What is Global Packaging Electrolyte Water Market?

The Global Packaging Electrolyte Water Market is a niche segment within the broader beverage industry, focusing on the production and distribution of electrolyte-infused water. Electrolyte water is enhanced with minerals such as sodium, potassium, and magnesium, which are essential for maintaining hydration and supporting bodily functions. This market has gained traction due to the increasing consumer awareness of health and wellness, as well as the growing demand for functional beverages that offer more than just hydration. The market is characterized by a variety of products that cater to different consumer preferences, including flavored and unflavored options. The rise in fitness activities and the need for quick rehydration solutions have further propelled the demand for electrolyte water. Additionally, the convenience of packaged electrolyte water makes it a popular choice for on-the-go consumption, appealing to busy lifestyles. As consumers continue to prioritize health and wellness, the Global Packaging Electrolyte Water Market is expected to see sustained growth, driven by innovation in product offerings and expanding distribution channels.

Flavor Type, Unflavored Type in the Global Packaging Electrolyte Water Market:

In the Global Packaging Electrolyte Water Market, products are primarily categorized into two types: flavored and unflavored. Flavored electrolyte water is infused with various taste profiles, ranging from fruity to exotic flavors, to enhance the drinking experience. This type of electrolyte water is particularly appealing to consumers who prefer a more enjoyable taste while still benefiting from the hydration and mineral replenishment that electrolytes provide. Flavored options often include popular choices like lemon, berry, and tropical fruits, which are designed to cater to diverse taste preferences. The addition of natural flavors and sweeteners can make these beverages more palatable, especially for those who might find plain water unappealing. On the other hand, unflavored electrolyte water offers a more straightforward approach, focusing solely on the functional benefits without any added taste. This type is ideal for consumers who prefer a neutral taste or who are looking to avoid any additional ingredients that might interfere with their dietary preferences or restrictions. Unflavored electrolyte water is often favored by athletes and fitness enthusiasts who prioritize functionality over taste, as it provides the necessary electrolytes without any distractions. Both flavored and unflavored types have their unique appeal and target different consumer segments within the market. The choice between flavored and unflavored electrolyte water often depends on individual preferences, lifestyle, and specific hydration needs. As the market continues to evolve, manufacturers are likely to innovate and expand their product lines to include a wider variety of flavors and formulations, catering to the ever-changing consumer demands. This diversification not only helps in attracting a broader audience but also in retaining existing customers by offering them new and exciting options. The competition between flavored and unflavored types is expected to drive further advancements in product development, ensuring that consumers have access to high-quality and effective hydration solutions. As a result, the Global Packaging Electrolyte Water Market is poised for continued growth, with both flavored and unflavored types playing a significant role in meeting the diverse needs of consumers worldwide.

Online Sales, Offline Sales in the Global Packaging Electrolyte Water Market:

The usage of Global Packaging Electrolyte Water Market products can be broadly categorized into two main sales channels: online and offline. Online sales have become increasingly popular due to the convenience and accessibility they offer. Consumers can easily browse and purchase electrolyte water from the comfort of their homes, with the added benefit of home delivery. E-commerce platforms and brand-specific websites provide a wide range of options, allowing consumers to compare different products and make informed decisions. The online sales channel also enables brands to reach a global audience, expanding their market presence beyond geographical limitations. Additionally, online platforms often offer exclusive deals and discounts, making it an attractive option for price-sensitive consumers. On the other hand, offline sales continue to play a crucial role in the distribution of electrolyte water. Traditional retail outlets such as supermarkets, convenience stores, and specialty health stores provide consumers with the opportunity to physically examine products before making a purchase. This tactile experience can be particularly important for new customers who are unfamiliar with the product and want to assess its packaging and quality firsthand. Offline sales also benefit from impulse purchases, as consumers may be more likely to buy electrolyte water when they see it prominently displayed in-store. Furthermore, offline channels allow for immediate consumption, catering to consumers who need quick hydration solutions while on the go. Both online and offline sales channels have their unique advantages and challenges, and successful brands often leverage a combination of both to maximize their reach and sales potential. The integration of online and offline strategies, such as click-and-collect services or in-store promotions linked to online campaigns, can further enhance consumer engagement and drive sales. As the Global Packaging Electrolyte Water Market continues to grow, the balance between online and offline sales will be crucial in meeting consumer demands and ensuring widespread availability of products.

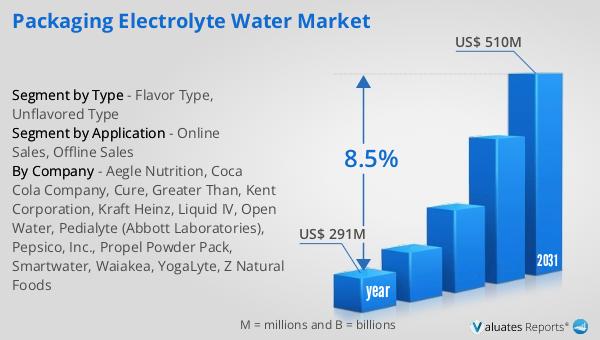

Global Packaging Electrolyte Water Market Outlook:

The global market for Packaging Electrolyte Water was valued at approximately $291 million in 2024. This market is anticipated to expand significantly, reaching an estimated size of $510 million by 2031. This growth trajectory represents a compound annual growth rate (CAGR) of 8.5% over the forecast period. The increasing consumer awareness regarding health and wellness, coupled with the rising demand for functional beverages, is driving this growth. Electrolyte water, with its added minerals and hydration benefits, is becoming a preferred choice for health-conscious consumers. The market's expansion is also supported by the growing trend of fitness activities and the need for effective rehydration solutions. As more consumers engage in physical activities, the demand for convenient and efficient hydration options like electrolyte water is expected to rise. Additionally, the diversification of product offerings, including flavored and unflavored options, is attracting a broader consumer base. The market's growth is further fueled by the expansion of distribution channels, both online and offline, making electrolyte water more accessible to consumers worldwide. As the market continues to evolve, manufacturers are likely to focus on innovation and product development to maintain competitiveness and meet the changing needs of consumers. This dynamic market environment presents opportunities for both established brands and new entrants to capture market share and drive growth.

| Report Metric | Details |

| Report Name | Packaging Electrolyte Water Market |

| Accounted market size in year | US$ 291 million |

| Forecasted market size in 2031 | US$ 510 million |

| CAGR | 8.5% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| Consumption by Region |

|

| By Company | Aegle Nutrition, Coca Cola Company, Cure, Greater Than, Kent Corporation, Kraft Heinz, Liquid IV, Open Water, Pedialyte (Abbott Laboratories), Pepsico, Inc., Propel Powder Pack, Smartwater, Waiakea, YogaLyte, Z Natural Foods |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |