What is Global Medical Loan Platform Market?

The Global Medical Loan Platform Market is a burgeoning sector that caters to the financial needs of individuals and healthcare institutions seeking medical services. This market provides a structured platform for obtaining loans specifically for medical purposes, which can include surgeries, treatments, and other healthcare-related expenses. The platform acts as a bridge between financial institutions and borrowers, offering tailored loan products that cater to the unique needs of the medical sector. With the rising costs of healthcare and the increasing demand for advanced medical treatments, the need for accessible financial solutions has become more critical. These platforms often offer flexible repayment options, competitive interest rates, and quick approval processes, making them an attractive option for those in need of immediate financial assistance. Additionally, the integration of technology in these platforms has streamlined the application and approval process, making it more efficient and user-friendly. As healthcare continues to evolve, the Global Medical Loan Platform Market is poised to play a significant role in ensuring that financial constraints do not hinder access to necessary medical care.

Cloud Based, Web Based in the Global Medical Loan Platform Market:

In the realm of the Global Medical Loan Platform Market, cloud-based and web-based solutions have emerged as pivotal components, each offering distinct advantages and functionalities. Cloud-based platforms are hosted on remote servers and accessed via the internet, providing users with the flexibility to access their loan information from anywhere at any time. This model is particularly beneficial for medical institutions and individuals who require constant access to their financial data without the constraints of physical infrastructure. Cloud-based solutions offer scalability, allowing platforms to handle increasing amounts of data and users without compromising performance. They also provide enhanced security features, ensuring that sensitive financial and medical information is protected against unauthorized access. On the other hand, web-based platforms are accessed through a web browser and do not require any software installation on the user's device. This makes them highly accessible and easy to use, as users only need an internet connection to access their loan information. Web-based platforms are often designed with user-friendly interfaces, making it easy for individuals to navigate through their loan options and manage their accounts. Both cloud-based and web-based solutions offer real-time updates, ensuring that users have the most current information regarding their loans. This is particularly important in the medical field, where timely access to funds can be critical. Furthermore, these platforms often integrate with other financial and healthcare systems, providing a seamless experience for users. The choice between cloud-based and web-based solutions often depends on the specific needs and preferences of the user, as well as the resources available to them. While cloud-based platforms offer greater flexibility and scalability, web-based platforms provide simplicity and ease of access. Both models, however, play a crucial role in the Global Medical Loan Platform Market, enabling users to efficiently manage their medical loans and access the necessary funds for healthcare services.

Personal, Enterprise in the Global Medical Loan Platform Market:

The Global Medical Loan Platform Market serves a diverse range of users, including both personal and enterprise clients, each with unique needs and requirements. For personal users, these platforms offer a lifeline in times of medical emergencies or when facing significant healthcare expenses. Individuals can apply for loans to cover costs such as surgeries, treatments, medications, and other healthcare services that may not be fully covered by insurance. The platforms provide a streamlined application process, often requiring minimal documentation and offering quick approval times, which is crucial for individuals in urgent need of financial assistance. Personal users benefit from flexible repayment options, allowing them to choose a plan that fits their financial situation. Additionally, the platforms often provide educational resources and support to help individuals understand their loan options and make informed decisions. For enterprise clients, such as hospitals, clinics, and other healthcare institutions, the Global Medical Loan Platform Market offers solutions to manage large-scale financial needs. These institutions may require loans to invest in new medical equipment, expand facilities, or cover operational costs. The platforms provide enterprise clients with access to larger loan amounts and more complex financial products tailored to their specific needs. Enterprise users benefit from the ability to manage multiple loans and financial transactions through a single platform, streamlining their financial operations. The platforms also offer integration with existing financial and healthcare systems, providing a seamless experience for enterprise clients. Both personal and enterprise users benefit from the technological advancements in the Global Medical Loan Platform Market, which have made the process of obtaining and managing medical loans more efficient and accessible. As the demand for healthcare services continues to grow, these platforms play a vital role in ensuring that both individuals and institutions have the financial resources they need to access and provide quality medical care.

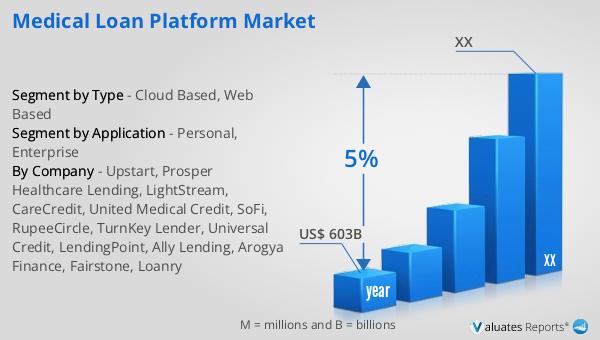

Global Medical Loan Platform Market Outlook:

Based on our research, the global market for medical devices is projected to reach approximately $603 billion in 2023, with an anticipated growth rate of 5% annually over the next six years. This growth is indicative of the increasing demand for advanced medical technologies and the continuous innovation within the healthcare sector. The expansion of the medical device market is driven by several factors, including the rising prevalence of chronic diseases, an aging global population, and the growing emphasis on improving healthcare infrastructure. As medical devices become more sophisticated and integrated with digital technologies, there is a heightened need for financial solutions to support their acquisition and implementation. The Global Medical Loan Platform Market plays a crucial role in facilitating access to these devices by providing tailored financial products that cater to the specific needs of healthcare providers and patients. By offering flexible loan options and competitive interest rates, these platforms enable healthcare institutions to invest in cutting-edge medical technologies, ultimately enhancing the quality of care they provide. Additionally, individuals seeking personal medical devices can benefit from the financial assistance offered by these platforms, ensuring that they have access to the necessary tools for managing their health. As the medical device market continues to grow, the Global Medical Loan Platform Market will remain an essential component in supporting the financial needs of both healthcare providers and patients.

| Report Metric | Details |

| Report Name | Medical Loan Platform Market |

| Accounted market size in year | US$ 603 billion |

| CAGR | 5% |

| Base Year | year |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Upstart, Prosper Healthcare Lending, LightStream, CareCredit, United Medical Credit, SoFi, RupeeCircle, TurnKey Lender, Universal Credit, LendingPoint, Ally Lending, Arogya Finance, Fairstone, Loanry |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |