What is Global Hemophilia Drugs Market?

The Global Hemophilia Drugs Market refers to the worldwide industry focused on the development, production, and distribution of medications used to treat hemophilia, a genetic disorder that impairs the body's ability to make blood clots, a process needed to stop bleeding. This market encompasses a range of therapies designed to manage and treat different types of hemophilia, including Hemophilia A, Hemophilia B, and other related bleeding disorders such as Von Willebrand Disease. The market is driven by advancements in medical research, increasing awareness about hemophilia, and the growing demand for effective treatment options. Pharmaceutical companies are investing heavily in research and development to create innovative drugs that can improve the quality of life for patients with hemophilia. The market is also influenced by factors such as government initiatives, healthcare infrastructure, and the availability of healthcare services. As the global population continues to grow and age, the demand for hemophilia drugs is expected to increase, making this market a critical component of the broader healthcare industry. The Global Hemophilia Drugs Market plays a vital role in providing patients with access to life-saving treatments and improving their overall health outcomes.

Hemophilia A, Inhibitors, Hemophilia B, Von Willebrand Disease in the Global Hemophilia Drugs Market:

Hemophilia A is the most common form of hemophilia, caused by a deficiency of clotting factor VIII. Patients with Hemophilia A experience prolonged bleeding episodes, which can occur spontaneously or after injuries. The severity of the condition varies, with some individuals experiencing frequent bleeding episodes and others having milder symptoms. Inhibitors are antibodies that develop in some patients with hemophilia, particularly those with Hemophilia A, and they neutralize the effectiveness of replacement clotting factors. This presents a significant challenge in treatment, as standard therapies become less effective, necessitating alternative approaches such as bypassing agents or immune tolerance induction. Hemophilia B, also known as Christmas disease, is caused by a deficiency of clotting factor IX. It is less common than Hemophilia A but presents similar symptoms, including spontaneous bleeding and prolonged bleeding after injuries. Treatment for Hemophilia B typically involves replacement therapy with factor IX concentrates. Von Willebrand Disease is another bleeding disorder, caused by a deficiency or dysfunction of the von Willebrand factor, a protein that helps platelets stick together and adhere to blood vessel walls. It is the most common inherited bleeding disorder and can range from mild to severe. Treatment for Von Willebrand Disease may include desmopressin, which stimulates the release of von Willebrand factor, or replacement therapies with von Willebrand factor concentrates. The Global Hemophilia Drugs Market addresses these conditions by providing a range of therapeutic options tailored to the specific needs of patients. Pharmaceutical companies are continually researching and developing new treatments to improve the efficacy and safety of hemophilia therapies. The market is characterized by a strong focus on innovation, with companies exploring gene therapy, novel recombinant products, and other advanced treatment modalities. As a result, patients with hemophilia and related bleeding disorders have access to a growing array of treatment options that can help manage their conditions and improve their quality of life. The Global Hemophilia Drugs Market is a dynamic and rapidly evolving industry, driven by the need to address the complex challenges associated with bleeding disorders and provide effective solutions for patients worldwide.

Recombinant Therapies, Plasma-Derived Therapies in the Global Hemophilia Drugs Market:

The Global Hemophilia Drugs Market is characterized by the use of two primary types of therapies: recombinant therapies and plasma-derived therapies. Recombinant therapies involve the use of genetically engineered proteins that mimic the natural clotting factors in the body. These therapies are produced using recombinant DNA technology, which allows for the creation of highly purified and consistent products. Recombinant therapies are considered the gold standard in hemophilia treatment due to their safety and efficacy. They are less likely to cause allergic reactions or transmit infections compared to plasma-derived therapies. Recombinant factor VIII and factor IX products are commonly used to treat Hemophilia A and Hemophilia B, respectively. These therapies have significantly improved the management of hemophilia, allowing patients to lead more active and fulfilling lives. Plasma-derived therapies, on the other hand, are made from human plasma, the liquid component of blood. These therapies have been used for decades to treat hemophilia and other bleeding disorders. Plasma-derived factor concentrates are used to replace the missing or deficient clotting factors in patients with hemophilia. While plasma-derived therapies are effective, they carry a risk of transmitting infections, although this risk has been greatly reduced through advanced screening and purification processes. Despite the availability of recombinant therapies, plasma-derived products remain an important option for some patients, particularly in regions where recombinant products may not be readily available or affordable. The Global Hemophilia Drugs Market continues to evolve as new therapies are developed and existing treatments are refined. Advances in biotechnology and genetic engineering are paving the way for innovative therapies that have the potential to transform the treatment landscape for hemophilia. Gene therapy, for example, is an emerging area of research that aims to provide a long-term solution for hemophilia by correcting the underlying genetic defect. As the market continues to grow, patients with hemophilia and related bleeding disorders can expect to benefit from a wider range of treatment options that offer improved safety, efficacy, and convenience. The Global Hemophilia Drugs Market is committed to advancing the science of hemophilia treatment and improving the lives of patients around the world.

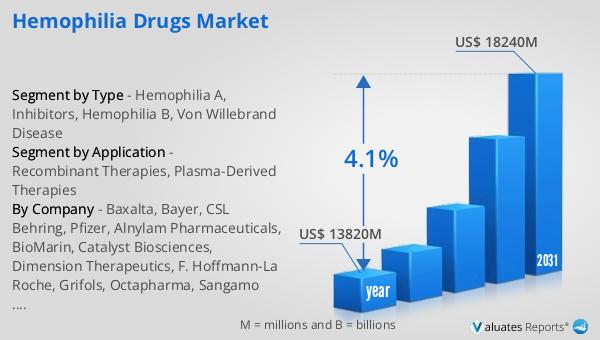

Global Hemophilia Drugs Market Outlook:

In 2024, the global market for Hemophilia Drugs was valued at approximately $13.82 billion, with projections indicating it will expand to around $18.24 billion by 2031, reflecting a compound annual growth rate (CAGR) of 4.1% over the forecast period. This growth is indicative of the increasing demand for effective hemophilia treatments and the ongoing advancements in medical research and drug development. In comparison, the global pharmaceutical market was valued at $1.475 trillion in 2022, with an anticipated CAGR of 5% over the next six years. This broader market growth underscores the dynamic nature of the pharmaceutical industry and its capacity to innovate and address a wide range of medical needs. Meanwhile, the chemical drug market, a subset of the pharmaceutical industry, was estimated to grow from $1.005 trillion in 2018 to $1.094 trillion in 2022. These figures highlight the significant role that hemophilia drugs play within the larger pharmaceutical landscape, as well as the potential for continued growth and development in this specialized market. The Global Hemophilia Drugs Market is poised to make substantial contributions to the healthcare sector by providing life-saving treatments and improving patient outcomes worldwide.

| Report Metric | Details |

| Report Name | Hemophilia Drugs Market |

| Accounted market size in year | US$ 13820 million |

| Forecasted market size in 2031 | US$ 18240 million |

| CAGR | 4.1% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| Consumption by Region |

|

| By Company | Baxalta, Bayer, CSL Behring, Pfizer, Alnylam Pharmaceuticals, BioMarin, Catalyst Biosciences, Dimension Therapeutics, F. Hoffmann-La Roche, Grifols, Octapharma, Sangamo Biosciences, Spark Therapeutics, Swedish Orphan Biovitrum |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |