What is Global In-Vehicle Wireless Charger Market?

The Global In-Vehicle Wireless Charger Market refers to the industry focused on the development, production, and distribution of wireless charging systems specifically designed for use in vehicles. These systems allow drivers and passengers to charge their electronic devices, such as smartphones and tablets, without the need for physical cables. The technology typically involves a charging pad installed within the vehicle, which uses electromagnetic fields to transfer energy to compatible devices. This market has seen significant growth due to the increasing adoption of electric vehicles (EVs) and the rising demand for convenience and connectivity in modern cars. As more consumers seek seamless and efficient ways to keep their devices powered while on the go, the in-vehicle wireless charger market is expected to expand further. The market encompasses various segments, including different power ranges and applications in both passenger and commercial vehicles. The advancements in wireless charging technology, coupled with the integration of smart features and compatibility with a wide range of devices, are driving the growth of this market.

5W-15W, 15W-50W, Others in the Global In-Vehicle Wireless Charger Market:

In the Global In-Vehicle Wireless Charger Market, the power range of wireless chargers is a crucial factor that determines their efficiency and suitability for different types of vehicles and devices. The power ranges are typically categorized into three segments: 5W-15W, 15W-50W, and others. The 5W-15W segment includes chargers that provide a lower power output, suitable for charging smaller devices like smartphones and smartwatches. These chargers are commonly used in passenger cars where the primary need is to keep personal devices charged during travel. The lower power output ensures that the devices are charged safely without overheating or causing any damage. On the other hand, the 15W-50W segment includes chargers with higher power output, which are capable of charging larger devices such as tablets and even some laptops. These chargers are often used in commercial vehicles where there is a need to charge multiple devices simultaneously or to charge devices that require more power. The higher power output ensures faster charging times, which is essential for commercial applications where time is a critical factor. The "others" category includes chargers with power outputs that do not fall within the 5W-15W or 15W-50W ranges. This category may include specialized chargers designed for specific applications or devices that require unique power specifications. The advancements in wireless charging technology have led to the development of more efficient and versatile chargers that can cater to a wide range of power requirements. The integration of smart features, such as automatic power adjustment and device recognition, further enhances the usability and safety of these chargers. As the demand for wireless charging solutions continues to grow, manufacturers are focusing on developing chargers with higher power outputs and improved efficiency to meet the diverse needs of consumers. The increasing adoption of electric vehicles (EVs) is also driving the demand for high-power wireless chargers, as these vehicles require more power to charge their batteries. The development of wireless charging infrastructure for EVs is expected to further boost the growth of the in-vehicle wireless charger market. The integration of wireless charging technology with other in-car systems, such as infotainment and navigation, is also contributing to the market's growth. This integration allows for a more seamless and convenient user experience, as drivers and passengers can charge their devices while using other in-car features. The advancements in wireless charging technology, coupled with the increasing demand for convenience and connectivity, are driving the growth of the Global In-Vehicle Wireless Charger Market.

Passenger Car, Commercial Car in the Global In-Vehicle Wireless Charger Market:

The usage of Global In-Vehicle Wireless Charger Market in passenger cars and commercial cars varies significantly based on the needs and requirements of the users. In passenger cars, the primary focus is on providing convenience and enhancing the user experience. Wireless chargers in passenger cars are typically used to charge personal devices such as smartphones, tablets, and smartwatches. The integration of wireless charging pads in the center console or armrest allows drivers and passengers to charge their devices without the hassle of dealing with cables. This not only provides a clutter-free environment but also ensures that the devices are easily accessible while driving. The increasing use of smartphones for navigation, music streaming, and communication makes wireless charging an essential feature in modern passenger cars. The convenience of wireless charging is particularly beneficial for long journeys, where keeping devices charged is crucial. In commercial cars, the usage of wireless chargers is more focused on efficiency and productivity. Commercial vehicles, such as taxis, delivery vans, and trucks, often require multiple devices to be charged simultaneously. Wireless chargers with higher power outputs are used in these vehicles to ensure that all devices, including smartphones, tablets, and even laptops, are charged quickly and efficiently. The ability to charge multiple devices at once is particularly important for commercial drivers who rely on these devices for navigation, communication, and managing their work schedules. The integration of wireless charging technology in commercial vehicles also helps in reducing downtime, as drivers do not have to spend time dealing with cables and connectors. This leads to increased productivity and efficiency, which is crucial for businesses that rely on timely deliveries and services. The advancements in wireless charging technology have also led to the development of more robust and durable chargers that can withstand the rigors of commercial use. The integration of smart features, such as automatic power adjustment and device recognition, ensures that the devices are charged safely and efficiently. The increasing adoption of electric vehicles (EVs) in the commercial sector is also driving the demand for wireless chargers. EVs require more power to charge their batteries, and wireless charging provides a convenient and efficient solution. The development of wireless charging infrastructure for EVs is expected to further boost the growth of the in-vehicle wireless charger market in the commercial sector. The integration of wireless charging technology with other in-car systems, such as fleet management and telematics, is also contributing to the market's growth. This integration allows for a more seamless and efficient operation, as drivers can charge their devices while using other in-car features. The advancements in wireless charging technology, coupled with the increasing demand for efficiency and productivity, are driving the growth of the Global In-Vehicle Wireless Charger Market in both passenger and commercial cars.

Global In-Vehicle Wireless Charger Market Outlook:

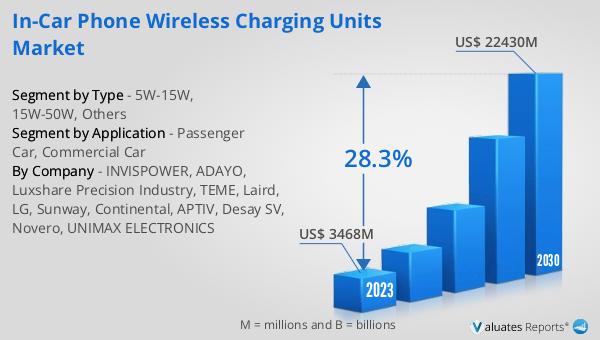

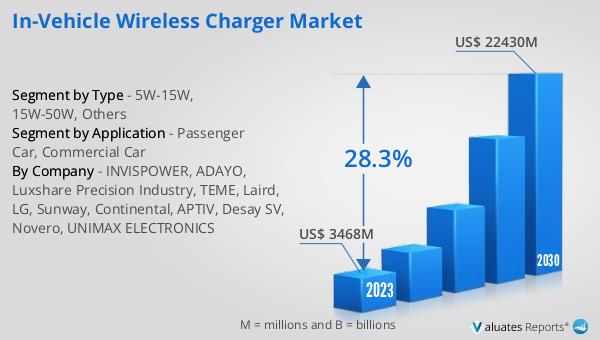

The global In-Vehicle Wireless Charger market was valued at US$ 3468 million in 2023 and is anticipated to reach US$ 22430 million by 2030, witnessing a CAGR of 28.3% during the forecast period 2024-2030. This significant growth reflects the increasing demand for wireless charging solutions in vehicles, driven by the rising adoption of electric vehicles (EVs) and the growing need for convenience and connectivity. The market's expansion is also fueled by advancements in wireless charging technology, which have led to the development of more efficient and versatile chargers. These chargers cater to a wide range of power requirements, making them suitable for both passenger and commercial vehicles. The integration of smart features, such as automatic power adjustment and device recognition, further enhances the usability and safety of these chargers. As more consumers seek seamless and efficient ways to keep their devices powered while on the go, the in-vehicle wireless charger market is expected to continue its upward trajectory. The increasing adoption of wireless charging infrastructure for EVs is also expected to play a significant role in the market's growth. The integration of wireless charging technology with other in-car systems, such as infotainment and navigation, is contributing to a more seamless and convenient user experience. Overall, the global In-Vehicle Wireless Charger market is poised for substantial growth in the coming years, driven by the increasing demand for convenience, connectivity, and efficiency in modern vehicles.

| Report Metric | Details |

| Report Name | In-Vehicle Wireless Charger Market |

| Accounted market size in 2023 | US$ 3468 million |

| Forecasted market size in 2030 | US$ 22430 million |

| CAGR | 28.3% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | INVISPOWER, ADAYO, Luxshare Precision Industry, TEME, Laird, LG, Sunway, Continental, APTIV, Desay SV, Novero, UNIMAX ELECTRONICS |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |