What is Global Option Trading Analysis Software Market?

The Global Option Trading Analysis Software Market refers to the industry focused on providing software solutions that assist traders and investors in analyzing and executing options trades. Options trading involves contracts that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price before a specified date. This market is driven by the increasing demand for sophisticated tools that can help traders make informed decisions by analyzing market trends, volatility, and other critical factors. These software solutions often come with features like real-time data analysis, risk management tools, and customizable trading strategies, making them essential for both novice and experienced traders. As financial markets become more complex, the need for advanced analytical tools continues to grow, fueling the expansion of the Global Option Trading Analysis Software Market. This market is characterized by a diverse range of products catering to different user needs, from individual traders to large financial institutions, and is expected to continue evolving with advancements in technology and changes in market dynamics.

Cloud-Based, On-Premised in the Global Option Trading Analysis Software Market:

In the Global Option Trading Analysis Software Market, there are two primary deployment models: cloud-based and on-premise. Cloud-based solutions are hosted on remote servers and accessed via the internet, offering several advantages such as scalability, flexibility, and cost-effectiveness. These solutions allow users to access their trading platforms from anywhere with an internet connection, making them ideal for traders who require mobility and real-time data access. Cloud-based software often comes with automatic updates and maintenance, reducing the need for in-house IT support and infrastructure. This model is particularly appealing to small and medium-sized enterprises (SMEs) and individual traders who may not have the resources to maintain extensive IT systems. On the other hand, on-premise solutions are installed locally on a company's own servers and computers. This model provides greater control over data security and system customization, which can be crucial for large financial institutions and organizations with specific regulatory requirements. On-premise software allows for a tailored approach to trading analysis, enabling firms to integrate the software with their existing systems and workflows. However, it often requires a significant upfront investment in hardware and IT resources, as well as ongoing maintenance and support. Despite these challenges, some organizations prefer on-premise solutions for their perceived reliability and security. The choice between cloud-based and on-premise solutions depends largely on the specific needs and resources of the user. For instance, a financial company with a robust IT infrastructure and stringent data security requirements might opt for an on-premise solution to maintain full control over their trading data. Conversely, a smaller firm or individual trader might choose a cloud-based solution for its ease of use and lower initial costs. As technology continues to advance, the lines between these two models are blurring, with hybrid solutions emerging that offer the benefits of both cloud and on-premise deployments. These hybrid models allow users to store sensitive data on-premise while leveraging the scalability and accessibility of the cloud for less critical functions. This flexibility is becoming increasingly important as organizations seek to balance security, cost, and performance in their trading operations. Overall, the choice between cloud-based and on-premise solutions in the Global Option Trading Analysis Software Market is influenced by factors such as cost, security, scalability, and the specific needs of the user. As the market continues to evolve, we can expect to see further innovations in deployment models, offering even more options for traders and financial institutions looking to optimize their trading strategies.

Bank, Financial Company, Government, Personal, Others in the Global Option Trading Analysis Software Market:

The Global Option Trading Analysis Software Market finds its application across various sectors, including banks, financial companies, government entities, personal users, and others. In banks, these software solutions are used to manage and analyze complex options portfolios, helping traders and risk managers make informed decisions. Banks often deal with large volumes of options contracts, and having a robust analysis tool is crucial for managing risk and optimizing trading strategies. Financial companies, such as hedge funds and investment firms, also rely heavily on option trading analysis software to gain a competitive edge in the market. These firms use the software to develop and test trading strategies, analyze market trends, and manage risk. The ability to quickly process large amounts of data and generate actionable insights is a key advantage for financial companies operating in fast-paced markets. Government entities may use option trading analysis software for regulatory and oversight purposes, ensuring that financial markets operate smoothly and transparently. These tools can help government agencies monitor trading activities, detect anomalies, and enforce compliance with financial regulations. For personal users, option trading analysis software provides an accessible way to engage in options trading, offering features like educational resources, strategy development tools, and real-time market data. Individual traders can use these tools to enhance their trading skills, manage risk, and make informed investment decisions. Other sectors, such as educational institutions and research organizations, may use option trading analysis software for academic and research purposes, studying market behavior and developing new trading theories. Overall, the versatility and functionality of option trading analysis software make it a valuable tool across a wide range of applications, helping users navigate the complexities of options trading and achieve their financial goals.

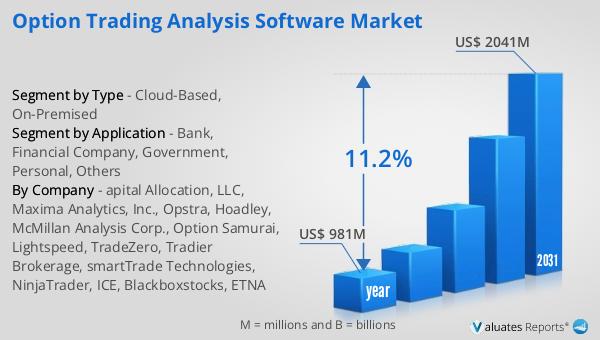

Global Option Trading Analysis Software Market Outlook:

The outlook for the Global Option Trading Analysis Software Market indicates significant growth potential. In 2024, the market was valued at approximately US$ 981 million. By 2031, it is expected to reach a revised size of around US$ 2041 million, reflecting a compound annual growth rate (CAGR) of 11.2% over the forecast period. This growth can be attributed to several factors, including the increasing complexity of financial markets, the growing demand for advanced analytical tools, and the rising adoption of technology in trading activities. As traders and financial institutions seek to gain a competitive edge, the need for sophisticated software solutions that can provide real-time data analysis, risk management, and strategy development is becoming more pronounced. Additionally, the shift towards digital trading platforms and the increasing popularity of options trading among individual investors are driving demand for user-friendly and accessible software solutions. The market is also benefiting from technological advancements, such as artificial intelligence and machine learning, which are enhancing the capabilities of trading analysis software and enabling more accurate predictions and insights. As the market continues to evolve, we can expect to see further innovations and developments that will shape the future of option trading analysis software, offering new opportunities for growth and expansion.

| Report Metric | Details |

| Report Name | Option Trading Analysis Software Market |

| Accounted market size in year | US$ 981 million |

| Forecasted market size in 2031 | US$ 2041 million |

| CAGR | 11.2% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | apital Allocation, LLC, Maxima Analytics, Inc., Opstra, Hoadley, McMillan Analysis Corp., Option Samurai, Lightspeed, TradeZero, Tradier Brokerage, smartTrade Technologies, NinjaTrader, ICE, Blackboxstocks, ETNA |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |