What is Global 75% Alcohol Germicidal Wipes Market?

The Global 75% Alcohol Germicidal Wipes Market refers to the worldwide industry focused on the production and distribution of disinfectant wipes containing 75% alcohol. These wipes are designed to kill germs and bacteria on various surfaces, making them essential for maintaining hygiene in both personal and professional settings. The market has seen significant growth due to increased awareness of hygiene and sanitation, especially in the wake of global health crises like the COVID-19 pandemic. These wipes are used in a variety of settings, including hospitals, schools, offices, and homes, to ensure a clean and germ-free environment. The demand for these wipes is driven by their effectiveness in killing a wide range of pathogens, ease of use, and convenience. As a result, many companies have entered the market, offering a variety of products to meet the diverse needs of consumers.

Individually Packaged, Non-individually Packaged in the Global 75% Alcohol Germicidal Wipes Market:

Individually packaged and non-individually packaged wipes are two main categories within the Global 75% Alcohol Germicidal Wipes Market. Individually packaged wipes are single-use wipes that come in separate, sealed packets. These are particularly useful for on-the-go situations, such as traveling or when a quick, convenient disinfecting solution is needed. They are often used in settings where hygiene is paramount, such as hospitals, clinics, and other healthcare facilities. The individual packaging ensures that each wipe remains sterile until it is used, reducing the risk of contamination. On the other hand, non-individually packaged wipes come in bulk containers, such as canisters or resealable packs. These are more cost-effective and are commonly used in environments where frequent disinfection is required, such as offices, schools, and homes. The bulk packaging allows for easy access and quick use, making them ideal for high-traffic areas. Both types of packaging have their advantages and are chosen based on the specific needs and preferences of the user. For instance, individually packaged wipes are more portable and convenient for personal use, while non-individually packaged wipes are more economical and suitable for larger-scale disinfection tasks. The choice between the two often depends on factors such as the intended use, frequency of use, and budget. In the healthcare sector, individually packaged wipes are preferred for their sterility and ease of use, while in commercial and residential settings, non-individually packaged wipes are favored for their cost-effectiveness and convenience. The market for both types of wipes is growing, driven by the increasing need for effective disinfection solutions in various settings. Companies in the market are continuously innovating to offer products that meet the evolving needs of consumers, such as wipes with added features like fragrance, skin moisturizers, and eco-friendly materials. The competition in the market is intense, with numerous players vying for market share by offering high-quality, effective, and affordable products. As a result, consumers have a wide range of options to choose from, ensuring that they can find a product that meets their specific needs.

Online, Offline in the Global 75% Alcohol Germicidal Wipes Market:

The usage of Global 75% Alcohol Germicidal Wipes Market can be broadly categorized into online and offline channels. Online channels refer to e-commerce platforms and websites where consumers can purchase these wipes. The convenience of online shopping has made it a popular choice for many consumers, especially during the COVID-19 pandemic when people were encouraged to stay at home. Online platforms offer a wide variety of products, allowing consumers to compare different brands and prices before making a purchase. Additionally, online shopping provides the convenience of home delivery, which is particularly beneficial for those who may have difficulty accessing physical stores. Many companies have also started offering subscription services, where consumers can receive regular deliveries of wipes, ensuring they never run out. On the other hand, offline channels refer to physical retail stores, such as supermarkets, pharmacies, and specialty stores. These stores offer the advantage of immediate availability, allowing consumers to purchase wipes as needed without waiting for delivery. Additionally, physical stores provide the opportunity for consumers to see and feel the product before making a purchase, which can be an important factor for some buyers. Offline channels also include wholesale distributors who supply wipes to various businesses and institutions, such as hospitals, schools, and offices. These bulk purchases are often more cost-effective and ensure that large organizations have a steady supply of disinfectant wipes. Both online and offline channels play a crucial role in the distribution of 75% alcohol germicidal wipes, catering to the diverse needs and preferences of consumers. The choice between online and offline channels often depends on factors such as convenience, availability, and personal preference. For instance, tech-savvy consumers who value convenience may prefer to shop online, while those who prefer to see the product before buying may opt for offline stores. Additionally, businesses and institutions that require large quantities of wipes may prefer to purchase from wholesale distributors. The market for 75% alcohol germicidal wipes is highly competitive, with numerous players offering a wide range of products through both online and offline channels. Companies are continuously innovating to improve their products and meet the evolving needs of consumers, such as offering eco-friendly options, adding skin-friendly ingredients, and providing various packaging options. The competition in the market ensures that consumers have access to high-quality, effective, and affordable products, regardless of their preferred shopping channel.

Global 75% Alcohol Germicidal Wipes Market Outlook:

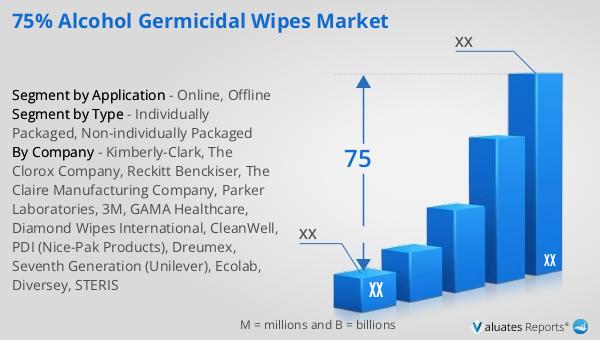

The global market for 75% Alcohol Germicidal Wipes was valued at several million US dollars in 2023 and is expected to grow significantly by 2030, witnessing a compound annual growth rate (CAGR) during the forecast period from 2024 to 2030. In North America, the market is projected to increase from its 2023 valuation to a higher value by 2030, also experiencing a notable CAGR during the same period. Similarly, the Asia-Pacific region is anticipated to see substantial growth, with the market value rising from its 2023 figure to a higher amount by 2030, driven by a comparable CAGR. Major global manufacturers in this market include well-known companies such as Kimberly-Clark, The Clorox Company, Reckitt Benckiser, The Claire Manufacturing Company, Parker Laboratories, 3M, GAMA Healthcare, Diamond Wipes International, and CleanWell. These companies are key players in the industry, contributing to the market's growth through their innovative products and extensive distribution networks. Their presence in the market ensures a steady supply of high-quality germicidal wipes, meeting the increasing demand for effective disinfection solutions worldwide.

| Report Metric | Details |

| Report Name | 75% Alcohol Germicidal Wipes Market |

| CAGR | 75 |

| Segment by Type |

|

| Segment by Application |

|

| Consumption by Region |

|

| By Company | Kimberly-Clark, The Clorox Company, Reckitt Benckiser, The Claire Manufacturing Company, Parker Laboratories, 3M, GAMA Healthcare, Diamond Wipes International, CleanWell, PDI (Nice-Pak Products), Dreumex, Seventh Generation (Unilever), Ecolab, Diversey, STERIS |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |