What is Aluminum Foam for Automotive - Global Market?

Aluminum foam is a unique material that is gaining traction in the automotive industry due to its lightweight and energy-absorbing properties. This material is created by introducing gas bubbles into molten aluminum, resulting in a foam-like structure. The global market for aluminum foam in the automotive sector is expanding as manufacturers seek materials that can enhance vehicle performance while reducing weight. Aluminum foam is particularly valued for its ability to absorb impact energy, making it an excellent choice for safety applications such as crash barriers. Additionally, its thermal conductivity properties make it suitable for use in heat exchangers, while its sound absorption capabilities are beneficial for reducing noise in vehicles. As the automotive industry continues to prioritize fuel efficiency and safety, the demand for innovative materials like aluminum foam is expected to grow. This trend is driven by the need to meet stringent environmental regulations and consumer demand for safer, more efficient vehicles. The global market for aluminum foam in the automotive sector is poised for significant growth as these trends continue to evolve.

Open-cell Aluminum Foam, Closed-cell Aluminum Foam in the Aluminum Foam for Automotive - Global Market:

Open-cell and closed-cell aluminum foams are two primary types of aluminum foam used in the automotive industry, each with distinct characteristics and applications. Open-cell aluminum foam is characterized by its interconnected pores, which allow fluids and gases to pass through. This type of foam is particularly useful in applications where fluid flow is necessary, such as in heat exchangers and filters. The open structure of the foam provides a large surface area, enhancing its ability to transfer heat and filter particles. In the automotive industry, open-cell aluminum foam is often used in heat exchangers to improve thermal management and increase the efficiency of cooling systems. Its lightweight nature also contributes to overall vehicle weight reduction, which is crucial for improving fuel efficiency. On the other hand, closed-cell aluminum foam consists of sealed, non-interconnected pores. This structure makes it highly effective at absorbing energy and providing insulation. Closed-cell aluminum foam is commonly used in automotive applications where impact resistance and sound insulation are critical. For instance, it is often employed in crash barriers and protective panels to absorb impact energy during collisions, thereby enhancing passenger safety. Additionally, its sound-dampening properties make it an ideal material for reducing noise and vibrations within the vehicle cabin, contributing to a more comfortable driving experience. Both open-cell and closed-cell aluminum foams offer unique advantages that cater to different needs within the automotive industry. The choice between the two depends on the specific requirements of the application, such as the need for fluid flow, energy absorption, or sound insulation. As the automotive industry continues to innovate and seek materials that can enhance vehicle performance while meeting environmental standards, the demand for both types of aluminum foam is expected to rise. Manufacturers are increasingly exploring the potential of these materials to improve vehicle safety, efficiency, and comfort, driving the growth of the aluminum foam market in the automotive sector.

Crash Barrier, Heat Exchanger, Sound Absorber, Others in the Aluminum Foam for Automotive - Global Market:

Aluminum foam is utilized in various automotive applications due to its unique properties, including crash barriers, heat exchangers, sound absorbers, and other uses. In crash barriers, aluminum foam is valued for its ability to absorb impact energy, which is crucial for enhancing vehicle safety. During a collision, the foam deforms and absorbs the kinetic energy, reducing the force transmitted to the vehicle's occupants. This energy absorption capability makes aluminum foam an ideal material for use in protective panels and crash structures, where safety is a top priority. Its lightweight nature also contributes to overall vehicle weight reduction, which is essential for improving fuel efficiency and reducing emissions. In heat exchangers, aluminum foam's high thermal conductivity and large surface area make it an excellent choice for improving thermal management in vehicles. The open-cell structure of the foam allows for efficient heat transfer, enhancing the performance of cooling systems and helping to maintain optimal operating temperatures for various vehicle components. This improved thermal management can lead to increased efficiency and longevity of the vehicle's engine and other critical systems. As a sound absorber, aluminum foam is used to reduce noise and vibrations within the vehicle cabin. Its porous structure effectively dampens sound waves, contributing to a quieter and more comfortable driving experience. This property is particularly important in electric and hybrid vehicles, where the absence of engine noise can make other sounds more noticeable. By incorporating aluminum foam into the vehicle's design, manufacturers can enhance the overall acoustic environment, improving passenger comfort and satisfaction. Beyond these specific applications, aluminum foam is also used in other areas of automotive design, such as structural components and lightweight panels. Its combination of strength, lightweight, and energy absorption capabilities makes it a versatile material that can contribute to various aspects of vehicle performance and safety. As the automotive industry continues to evolve and prioritize sustainability, the demand for innovative materials like aluminum foam is expected to grow, driving further advancements and applications in this field.

Aluminum Foam for Automotive - Global Market Outlook:

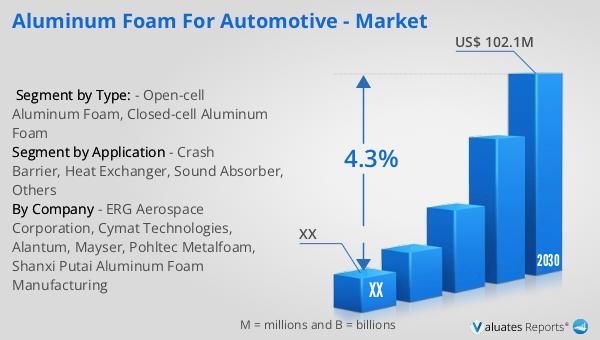

The global market for aluminum foam in the automotive sector was valued at approximately $75 million in 2023. It is projected to reach a revised size of $102.1 million by 2030, growing at a compound annual growth rate (CAGR) of 4.3% from 2024 to 2030. This growth is driven by the increasing demand for lightweight and energy-absorbing materials in the automotive industry, as manufacturers strive to enhance vehicle performance and safety while meeting stringent environmental regulations. Currently, over 90% of the world's automobiles are concentrated in Asia, Europe, and North America. Asia leads in automobile production, accounting for 56% of the global output, followed by Europe at 20% and North America at 16%. This concentration of automotive production in these regions highlights the significant role they play in driving the demand for innovative materials like aluminum foam. As these markets continue to grow and evolve, the demand for aluminum foam in the automotive sector is expected to increase, driven by the need for safer, more efficient vehicles. The ongoing focus on sustainability and environmental responsibility further underscores the importance of materials like aluminum foam in shaping the future of the automotive industry.

| Report Metric | Details |

| Report Name | Aluminum Foam for Automotive - Market |

| Forecasted market size in 2030 | US$ 102.1 million |

| CAGR | 4.3% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | ERG Aerospace Corporation, Cymat Technologies, Alantum, Mayser, Pohltec Metalfoam, Shanxi Putai Aluminum Foam Manufacturing |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |