What is Global Bank Management Software Market?

The Global Bank Management Software Market refers to the industry that provides software solutions specifically designed to help banks and financial institutions manage their operations more efficiently. These software solutions encompass a wide range of functionalities, including customer relationship management, transaction processing, risk management, compliance, and reporting. The market is driven by the increasing demand for digital banking solutions, the need for enhanced customer experience, and the growing regulatory requirements that banks must adhere to. As banks strive to remain competitive in a rapidly evolving financial landscape, they are increasingly turning to advanced software solutions to streamline their operations, reduce costs, and improve service delivery. The market is characterized by a diverse range of vendors offering both on-premise and cloud-based solutions, catering to the needs of small, medium, and large financial institutions. With the continuous advancements in technology, the Global Bank Management Software Market is poised for significant growth, as banks seek to leverage innovative solutions to meet the changing demands of their customers and the regulatory environment.

Cloud Based, Web Based in the Global Bank Management Software Market:

In the Global Bank Management Software Market, cloud-based and web-based solutions play a crucial role in transforming how banks operate. Cloud-based software refers to applications and services that are hosted on remote servers and accessed via the internet. This model offers several advantages, such as scalability, flexibility, and cost-effectiveness. Banks can easily scale their operations up or down based on demand without the need for significant upfront investments in hardware or infrastructure. Additionally, cloud-based solutions enable banks to access the latest software updates and features without the hassle of manual installations, ensuring they always have the most up-to-date tools at their disposal. This is particularly beneficial for banks operating in multiple locations, as it allows for seamless integration and collaboration across different branches. On the other hand, web-based software refers to applications that are accessed through a web browser, eliminating the need for local installations. This model offers the advantage of accessibility, as users can access the software from any device with an internet connection. Web-based solutions are particularly appealing to banks looking to enhance their customer experience, as they enable the development of user-friendly interfaces and personalized services. Both cloud-based and web-based solutions offer enhanced security features, which are critical for banks handling sensitive financial data. With the increasing threat of cyberattacks, banks are prioritizing security measures to protect their customers' information and maintain trust. Furthermore, these solutions support regulatory compliance by providing tools for monitoring and reporting, ensuring that banks adhere to the ever-evolving regulatory landscape. As the demand for digital banking solutions continues to rise, cloud-based and web-based software are becoming integral components of the Global Bank Management Software Market, offering banks the tools they need to stay competitive and meet the expectations of their customers.

Small and Medium Bank, Big Bank in the Global Bank Management Software Market:

The usage of Global Bank Management Software Market solutions varies significantly between small and medium banks and large banks, each with its unique set of needs and challenges. For small and medium banks, these software solutions offer a lifeline to compete with larger institutions by providing them with the tools to enhance their operational efficiency and customer service. These banks often face resource constraints, making it difficult to invest in extensive IT infrastructure. Cloud-based solutions, in particular, are appealing to small and medium banks as they offer a cost-effective way to access advanced banking technologies without the need for significant capital expenditure. These solutions enable smaller banks to offer a wide range of services, such as online banking, mobile banking, and personalized customer experiences, which are essential for attracting and retaining customers in a competitive market. Additionally, bank management software helps these institutions streamline their operations, reduce manual processes, and improve compliance with regulatory requirements, which can be particularly challenging for smaller banks with limited resources. On the other hand, large banks leverage bank management software to manage their complex operations and vast customer base. These institutions require robust and scalable solutions that can handle high volumes of transactions and data. Bank management software provides large banks with the tools to optimize their operations, enhance risk management, and ensure compliance with stringent regulatory standards. Furthermore, these solutions enable large banks to offer innovative services and products, such as real-time payments, advanced analytics, and personalized financial advice, which are crucial for maintaining their competitive edge. By leveraging advanced software solutions, large banks can improve their operational efficiency, reduce costs, and enhance the overall customer experience. In summary, the Global Bank Management Software Market plays a vital role in supporting the diverse needs of both small and medium banks and large banks, enabling them to navigate the challenges of the modern banking landscape and deliver exceptional value to their customers.

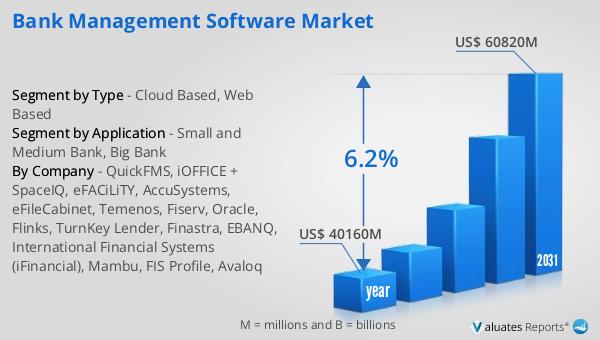

Global Bank Management Software Market Outlook:

The global market for Bank Management Software was valued at $40,160 million in 2024, and it is anticipated to grow significantly, reaching an estimated size of $60,820 million by 2031. This growth trajectory represents a compound annual growth rate (CAGR) of 6.2% over the forecast period. This upward trend underscores the increasing reliance on advanced software solutions by banks and financial institutions worldwide. As the banking industry continues to evolve, driven by technological advancements and changing customer expectations, the demand for sophisticated bank management software is expected to rise. These solutions are crucial for banks to streamline their operations, enhance customer experiences, and ensure compliance with regulatory requirements. The projected growth in the market reflects the ongoing digital transformation within the banking sector, as institutions seek to leverage innovative technologies to remain competitive and meet the evolving needs of their customers. With the continuous development of new features and functionalities, the Global Bank Management Software Market is poised for sustained growth, offering significant opportunities for vendors and financial institutions alike.

| Report Metric | Details |

| Report Name | Bank Management Software Market |

| Accounted market size in year | US$ 40160 million |

| Forecasted market size in 2031 | US$ 60820 million |

| CAGR | 6.2% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | QuickFMS, iOFFICE + SpaceIQ, eFACiLiTY, AccuSystems, eFileCabinet, Temenos, Fiserv, Oracle, Flinks, TurnKey Lender, Finastra, EBANQ, International Financial Systems (iFinancial), Mambu, FIS Profile, Avaloq |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |