What is Chip Polishing Liquid - Global Market?

Chip polishing liquid is a specialized solution used in the semiconductor industry to smooth and refine the surfaces of chips during manufacturing. This liquid plays a crucial role in ensuring that chips meet the high precision and quality standards required for modern electronic devices. The global market for chip polishing liquid is driven by the increasing demand for semiconductors in various applications, including consumer electronics, automotive, and telecommunications. As technology advances, the need for smaller, more efficient, and powerful chips grows, which in turn fuels the demand for high-quality polishing solutions. The market is characterized by continuous innovation, with manufacturers striving to develop liquids that offer better performance, efficiency, and environmental sustainability. The growth of the semiconductor industry, particularly in regions like Asia-Pacific, further propels the market for chip polishing liquids. Companies in this sector are investing in research and development to create advanced formulations that can handle the complexities of modern chip designs. As a result, the chip polishing liquid market is poised for significant growth, reflecting the broader trends in the semiconductor industry and the increasing importance of precision manufacturing.

High Concentration Polishing Liquid, Low Concentration Polishing Liquid in the Chip Polishing Liquid - Global Market:

High concentration polishing liquid and low concentration polishing liquid are two primary types of solutions used in the chip polishing process, each serving distinct purposes based on the specific requirements of the semiconductor manufacturing process. High concentration polishing liquids are formulated with a greater amount of abrasive particles and chemical agents, making them ideal for applications that require aggressive material removal and rapid surface smoothing. These liquids are typically used in the initial stages of the polishing process, where the goal is to quickly remove large amounts of material and achieve a rough level of smoothness. The high concentration of abrasives ensures that the liquid can effectively tackle the tougher surfaces of semiconductor wafers, preparing them for further refinement. On the other hand, low concentration polishing liquids contain fewer abrasive particles and are designed for more delicate polishing tasks. These solutions are used in the later stages of the polishing process, where precision and fine-tuning are essential. The lower concentration of abrasives allows for a gentler polishing action, minimizing the risk of damaging the wafer surface while achieving a high degree of smoothness and uniformity. This makes low concentration polishing liquids ideal for finishing touches and ensuring that the final product meets the stringent quality standards of the semiconductor industry. The choice between high and low concentration polishing liquids depends on several factors, including the type of material being polished, the desired level of smoothness, and the specific requirements of the manufacturing process. Manufacturers often use a combination of both types of liquids to achieve optimal results, starting with high concentration solutions for initial material removal and transitioning to low concentration liquids for final polishing. The global market for chip polishing liquids is influenced by the demand for both high and low concentration solutions, as manufacturers seek to balance efficiency, cost-effectiveness, and quality in their production processes. As the semiconductor industry continues to evolve, the development of new materials and technologies will likely drive further innovation in polishing liquids, with manufacturers striving to create solutions that can meet the increasingly complex demands of modern chip production. This ongoing innovation is essential for maintaining the competitiveness of the chip polishing liquid market and ensuring that it can support the rapid advancements in semiconductor technology.

Wafer Nanomaterial Removal, Wafer Micron Material Removal in the Chip Polishing Liquid - Global Market:

Chip polishing liquid is extensively used in the semiconductor industry for wafer nanomaterial removal and wafer micron material removal, two critical processes in chip manufacturing. Wafer nanomaterial removal involves the precise elimination of extremely small particles and imperfections from the wafer surface, a task that requires highly specialized polishing solutions. Chip polishing liquids used for nanomaterial removal are formulated to provide a delicate yet effective polishing action, ensuring that even the tiniest imperfections are addressed without damaging the wafer. This process is crucial for achieving the high level of precision required in modern semiconductor devices, where even minor surface defects can significantly impact performance. The use of chip polishing liquid in wafer nanomaterial removal helps manufacturers achieve the smooth, defect-free surfaces necessary for the production of high-quality chips. In contrast, wafer micron material removal focuses on the elimination of larger particles and surface irregularities, a process that requires a more aggressive polishing action. Chip polishing liquids used for micron material removal are designed to efficiently remove these larger imperfections, preparing the wafer for further processing and refinement. This step is essential for ensuring that the wafer meets the necessary specifications for thickness, flatness, and surface quality. The ability to effectively remove micron-sized material is critical for maintaining the integrity of the wafer and ensuring that it can withstand the subsequent stages of chip manufacturing. The global market for chip polishing liquid is driven by the demand for solutions that can effectively address both nanomaterial and micron material removal, as manufacturers seek to produce chips that meet the highest standards of quality and performance. The development of advanced polishing liquids that can handle the complexities of modern wafer materials and designs is a key focus for companies in this market. As the semiconductor industry continues to advance, the need for more precise and efficient polishing solutions will only grow, driving further innovation and growth in the chip polishing liquid market. The ability to effectively manage both wafer nanomaterial and micron material removal is essential for maintaining the competitiveness of semiconductor manufacturers and ensuring that they can meet the demands of an increasingly technology-driven world.

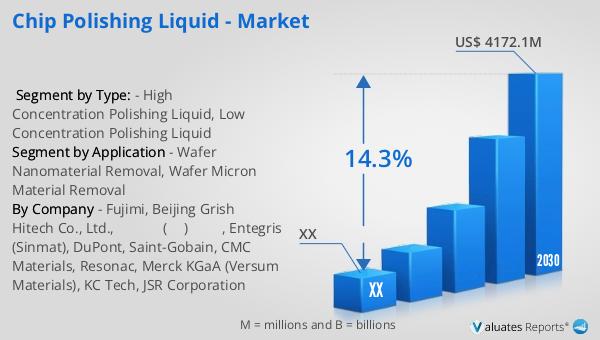

Chip Polishing Liquid - Global Market Outlook:

The global market for chip polishing liquid was valued at approximately $1,623 million in 2023 and is projected to expand to around $4,172.1 million by 2030, reflecting a compound annual growth rate (CAGR) of 14.3% during the forecast period from 2024 to 2030. This growth trajectory highlights the increasing demand for chip polishing solutions as the semiconductor industry continues to evolve and expand. In 2021, the semiconductor market experienced a robust growth rate of 26.2%, but this was adjusted to a single-digit growth rate in 2022, with the market reaching a total size of $580 billion, marking a 4.4% increase. The Asia-Pacific region, which is the largest market for semiconductors, saw a decline of 2.0% in 2022. Meanwhile, sales in the Americas reached $142.1 billion, representing a 17.0% year-on-year increase. In Europe, sales were $53.8 billion, up 12.6% year-on-year, and in Japan, sales were $48.1 billion, up 10.0% year-on-year. Despite the decline in the Asia-Pacific region, which recorded sales of $336.2 billion, down 2.0% year-on-year, the overall market outlook for chip polishing liquid remains positive, driven by the ongoing advancements in semiconductor technology and the increasing demand for high-quality chips across various industries.

| Report Metric | Details |

| Report Name | Chip Polishing Liquid - Market |

| Forecasted market size in 2030 | US$ 4172.1 million |

| CAGR | 14.3% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Fujimi, Beijing Grish Hitech Co., Ltd., 安集微电子 (上海)有限公司, Entegris (Sinmat), DuPont, Saint-Gobain, CMC Materials, Resonac, Merck KGaA (Versum Materials), KC Tech, JSR Corporation |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |