What is Global Neo and Challenger Bank Market?

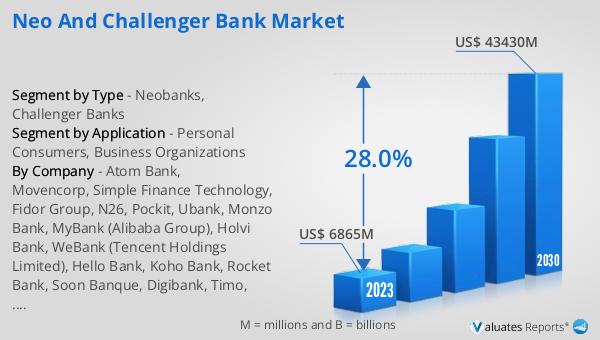

The global market for Neo and Challenger Banks was valued at approximately US$ 6,865 million in 2023 and is projected to grow significantly, reaching an estimated size of US$ 43,430 million by 2030. This represents a compound annual growth rate (CAGR) of 28.0% during the forecast period from 2024 to 2030. The top six players in the Neo and Challenger Bank sector collectively account for around 24% of the total global market. This rapid growth is driven by the increasing adoption of digital banking solutions, which offer enhanced convenience, lower fees, and innovative financial services compared to traditional banks. As more consumers and businesses seek efficient and user-friendly banking options, the market for Neo and Challenger Banks is expected to expand further. These digital-first banks leverage advanced technology to provide seamless banking experiences, attracting a growing number of users worldwide. The competitive landscape is also evolving, with new entrants continuously emerging, further fueling the market's growth. Overall, the future of the Neo and Challenger Bank market looks promising, with substantial opportunities for growth and innovation.

Neobanks, Challenger Banks in the Global Neo and Challenger Bank Market:

Neo and Challenger Banks are revolutionizing the banking industry by offering digital-first, customer-centric financial services. Neobanks are entirely digital banks without any physical branches, providing services through mobile apps and online platforms. They focus on delivering a seamless user experience, often with lower fees and more innovative features than traditional banks. Challenger Banks, on the other hand, may have some physical presence but primarily operate online. They aim to challenge the dominance of established banks by offering more competitive products and services. Both types of banks leverage advanced technologies such as artificial intelligence, machine learning, and big data analytics to enhance their offerings. They provide a range of services including savings accounts, checking accounts, loans, and investment options, all accessible through user-friendly digital interfaces. The global market for Neo and Challenger Banks is driven by the increasing demand for convenient, efficient, and cost-effective banking solutions. As more consumers and businesses embrace digital banking, these banks are poised to capture a significant share of the market. Their ability to quickly adapt to changing customer needs and technological advancements gives them a competitive edge over traditional banks. Additionally, regulatory support in various regions is facilitating the growth of these digital banks, making it easier for them to enter and operate in new markets. Overall, Neo and Challenger Banks are set to play a crucial role in the future of banking, offering innovative solutions that cater to the evolving needs of modern consumers and businesses.

Personal Consumers, Business Organizations in the Global Neo and Challenger Bank Market:

The usage of Global Neo and Challenger Bank Market extends to both personal consumers and business organizations, offering a wide range of benefits and services tailored to meet their specific needs. For personal consumers, Neo and Challenger Banks provide a more convenient and user-friendly banking experience. With features like instant account setup, real-time transaction notifications, and easy access to financial services through mobile apps, these banks make managing personal finances simpler and more efficient. They often offer lower fees and higher interest rates on savings accounts compared to traditional banks, making them an attractive option for individuals looking to maximize their savings. Additionally, many Neo and Challenger Banks provide budgeting tools, financial planning services, and personalized financial advice, helping consumers make informed decisions about their money. For business organizations, Neo and Challenger Banks offer a range of services designed to streamline financial operations and improve efficiency. These banks provide business accounts with features like automated invoicing, expense tracking, and seamless integration with accounting software. They also offer competitive loan products, making it easier for businesses to access the capital they need to grow. Furthermore, Neo and Challenger Banks leverage advanced technologies to provide real-time financial insights and analytics, helping businesses make data-driven decisions. The ability to quickly and easily manage finances through digital platforms allows businesses to focus more on their core operations and less on administrative tasks. Overall, the Global Neo and Challenger Bank Market is transforming the way personal consumers and business organizations manage their finances, offering innovative solutions that cater to their unique needs.

Global Neo and Challenger Bank Market Outlook:

English: #NeoBanks #ChallengerBanks #DigitalBanking #Fintech #BankingInnovation #FinancialServices #GlobalMarket #BusinessBanking #PersonalFinance #TechInBanking

| Report Metric | Details |

| Report Name | Neo and Challenger Bank Market |

| Forecasted market size in 2030 | US$ 43430 million |

| CAGR | 28.0% |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Atom Bank, Movencorp, Simple Finance Technology, Fidor Group, N26, Pockit, Ubank, Monzo Bank, MyBank (Alibaba Group), Holvi Bank, WeBank (Tencent Holdings Limited), Hello Bank, Koho Bank, Rocket Bank, Soon Banque, Digibank, Timo, Jibun, Jenius, K Bank, Kakao Bank, Starling Bank, Tandem Bank |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |