What is Accounts Receivable (AR) Automation - Global Market?

Accounts Receivable (AR) Automation is a transformative solution in the global market that streamlines the process of managing outstanding invoices and payments owed by customers. Traditionally, managing accounts receivable has been a labor-intensive task, involving manual data entry, invoice generation, and follow-ups for payment collection. AR Automation leverages technology to automate these processes, reducing human error and increasing efficiency. This automation encompasses various functions such as invoice processing, payment reminders, and reconciliation of accounts. By implementing AR Automation, businesses can significantly reduce the time and resources spent on managing receivables, leading to improved cash flow and financial health. The global market for AR Automation is expanding as more companies recognize the benefits of automating their accounts receivable processes. This growth is driven by the increasing demand for efficient financial operations and the need to enhance customer relationships through timely and accurate billing. As businesses continue to adopt digital solutions, AR Automation is becoming an essential tool for maintaining competitive advantage in the global marketplace.

Local Based, Cloud Based in the Accounts Receivable (AR) Automation - Global Market:

In the realm of Accounts Receivable (AR) Automation, businesses have the option to choose between local-based and cloud-based solutions, each offering distinct advantages and challenges. Local-based AR Automation systems are installed directly on a company's servers and infrastructure. This setup allows for greater control over data and customization of the software to meet specific business needs. Companies with stringent data security requirements or those operating in industries with strict compliance regulations may prefer local-based solutions. However, these systems often require significant upfront investment in hardware and software, as well as ongoing maintenance and IT support. On the other hand, cloud-based AR Automation solutions are hosted on remote servers and accessed via the internet. This model offers flexibility and scalability, allowing businesses to easily adjust their usage based on demand. Cloud-based solutions typically involve lower initial costs, as they operate on a subscription basis, eliminating the need for extensive hardware investments. Additionally, cloud-based systems are often updated automatically, ensuring that businesses have access to the latest features and security enhancements. One of the key benefits of cloud-based AR Automation is the ability to access the system from anywhere with an internet connection, facilitating remote work and collaboration. This accessibility is particularly advantageous for businesses with multiple locations or a distributed workforce. Furthermore, cloud-based solutions often integrate seamlessly with other cloud-based applications, such as customer relationship management (CRM) and enterprise resource planning (ERP) systems, creating a cohesive and efficient workflow. Despite these advantages, some businesses may have concerns about data security and privacy when using cloud-based solutions. It is crucial for companies to thoroughly evaluate the security measures and compliance certifications of potential cloud service providers to ensure that their data is protected. Ultimately, the choice between local-based and cloud-based AR Automation solutions depends on a company's specific needs, resources, and strategic goals. Businesses must weigh the benefits of control and customization offered by local-based systems against the flexibility and cost-effectiveness of cloud-based solutions. As the global market for AR Automation continues to evolve, companies are increasingly opting for hybrid approaches that combine elements of both local and cloud-based systems, allowing them to leverage the strengths of each model while mitigating potential drawbacks. This hybrid approach enables businesses to maintain control over sensitive data while benefiting from the scalability and accessibility of cloud-based solutions. As technology advances and the demand for efficient financial operations grows, the distinction between local-based and cloud-based AR Automation solutions may become less pronounced, with more businesses adopting integrated systems that offer the best of both worlds.

Personal, Business in the Accounts Receivable (AR) Automation - Global Market:

Accounts Receivable (AR) Automation is not only beneficial for businesses but also has applications in personal finance management. In the business context, AR Automation streamlines the process of managing invoices and payments, reducing the time and effort required to track outstanding receivables. This automation leads to improved cash flow, as businesses can quickly identify overdue accounts and take appropriate action to collect payments. By automating routine tasks such as invoice generation and payment reminders, businesses can allocate resources more efficiently and focus on strategic activities that drive growth. Additionally, AR Automation enhances accuracy and reduces the risk of errors associated with manual data entry, leading to more reliable financial reporting and decision-making. In the personal finance realm, AR Automation can help individuals manage their finances more effectively by automating bill payments and tracking expenses. Personal finance applications that incorporate AR Automation features can send reminders for upcoming bills, automatically categorize expenses, and provide insights into spending patterns. This automation simplifies the process of managing personal finances, allowing individuals to stay on top of their financial obligations and make informed decisions about their spending and saving habits. By reducing the administrative burden of managing finances, AR Automation empowers individuals to focus on achieving their financial goals, whether it's saving for a major purchase, paying off debt, or building an emergency fund. Furthermore, AR Automation can facilitate better communication between individuals and their financial institutions, as automated systems can provide real-time updates on account balances and transaction history. This transparency helps individuals maintain control over their finances and avoid potential issues such as overdrafts or missed payments. In both personal and business contexts, AR Automation offers significant benefits by improving efficiency, accuracy, and financial management. As technology continues to advance, the adoption of AR Automation is likely to increase, providing even greater opportunities for individuals and businesses to optimize their financial operations.

Accounts Receivable (AR) Automation - Global Market Outlook:

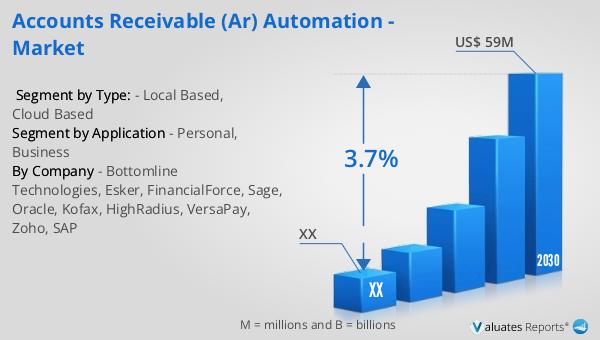

The global market for Accounts Receivable (AR) Automation was valued at approximately $46 million in 2023. Looking ahead, it is anticipated that this market will experience growth, reaching an adjusted size of around $59 million by the year 2030. This growth trajectory represents a compound annual growth rate (CAGR) of 3.7% over the forecast period from 2024 to 2030. This steady increase in market size reflects the growing recognition of the benefits that AR Automation brings to businesses worldwide. As companies continue to seek ways to enhance their financial operations and improve cash flow management, the demand for AR Automation solutions is expected to rise. The projected growth in the AR Automation market underscores the importance of efficient accounts receivable processes in today's competitive business environment. By adopting AR Automation, businesses can streamline their operations, reduce manual errors, and improve customer relationships through timely and accurate billing. As the market evolves, companies that invest in AR Automation are likely to gain a competitive edge by optimizing their financial processes and enhancing overall business performance. The anticipated growth in the AR Automation market highlights the increasing importance of digital solutions in driving business success and underscores the potential for continued innovation in this field.

| Report Metric | Details |

| Report Name | Accounts Receivable (AR) Automation - Market |

| Forecasted market size in 2030 | US$ 59 million |

| CAGR | 3.7% |

| Forecasted years | 2024 - 2030 |

| Segment by Type: |

|

| Segment by Application |

|

| By Region |

|

| By Company | Bottomline Technologies, Esker, FinancialForce, Sage, Oracle, Kofax, HighRadius, VersaPay, Zoho, SAP |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |