What is Global Potting and Encapsulating Compounds Market?

The Global Potting and Encapsulating Compounds Market refers to a specialized sector within the materials industry, focusing on the production and distribution of substances used to protect electronic components. These compounds are designed to shield sensitive parts from moisture, dust, and thermal or mechanical shocks, thereby enhancing their durability and performance. The market encompasses a variety of materials, each tailored to meet specific environmental and operational requirements. As electronic devices become increasingly integral to daily life and industries, the demand for these protective compounds has surged. Manufacturers are continuously innovating to develop materials that offer superior protection, extended lifespan, and improved reliability of electronic components. This market's growth is propelled by the expanding electronics sector, including consumer electronics, automotive, aerospace, and healthcare devices, where the reliability and longevity of components are crucial. The global reach of this market underscores its importance in supporting the technological advancements that drive modern economies and societies.

Epoxy, Polyurethane, Silicone, Polyamide, Polyolefin, Others in the Global Potting and Encapsulating Compounds Market:

Diving into the specifics, the Global Potting and Encapsulating Compounds Market is segmented by the types of materials used, including Epoxy, Polyurethane, Silicone, Polyamide, Polyolefin, among others. Each of these materials offers unique properties catering to diverse applications. Epoxy compounds are renowned for their mechanical strength and excellent adhesion, making them ideal for high-stress environments. Polyurethane materials are flexible and offer superior resistance to wear and tear, suited for dynamic components. Silicone-based compounds stand out for their exceptional thermal stability and flexibility, ensuring protection in a wide temperature range. Polyamide materials are valued for their good electrical properties and chemical resistance, suitable for sensitive electronic applications. Polyolefin compounds, on the other hand, are used for their excellent insulating properties and chemical resistance, making them perfect for electrical insulation. The "Others" category encompasses a range of specialized materials designed for niche applications, highlighting the market's versatility. The choice of material depends on the specific requirements of the application, including environmental exposure, mechanical stress, and thermal management needs. This diversity in materials underscores the market's ability to cater to the broad spectrum of industries relying on electronic components, from consumer electronics to automotive and aerospace sectors.

Electronics, Automotive, Aerospace, Marine, Energy & Power, Healthcare, Others in the Global Potting and Encapsulating Compounds Market:

The usage of Global Potting and Encapsulating Compounds extends across various industries, each with its unique requirements and challenges. In the electronics sector, these compounds are crucial for protecting circuit boards and components from moisture, dust, and thermal stress, ensuring reliability and longevity. The automotive industry benefits from these materials in safeguarding electronic systems against vibrations, heat, and corrosive substances, contributing to vehicle safety and performance. Aerospace applications demand high-performance compounds for protecting avionics and onboard systems against extreme environmental conditions encountered during flight. In the marine sector, potting and encapsulating compounds prevent water ingress and corrosion in electronic devices exposed to harsh marine environments. The energy and power industry utilizes these materials to insulate and protect electrical components in power generation and distribution systems, enhancing efficiency and safety. Healthcare devices, particularly those that are implantable or used in critical diagnostics, rely on these compounds for biocompatibility and protection against bodily fluids. Other applications include telecommunications, industrial machinery, and consumer electronics, where the durability and reliability of components are paramount. This wide-ranging usage underscores the critical role of potting and encapsulating compounds in modern technology and industry, facilitating advancements and ensuring the smooth operation of electronic systems across sectors.

Global Potting and Encapsulating Compounds Market Outlook:

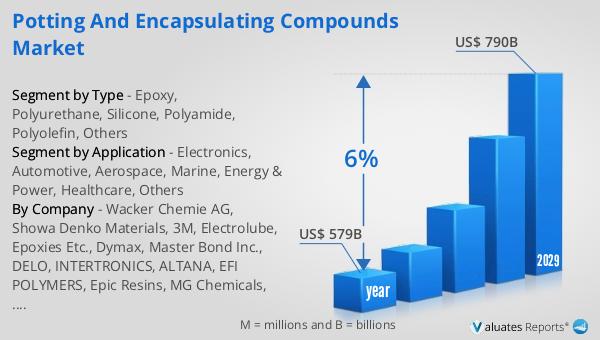

The market outlook for the global semiconductor industry, as estimated in 2022, valued the sector at approximately US$ 579 billion. This figure is anticipated to reach around US$ 790 billion by the year 2029. This projection indicates a steady growth trajectory, with an expected Compound Annual Growth Rate (CAGR) of 6% throughout the forecast period. This growth is reflective of the increasing demand for semiconductors across various applications, including consumer electronics, automotive, and industrial uses, among others. The semiconductor industry's expansion is crucial for the technological advancements that define our modern world, from smartphones and computers to electric vehicles and smart manufacturing. The projected increase in market value underscores the industry's vital role in the global economy and its potential for continued innovation and development. This outlook not only highlights the robust health of the semiconductor market but also points towards the broader implications for related sectors, including the Global Potting and Encapsulating Compounds Market, which plays a significant role in ensuring the durability and reliability of semiconductor devices.

| Report Metric | Details |

| Report Name | Potting and Encapsulating Compounds Market |

| Accounted market size in year | US$ 579 billion |

| Forecasted market size in 2029 | US$ 790 billion |

| CAGR | 6% |

| Base Year | year |

| Forecasted years | 2024 - 2029 |

| Segment by Type |

|

| Segment by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Wacker Chemie AG, Showa Denko Materials, 3M, Electrolube, Epoxies Etc., Dymax, Master Bond Inc., DELO, INTERTRONICS, ALTANA, EFI POLYMERS, Epic Resins, MG Chemicals, Nagase America LLC., DuPont, Avantor, Inc., United Resin Corporation, Copps Industries, Aremco, Vitrochem Technology, Creative Materials Inc., Henkel AG & Co. KGaA, GS Polymers, RBC Industries, Inc, PARKER HANNIFIN CORP, Panacol-USA (A subsidiary of Dr. Honle AG), Momentive, HERNON MANUFACTURING INC., ITW Performance Polymers |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |