What is Global Livestock Anti Infective Medicine Market?

The Global Livestock Anti Infective Medicine Market is a crucial segment of the veterinary pharmaceutical industry, focusing on the development and distribution of medications designed to prevent and treat infections in livestock animals. These medicines are essential for maintaining the health and productivity of animals such as cattle, swine, poultry, and equine. The market encompasses a wide range of products, including antibiotics, antivirals, antifungals, and antiparasitics, each tailored to combat specific pathogens that threaten animal health. The demand for these medicines is driven by the need to ensure food safety, improve animal welfare, and enhance the efficiency of livestock production. As the global population continues to grow, the pressure on the agricultural sector to produce more food sustainably increases, further boosting the demand for effective anti-infective solutions. The market is characterized by continuous research and development efforts aimed at discovering new drugs and improving existing ones to address the evolving challenges posed by antibiotic resistance and emerging infectious diseases. Companies operating in this market are also focusing on developing products that comply with stringent regulatory standards to ensure the safety and efficacy of their offerings.

External Use, Internal Use in the Global Livestock Anti Infective Medicine Market:

In the Global Livestock Anti Infective Medicine Market, the application of these medicines can be broadly categorized into external use and internal use, each serving distinct purposes in the management of animal health. External use refers to the application of anti-infective agents on the surface of the animal's body, primarily to treat or prevent skin infections, wounds, and infestations by parasites such as ticks and lice. These products are often available in the form of sprays, ointments, or powders and are designed to provide a protective barrier against pathogens. External use medicines are crucial in maintaining the skin integrity of livestock, which is the first line of defense against infections. They are particularly important in environments where animals are exposed to harsh conditions or where there is a high risk of injury and subsequent infection. On the other hand, internal use involves the administration of anti-infective medicines through oral, injectable, or other systemic routes to treat infections that affect the internal organs or systems of the animal. Internal use medicines are vital for combating bacterial, viral, and parasitic infections that can severely impact the health and productivity of livestock. These medicines work by targeting the pathogens within the animal's body, helping to eliminate the infection and restore health. The choice between external and internal use depends on the type of infection, the severity of the condition, and the specific needs of the animal. In many cases, a combination of both external and internal treatments may be necessary to effectively manage and control infections. The development of these medicines involves rigorous testing and research to ensure they are safe and effective for use in animals. Companies in this market are continually innovating to create new formulations and delivery methods that enhance the efficacy and convenience of these treatments. Additionally, there is a growing emphasis on developing products that minimize the risk of antibiotic resistance, a significant concern in both human and veterinary medicine. This has led to increased interest in alternative therapies, such as probiotics and vaccines, which can complement traditional anti-infective treatments. The market for external and internal use anti-infective medicines is influenced by various factors, including regulatory policies, consumer preferences, and advancements in veterinary science. As awareness of animal health and welfare continues to rise, there is a greater demand for products that not only treat infections but also promote overall well-being and productivity. This has prompted companies to invest in research and development to create innovative solutions that meet the evolving needs of the livestock industry. The integration of technology in the development and distribution of these medicines is also playing a significant role in shaping the market. Digital platforms and data analytics are being used to improve the precision and efficiency of treatment protocols, ensuring that animals receive the right medication at the right time. This not only enhances the effectiveness of treatments but also reduces the risk of overuse and misuse of anti-infective agents. Overall, the Global Livestock Anti Infective Medicine Market is a dynamic and rapidly evolving sector that plays a critical role in supporting the health and productivity of livestock animals worldwide.

Cattle, Equine, Swine, Poultry in the Global Livestock Anti Infective Medicine Market:

The usage of Global Livestock Anti Infective Medicine Market products varies significantly across different types of livestock, including cattle, equine, swine, and poultry, each with its unique health challenges and requirements. In cattle, anti-infective medicines are primarily used to treat and prevent diseases such as mastitis, respiratory infections, and foot rot, which can severely impact milk production and overall herd health. These medicines help maintain the productivity and profitability of dairy and beef operations by ensuring that cattle remain healthy and free from debilitating infections. In equine, anti-infective medicines are essential for managing conditions such as respiratory infections, skin infections, and joint infections, which can affect the performance and well-being of horses. Equine anti-infective treatments are often tailored to the specific needs of individual animals, taking into account factors such as age, breed, and activity level. In swine, the use of anti-infective medicines is critical for controlling diseases such as swine flu, pneumonia, and enteric infections, which can spread rapidly in pig populations and lead to significant economic losses. These medicines are used to protect the health of pigs and ensure the efficiency of pork production. In poultry, anti-infective medicines are used to prevent and treat infections such as avian influenza, coccidiosis, and bacterial infections, which can affect the health and productivity of flocks. The use of these medicines is essential for maintaining the quality and safety of poultry products, which are a major source of protein for people worldwide. The application of anti-infective medicines in these livestock sectors is guided by best practices in animal husbandry and veterinary care, with a focus on minimizing the risk of antibiotic resistance and ensuring the responsible use of these products. This involves implementing comprehensive health management programs that include vaccination, biosecurity measures, and regular monitoring of animal health. The development of species-specific anti-infective medicines is a key area of focus for companies in this market, as it allows for more targeted and effective treatments that address the unique needs of different types of livestock. This includes the creation of formulations that are easy to administer and have minimal impact on the environment. The use of anti-infective medicines in livestock is also influenced by consumer preferences and regulatory requirements, which are increasingly emphasizing the importance of sustainable and ethical farming practices. This has led to a growing interest in alternative therapies and natural products that can complement traditional anti-infective treatments and support the overall health and well-being of animals. As the demand for high-quality animal products continues to rise, the Global Livestock Anti Infective Medicine Market is expected to play an increasingly important role in supporting the health and productivity of livestock worldwide.

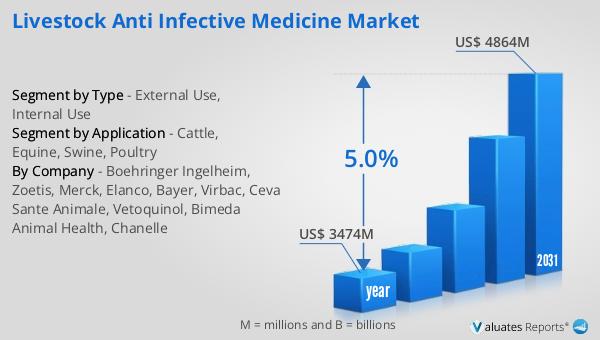

Global Livestock Anti Infective Medicine Market Outlook:

The global market for Livestock Anti Infective Medicine was valued at $3,474 million in 2024, and it is anticipated to expand to a revised size of $4,864 million by 2031, reflecting a compound annual growth rate (CAGR) of 5.0% over the forecast period. This growth trajectory underscores the increasing demand for effective anti-infective solutions in the livestock industry, driven by the need to enhance animal health and productivity. The market's expansion is fueled by several factors, including the rising global population, which necessitates increased food production, and the growing awareness of animal welfare and food safety. As livestock producers strive to meet these demands, the adoption of advanced veterinary medicines becomes essential. The projected growth also highlights the ongoing efforts by pharmaceutical companies to innovate and develop new products that address the challenges posed by antibiotic resistance and emerging infectious diseases. These efforts are crucial in ensuring the sustainability and resilience of the livestock sector, which plays a vital role in global food security. The market's positive outlook reflects the broader trends in the agricultural industry, where there is a continuous push towards more efficient and sustainable practices. As the market evolves, stakeholders are expected to focus on developing solutions that not only treat infections but also promote overall animal health and well-being. This holistic approach is likely to drive further growth and innovation in the Global Livestock Anti Infective Medicine Market.

| Report Metric | Details |

| Report Name | Livestock Anti Infective Medicine Market |

| Accounted market size in year | US$ 3474 million |

| Forecasted market size in 2031 | US$ 4864 million |

| CAGR | 5.0% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| Consumption by Region |

|

| By Company | Boehringer Ingelheim, Zoetis, Merck, Elanco, Bayer, Virbac, Ceva Sante Animale, Vetoquinol, Bimeda Animal Health, Chanelle |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |