% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Ambarella, MediaTek, Hisilicon Technologies, NovaTek, Allwinnertech Technology, Beijing Ziguang Zhanrui Technology, Rockchip Electronics, Qualcomm |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |