What is Global Third Party Payroll Service Market?

The Global Third Party Payroll Service Market is a dynamic and evolving sector that plays a crucial role in the modern business landscape. Essentially, third-party payroll services involve outsourcing payroll processing to specialized firms that handle all aspects of employee compensation, including salary calculations, tax withholdings, and compliance with labor laws. This market has gained significant traction as businesses increasingly seek to streamline operations and focus on core activities. By leveraging third-party payroll services, companies can reduce administrative burdens, minimize errors, and ensure timely and accurate payroll processing. The market is characterized by a diverse range of service providers, from large multinational firms to smaller, niche players, each offering tailored solutions to meet the unique needs of their clients. As businesses continue to expand globally, the demand for efficient and compliant payroll solutions is expected to grow, driving further innovation and competition within the market. The Global Third Party Payroll Service Market is poised for continued growth as organizations recognize the value of outsourcing payroll functions to expert providers who can deliver cost-effective and reliable services.

Software, Payroll Managed Services in the Global Third Party Payroll Service Market:

In the realm of the Global Third Party Payroll Service Market, software and payroll managed services are pivotal components that drive efficiency and accuracy in payroll processing. Software solutions in this market are designed to automate and streamline payroll tasks, reducing the need for manual intervention and minimizing the risk of errors. These software platforms often come equipped with features such as automated tax calculations, direct deposit capabilities, and compliance management tools, ensuring that businesses can meet regulatory requirements with ease. Additionally, many payroll software solutions offer integration with other business systems, such as human resources and accounting software, providing a seamless flow of information across departments. This integration is particularly beneficial for businesses that operate in multiple regions, as it allows for centralized management of payroll data and ensures consistency in payroll practices. Payroll managed services, on the other hand, involve outsourcing the entire payroll function to a third-party provider. This approach allows businesses to offload the complexities of payroll processing to experts who specialize in this area. Managed service providers typically offer a comprehensive suite of services, including payroll processing, tax filing, benefits administration, and compliance management. By partnering with a managed service provider, businesses can benefit from the provider's expertise and resources, ensuring that payroll is processed accurately and on time. This is particularly advantageous for companies with limited internal resources or those that lack the expertise to handle complex payroll tasks. One of the key advantages of using software and payroll managed services in the Global Third Party Payroll Service Market is the ability to ensure compliance with ever-changing labor laws and regulations. Payroll providers are well-versed in the latest legal requirements and can help businesses navigate the complexities of tax codes, wage laws, and other regulatory mandates. This is especially important for multinational companies that operate in multiple jurisdictions, as compliance requirements can vary significantly from one region to another. By outsourcing payroll to a third-party provider, businesses can mitigate the risk of non-compliance and avoid costly penalties. Another benefit of leveraging software and payroll managed services is the potential for cost savings. By automating payroll processes and outsourcing payroll functions, businesses can reduce the need for in-house payroll staff and associated overhead costs. This can result in significant savings, particularly for small and medium-sized enterprises (SMEs) that may not have the resources to maintain a dedicated payroll department. Additionally, third-party payroll providers often have access to advanced technology and infrastructure, allowing them to deliver services more efficiently and at a lower cost than businesses could achieve on their own. Furthermore, the use of software and payroll managed services can enhance data security and confidentiality. Payroll data is highly sensitive and must be protected from unauthorized access and breaches. Reputable third-party payroll providers invest in robust security measures to safeguard client data, including encryption, secure data centers, and regular security audits. By outsourcing payroll to a trusted provider, businesses can ensure that their payroll data is handled with the utmost care and confidentiality. In conclusion, software and payroll managed services are integral to the Global Third Party Payroll Service Market, offering businesses a range of benefits, including increased efficiency, compliance assurance, cost savings, and enhanced data security. As the market continues to evolve, businesses are likely to increasingly rely on these solutions to streamline their payroll processes and focus on their core operations.

Startups, SMEs, Large Enterprises in the Global Third Party Payroll Service Market:

The Global Third Party Payroll Service Market is utilized by a wide range of businesses, including startups, small and medium-sized enterprises (SMEs), and large enterprises, each of which benefits from these services in unique ways. For startups, third-party payroll services offer a cost-effective solution to manage payroll without the need for a dedicated in-house team. Startups often operate with limited resources and need to focus on growth and innovation rather than administrative tasks. By outsourcing payroll, startups can ensure that their employees are paid accurately and on time, while also complying with tax and labor regulations. This allows startup founders and their teams to concentrate on building their business and achieving their strategic goals. SMEs also stand to gain significantly from the Global Third Party Payroll Service Market. These businesses often face the challenge of balancing growth with operational efficiency. By leveraging third-party payroll services, SMEs can streamline their payroll processes and reduce the administrative burden on their internal teams. This is particularly beneficial for SMEs that are expanding into new markets or regions, as third-party providers can offer expertise in local payroll regulations and compliance requirements. Additionally, outsourcing payroll can help SMEs manage cash flow more effectively by providing predictable payroll costs and reducing the risk of errors that could lead to financial penalties. Large enterprises, with their complex organizational structures and extensive workforces, can also benefit from third-party payroll services. For these companies, managing payroll in-house can be a daunting task, requiring significant resources and expertise. By partnering with a third-party provider, large enterprises can ensure that their payroll processes are efficient, accurate, and compliant with all relevant regulations. This is particularly important for multinational corporations that operate in multiple countries, as third-party providers can offer centralized payroll solutions that accommodate diverse regulatory environments. Furthermore, outsourcing payroll allows large enterprises to focus on strategic initiatives and core business activities, rather than being bogged down by administrative tasks. In summary, the Global Third Party Payroll Service Market provides valuable solutions for businesses of all sizes, from startups to large enterprises. By outsourcing payroll functions, companies can achieve greater efficiency, compliance, and cost savings, allowing them to focus on their core operations and strategic objectives. As the market continues to grow and evolve, businesses are likely to increasingly rely on third-party payroll services to meet their payroll needs and drive their success.

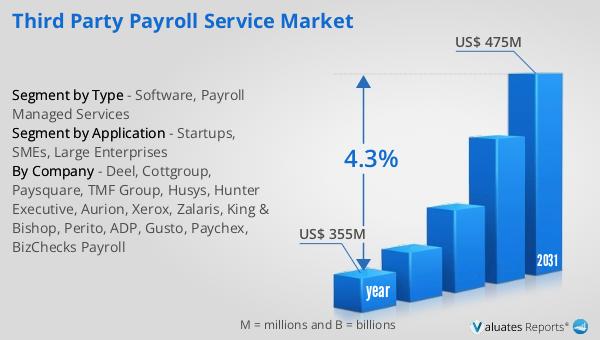

Global Third Party Payroll Service Market Outlook:

The global market for Third Party Payroll Service was valued at $355 million in 2024 and is anticipated to grow to a revised size of $475 million by 2031, reflecting a compound annual growth rate (CAGR) of 4.3% during the forecast period. This growth trajectory underscores the increasing demand for efficient and reliable payroll solutions across various industries. As businesses continue to expand and operate in a globalized environment, the need for specialized payroll services that can navigate complex regulatory landscapes and ensure compliance is becoming more pronounced. The projected growth in the market size indicates that more companies are recognizing the benefits of outsourcing payroll functions to expert providers who can deliver cost-effective and accurate services. This trend is likely to be driven by the ongoing digital transformation of business processes, as well as the increasing complexity of payroll regulations in different regions. As a result, the Global Third Party Payroll Service Market is expected to continue its upward trajectory, providing businesses with the tools and expertise they need to manage their payroll operations effectively and efficiently.

| Report Metric | Details |

| Report Name | Third Party Payroll Service Market |

| Accounted market size in year | US$ 355 million |

| Forecasted market size in 2031 | US$ 475 million |

| CAGR | 4.3% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Deel, Cottgroup, Paysquare, TMF Group, Husys, Hunter Executive, Aurion, Xerox, Zalaris, King & Bishop, Perito, ADP, Gusto, Paychex, BizChecks Payroll |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |