What is Global Personal Medical Insurance Market?

The Global Personal Medical Insurance Market is a vast and intricate sector that caters to the healthcare needs of individuals around the globe, offering them financial coverage against medical expenses. This market encompasses a range of policies that provide coverage for various medical services and treatments, ensuring that individuals can access the healthcare they require without the burden of exorbitant costs. Personal medical insurance plays a crucial role in the healthcare system, offering peace of mind to policyholders by mitigating the financial risks associated with illness and hospitalization. It covers a broad spectrum of medical services, from routine check-ups and outpatient care to more complex procedures and hospital stays. As healthcare costs continue to rise, the demand for personal medical insurance has seen significant growth, driven by an increasing awareness of the importance of health and well-being, and the desire to secure financial protection against unforeseen medical expenses. This market is characterized by its diversity, with policies tailored to meet the specific needs of individuals, including varying levels of coverage, premium options, and benefits. As such, the Global Personal Medical Insurance Market plays a pivotal role in supporting the health and financial stability of individuals across the world.

Mild Symptoms, Severe Symptoms, Others in the Global Personal Medical Insurance Market:

Delving into the Global Personal Medical Insurance Market, it's essential to understand the coverage spectrum, particularly in terms of mild symptoms, severe symptoms, and other conditions. Mild symptoms, often including common ailments like colds, minor injuries, or routine check-ups, are usually covered under basic personal medical insurance plans. These plans ensure that individuals can seek timely medical attention without worrying about the financial implications of these less severe conditions. On the other hand, severe symptoms, which could range from chronic diseases to major surgeries, require more comprehensive coverage. These conditions often incur higher medical costs, necessitating policies with higher premiums but offering extensive coverage to mitigate the financial strain on the insured. Beyond these, personal medical insurance also caters to a range of other conditions and medical needs, including preventive care, mental health services, and alternative treatments, among others. This broad coverage spectrum ensures that individuals can tailor their insurance plans to their specific health needs, providing a safety net that covers a wide array of medical conditions and treatments. The flexibility and diversity of coverage options within the Global Personal Medical Insurance Market underscore its role in offering comprehensive financial protection against a wide range of health issues, ensuring that individuals can access the care they need without the added stress of financial burden.

Children, Aduts, Senior Citizens in the Global Personal Medical Insurance Market:

The Global Personal Medical Insurance Market serves a critical role in providing healthcare coverage across different age groups, including children, adults, and senior citizens, each with their unique healthcare needs and challenges. For children, personal medical insurance is pivotal in covering the costs associated with pediatric care, vaccinations, and the treatment of common childhood illnesses, ensuring that children have access to the necessary healthcare services for a healthy start in life. As for adults, the insurance needs become more varied, covering everything from routine health check-ups and preventive care to more complex procedures and treatments for illnesses that may occur with increasing age. Personal medical insurance for adults is designed to offer financial protection against the high costs of healthcare, while also encouraging preventive care to maintain health and well-being. Senior citizens, on the other hand, face more complex health challenges, often requiring more frequent medical attention and long-term care. Personal medical insurance for seniors is tailored to address these needs, offering coverage for a range of services from chronic disease management to long-term care facilities. This comprehensive approach across different age groups highlights the Global Personal Medical Insurance Market's commitment to providing age-appropriate healthcare coverage, ensuring that individuals have access to the medical services they need at every stage of life.

Global Personal Medical Insurance Market Outlook:

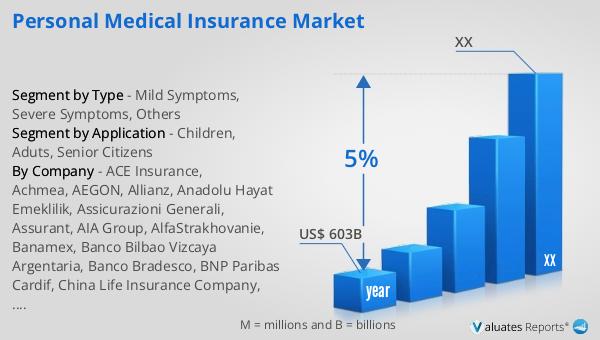

Our research indicates that the global market for medical devices is currently valued at approximately US$ 603 billion as of the year 2023. This market is on a trajectory of steady growth, with expectations to expand at a compound annual growth rate (CAGR) of 5% over the next six years. This growth is reflective of the increasing demand for medical devices across various healthcare sectors, driven by technological advancements, an aging global population, and a growing focus on healthcare improvement. The expansion of the medical devices market is a testament to the critical role these technologies play in diagnosing, treating, and managing a wide array of health conditions. As the market continues to evolve, it is anticipated that innovations in medical technology will further propel the growth of this sector, ensuring that healthcare providers have access to the tools and equipment necessary to offer high-quality care. This outlook underscores the dynamic nature of the medical devices market and its significant potential for continued growth and development in the coming years.

| Report Metric | Details |

| Report Name | Personal Medical Insurance Market |

| Accounted market size in year | US$ 603 billion |

| CAGR | 5% |

| Base Year | year |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | ACE Insurance, Achmea, AEGON, Allianz, Anadolu Hayat Emeklilik, Assicurazioni Generali, Assurant, AIA Group, AlfaStrakhovanie, Banamex, Banco Bilbao Vizcaya Argentaria, Banco Bradesco, BNP Paribas Cardif, China Life Insurance Company, China Pacific Insurance, CNP Assurances, Credit Agricole, DZ Bank, Garanti Emeklilik ve Hayat, Great Eastern Holdings, Grupo Nacional Provincial, Hanwha Life Insurance Company, HDFC Standard Life Insurance Company, ICICI Prudential Life Insurance Company |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |