What is Global Consumer Credit Market?

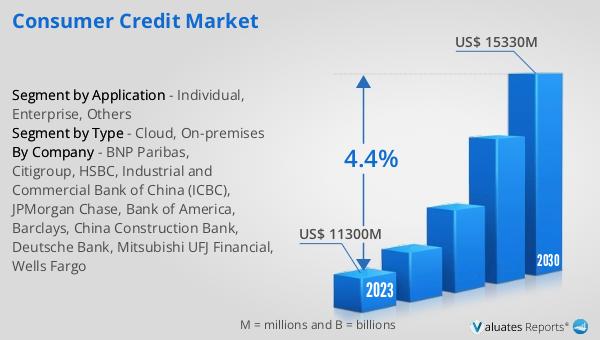

The Global Consumer Credit Market is essentially a vast financial landscape where individuals and businesses can borrow money. This market encompasses various types of credit, including personal loans, credit cards, auto loans, and mortgages. It's a critical component of the global economy, enabling consumers to make purchases and investments that they might not be able to afford upfront, thereby fueling economic growth and expansion. As of 2023, this market was valued at a substantial $11,300 million. It's projected to grow even further, reaching an impressive $15,330 million by 2030. This growth, at a compound annual growth rate (CAGR) of 4.4% from 2024 to 2030, reflects an increasing demand for consumer credit products worldwide. This demand is driven by various factors, including rising consumer spending, the expansion of digital lending platforms, and the increasing accessibility of credit in emerging markets. As such, the Global Consumer Credit Market plays a pivotal role in facilitating financial access and fostering economic development across the globe.

Cloud, On-premises in the Global Consumer Credit Market:

In the realm of the Global Consumer Credit Market, the distinction between cloud and on-premises solutions is pivotal. Cloud-based solutions refer to services and software that are hosted on the internet, allowing users to access them from anywhere at any time. This flexibility is particularly advantageous for consumer credit services, as it enables seamless access to credit applications, account management, and customer support. On the other hand, on-premises solutions are installed and run on computers on the premises of the person or organization using the software, rather than at a remote facility. This setup offers users complete control over their data and systems but requires significant investment in hardware and IT infrastructure. The choice between cloud and on-premises solutions in the Global Consumer Credit Market hinges on several factors, including cost, security, scalability, and regulatory compliance. Cloud solutions are generally more cost-effective and scalable, making them suitable for businesses of all sizes. They also offer the advantage of regular updates and enhancements without the need for significant capital expenditure. On-premises solutions, while more costly and complex to manage, provide enhanced security and control, which can be crucial for organizations with stringent data protection requirements. As the Global Consumer Credit Market continues to evolve, the interplay between cloud and on-premises solutions will play a critical role in shaping the future of consumer credit services.

Individual, Enterprise, Others in the Global Consumer Credit Market:

The Global Consumer Credit Market finds its application across various segments, including individuals, enterprises, and others. For individuals, consumer credit offers a way to manage personal finances, allowing for the purchase of goods and services or the consolidation of debt. This flexibility can help individuals improve their quality of life by making immediate purchases possible, with repayment spread over time. Enterprises, on the other hand, leverage consumer credit as a tool for financial management and growth. By offering credit to customers, businesses can boost sales and improve customer loyalty. Credit options can also help enterprises manage cash flow by providing a buffer during periods of low revenue. The 'others' category encompasses a broad range of entities, including government institutions and non-profit organizations, which might use consumer credit for various purposes, such as funding projects or facilitating operations. Each of these segments relies on the Global Consumer Credit Market in different ways, but all benefit from the increased financial flexibility and opportunities it provides. As the market continues to grow and evolve, its role in supporting economic activity across these segments is likely to expand further.

Global Consumer Credit Market Outlook:

The market outlook for the Global Consumer Credit Market presents a promising future. As of the year 2023, the market's valuation stood at approximately $11,300 million. Looking ahead, projections indicate a significant growth trajectory, with expectations to reach around $15,330 million by the year 2030. This anticipated growth, characterized by a compound annual growth rate (CAGR) of 4.4% during the forecast period from 2024 to 2030, underscores the robust demand and expanding scope of consumer credit services globally. Such growth is reflective of an increasing reliance on consumer credit products by individuals and businesses alike, driven by the need for financial flexibility and the desire to make immediate purchases or investments. The expanding digital lending landscape, coupled with the growing accessibility of credit services, especially in emerging markets, further fuels this growth. This optimistic outlook highlights the Global Consumer Credit Market's critical role in facilitating economic activity and underscores its potential for continued expansion in the coming years.

| Report Metric | Details |

| Report Name | Consumer Credit Market |

| Accounted market size in 2023 | US$ 11300 million |

| Forecasted market size in 2030 | US$ 15330 million |

| CAGR | 4.4% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | BNP Paribas, Citigroup, HSBC, Industrial and Commercial Bank of China (ICBC), JPMorgan Chase, Bank of America, Barclays, China Construction Bank, Deutsche Bank, Mitsubishi UFJ Financial, Wells Fargo |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |