What is Global Automotive Emissions Ceramics Market?

The Global Automotive Emissions Ceramics Market refers to the industry focused on producing ceramic materials used in automotive emission control systems. These ceramics are crucial in reducing harmful emissions from vehicles, such as nitrogen oxides (NOx), carbon monoxide (CO), and hydrocarbons (HC). The ceramics are used in various components like catalytic converters, diesel particulate filters (DPF), and gasoline particulate filters (GPF). These components help in converting toxic gases into less harmful substances before they are released into the atmosphere. The market is driven by stringent environmental regulations and the increasing demand for cleaner and more efficient vehicles. As governments worldwide implement stricter emission standards, the need for advanced emission control technologies, including ceramics, continues to grow. The market encompasses a wide range of products and technologies, each designed to meet specific emission reduction requirements for different types of vehicles, including passenger cars, commercial vehicles, and heavy-duty trucks. The continuous advancements in ceramic materials and manufacturing processes are expected to further enhance the performance and efficiency of automotive emission control systems, making them more effective in reducing pollution and improving air quality.

Honeycomb, GPF and DPF in the Global Automotive Emissions Ceramics Market:

Honeycomb, GPF, and DPF are essential components in the Global Automotive Emissions Ceramics Market, each playing a unique role in controlling vehicle emissions. Honeycomb ceramics are widely used in catalytic converters due to their high surface area and thermal stability. These structures are designed to maximize the contact between the exhaust gases and the catalytic material, facilitating the conversion of harmful pollutants into less harmful substances. The honeycomb design allows for efficient flow of exhaust gases while providing a large surface area for the catalytic reactions to occur. Gasoline Particulate Filters (GPF) are specifically designed for gasoline engines to capture and remove particulate matter from the exhaust gases. With the increasing use of direct injection gasoline engines, which tend to produce more particulate emissions, GPFs have become crucial in meeting stringent emission standards. GPFs use a porous ceramic material to trap and oxidize particulate matter, reducing the number of harmful particles released into the atmosphere. Diesel Particulate Filters (DPF) are used in diesel engines to capture and remove soot and other particulate matter from the exhaust gases. Diesel engines are known for their high particulate emissions, and DPFs are essential in reducing these emissions to meet regulatory requirements. DPFs use a combination of filtration and catalytic oxidation to trap and burn off particulate matter, ensuring that the exhaust gases released are cleaner and less harmful. Both GPFs and DPFs require periodic regeneration to burn off the accumulated particulate matter and maintain their efficiency. This regeneration process can be passive, occurring naturally during normal engine operation, or active, requiring additional fuel injection to raise the exhaust temperature and initiate the oxidation process. The development and optimization of these ceramic components are critical in ensuring that vehicles meet the increasingly stringent emission standards set by governments worldwide. The continuous advancements in ceramic materials and manufacturing processes are expected to further enhance the performance and efficiency of honeycomb, GPF, and DPF components, making them more effective in reducing vehicle emissions and improving air quality.

Commercial Vehicles, Passenger Car in the Global Automotive Emissions Ceramics Market:

The usage of Global Automotive Emissions Ceramics Market in commercial vehicles and passenger cars is vital for meeting stringent emission standards and improving air quality. In commercial vehicles, such as trucks and buses, the demand for advanced emission control technologies is particularly high due to their larger engines and higher emission levels. Diesel engines, commonly used in commercial vehicles, produce significant amounts of particulate matter and nitrogen oxides (NOx), which are harmful to both human health and the environment. To address these emissions, commercial vehicles are equipped with Diesel Particulate Filters (DPF) and Selective Catalytic Reduction (SCR) systems that use ceramic substrates to reduce NOx emissions. DPFs capture and oxidize particulate matter, while SCR systems use a urea-based solution to convert NOx into harmless nitrogen and water. The ceramics used in these systems are designed to withstand high temperatures and harsh operating conditions, ensuring long-term durability and efficiency. In passenger cars, the focus is on reducing emissions from both gasoline and diesel engines. Gasoline Particulate Filters (GPF) are increasingly being used in gasoline direct injection (GDI) engines to capture and remove particulate matter. These filters use a porous ceramic material to trap and oxidize particulate matter, reducing the number of harmful particles released into the atmosphere. For diesel passenger cars, DPFs are essential in capturing and removing soot and other particulate matter from the exhaust gases. Additionally, catalytic converters with ceramic substrates are used in both gasoline and diesel engines to convert harmful pollutants, such as carbon monoxide (CO), hydrocarbons (HC), and NOx, into less harmful substances. The ceramics used in these converters provide a large surface area for the catalytic reactions to occur, ensuring efficient conversion of pollutants. The continuous advancements in ceramic materials and manufacturing processes are expected to further enhance the performance and efficiency of emission control systems in both commercial vehicles and passenger cars. As governments worldwide implement stricter emission standards, the demand for advanced ceramic-based emission control technologies is expected to grow, driving the Global Automotive Emissions Ceramics Market.

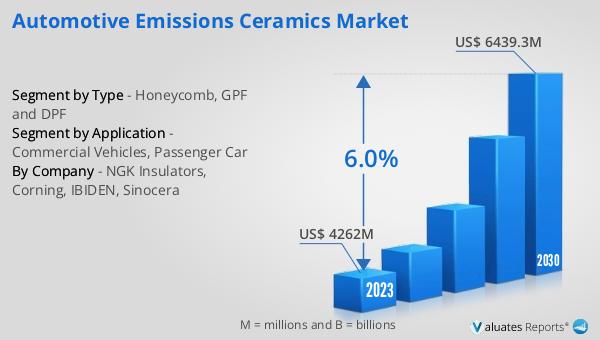

Global Automotive Emissions Ceramics Market Outlook:

The global Automotive Emissions Ceramics market is anticipated to grow significantly, reaching an estimated value of US$ 6439.3 million by 2030, up from US$ 4539.5 million in 2024, with a compound annual growth rate (CAGR) of 6.0% between 2024 and 2030. The market is highly concentrated, with the top three players accounting for approximately 88% of the total global market share. Europe stands as the largest consumer market for automotive emissions ceramics, representing about 30% of the global consumption, followed by China and North America. In terms of product types, honeycomb ceramics dominate the market, holding a substantial share of around 65%. These ceramics are integral to various emission control systems, including catalytic converters, diesel particulate filters (DPF), and gasoline particulate filters (GPF). The high demand for honeycomb ceramics is driven by their efficiency in maximizing the contact between exhaust gases and catalytic materials, thereby facilitating the conversion of harmful pollutants into less harmful substances. The continuous advancements in ceramic materials and manufacturing processes are expected to further enhance the performance and efficiency of automotive emission control systems, making them more effective in reducing pollution and improving air quality.

| Report Metric | Details |

| Report Name | Automotive Emissions Ceramics Market |

| Accounted market size in 2024 | an estimated US$ 4539.5 million |

| Forecasted market size in 2030 | US$ 6439.3 million |

| CAGR | 6.0% |

| Base Year | 2024 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | NGK Insulators, Corning, IBIDEN, Sinocera |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |