What is Global Insurance Brokerage Software Market?

The Global Insurance Brokerage Software Market is a rapidly expanding sector that plays a crucial role in the insurance industry. This software aids insurance brokers in managing their daily operations, including client relationships, policy and contract management, commission processing, and document management. It's a digital platform that streamlines the process of selling insurance policies and provides a centralized system for tracking all transactions and client information. The software is designed to help brokers improve their productivity, enhance customer service, and increase profitability. It's a comprehensive solution that integrates various functions such as CRM, document management, task management, and accounting, making it easier for brokers to manage their business. The software also provides analytical tools that help brokers make informed decisions and develop effective strategies.

Software as a Service, Platform as a Service, Infrastructure as a Service, On-premise in the Global Insurance Brokerage Software Market:

In the Global Insurance Brokerage Software Market, there are different types of software delivery models including Software as a Service (SaaS), Platform as a Service (PaaS), Infrastructure as a Service (IaaS), and On-premise. SaaS is a software distribution model where a third-party provider hosts applications and makes them available to customers over the Internet. PaaS is a cloud computing model that provides a platform allowing customers to develop, run, and manage applications without the complexity of building and maintaining the infrastructure. IaaS is a form of cloud computing that provides virtualized computing resources over the Internet. On-premise software is installed and run on computers on the premises of the person or organization using the software, rather than at a remote facility. Each of these models has its own advantages and is chosen based on the specific needs and resources of the business.

Large Enterprises(1000+ Users), Medium-Sized Enterprise(499-1000 Users), Small Enterprises(1-499 Users) in the Global Insurance Brokerage Software Market:

The Global Insurance Brokerage Software Market is used by businesses of all sizes including Large Enterprises (1000+ Users), Medium-Sized Enterprises (499-1000 Users), and Small Enterprises (1-499 Users). Large enterprises use this software to manage their extensive client base and complex insurance policies. Medium-sized enterprises use it to streamline their operations and improve efficiency. Small enterprises, on the other hand, use this software to automate their processes and enhance customer service. The software is scalable and can be customized to suit the specific needs of each business, making it a valuable tool for companies of all sizes.

Global Insurance Brokerage Software Market Outlook:

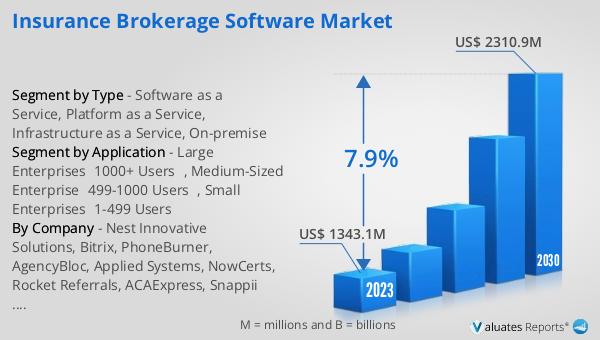

Looking at the market outlook, the Global Insurance Brokerage Software Market was valued at US$ 1343.1 million in 2023. It is expected to grow significantly and reach a value of US$ 2310.9 million by 2030. This represents a Compound Annual Growth Rate (CAGR) of 7.9% during the forecast period from 2024 to 2030. This growth can be attributed to the increasing demand for efficient and effective insurance brokerage management solutions. The software not only simplifies the process of selling insurance policies but also helps brokers in managing their client relationships, policy and contract management, commission processing, and document management.

| Report Metric | Details |

| Report Name | Insurance Brokerage Software Market |

| Accounted market size in 2023 | US$ 1343.1 million |

| Forecasted market size in 2030 | US$ 2310.9 million |

| CAGR | 7.9% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Nest Innovative Solutions, Bitrix, PhoneBurner, AgencyBloc, Applied Systems, NowCerts, Rocket Referrals, ACAExpress, Snappii Apps, HawkSoft, Indio Technologies, A1 Enterprise, Jenesis Software, AmbiCom, EZLynx, North American Software Associates, FreeAgent Network, Ytel, Mandon Software, Insly, Sentry IMS, VRC Insurance Systems, QQ Solutions, Agency Matrix, TechCanary, Surefyre Systems |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |