What is Global Process Analytical Technology Market?

The Global Process Analytical Technology (PAT) Market is a rapidly evolving sector that focuses on the use of various analytical tools and techniques to monitor and control manufacturing processes, particularly in industries like pharmaceuticals and biotechnology. PAT is designed to ensure the quality of products by analyzing critical parameters and attributes during production, rather than relying solely on end-product testing. This approach allows for real-time data collection and analysis, enabling manufacturers to make informed decisions and adjustments to optimize processes, reduce waste, and enhance product quality. The market for PAT is driven by the increasing demand for quality assurance and regulatory compliance, as well as the need for efficient and cost-effective manufacturing processes. With advancements in technology and the growing emphasis on precision and accuracy in production, the Global Process Analytical Technology Market is poised for significant growth, offering innovative solutions that cater to the evolving needs of various industries. As companies strive to maintain competitive advantage and meet stringent regulatory standards, the adoption of PAT is becoming increasingly essential, making it a critical component of modern manufacturing strategies.

Spectroscopy, Chromatography, Particle Size Analysis, Capillary Electrophoresis, Others in the Global Process Analytical Technology Market:

Spectroscopy, Chromatography, Particle Size Analysis, Capillary Electrophoresis, and other techniques play pivotal roles in the Global Process Analytical Technology Market, each offering unique capabilities to enhance process monitoring and control. Spectroscopy, for instance, is a powerful analytical tool that measures the interaction of light with matter, providing valuable insights into the chemical composition and structure of substances. It is widely used in PAT for its ability to deliver rapid, non-destructive analysis, making it ideal for real-time monitoring of production processes. Techniques such as Near-Infrared (NIR) and Raman spectroscopy are particularly popular due to their sensitivity and precision in detecting molecular changes. Chromatography, on the other hand, is a versatile separation technique that is essential for identifying and quantifying components in complex mixtures. It is extensively used in the pharmaceutical industry to ensure the purity and potency of drugs, as well as in biopharmaceuticals for protein and peptide analysis. High-Performance Liquid Chromatography (HPLC) and Gas Chromatography (GC) are among the most commonly employed methods, offering high resolution and accuracy. Particle Size Analysis is another critical aspect of PAT, particularly in industries where particle size can significantly impact product performance and quality. Techniques such as laser diffraction and dynamic light scattering provide precise measurements of particle size distribution, enabling manufacturers to optimize formulations and ensure consistency. Capillary Electrophoresis is a highly efficient separation technique that is gaining traction in the PAT market due to its ability to separate ions based on their charge and size. It is particularly useful in the analysis of small molecules, peptides, and nucleic acids, offering high resolution and speed. Other techniques, such as mass spectrometry and thermal analysis, also contribute to the PAT landscape, providing comprehensive data on molecular weight, thermal stability, and other critical parameters. Together, these techniques form a robust framework for process analytical technology, enabling manufacturers to achieve greater control, efficiency, and quality in their production processes. As the demand for precision and reliability continues to grow, the integration of these advanced analytical tools into manufacturing workflows is becoming increasingly essential, driving innovation and progress in the Global Process Analytical Technology Market.

Pharmaceutical Manufacturers, Biopharmaceutical Manufacturers, Contract Research and Manufacturing Organizations, Others in the Global Process Analytical Technology Market:

The usage of Global Process Analytical Technology Market in various sectors such as Pharmaceutical Manufacturers, Biopharmaceutical Manufacturers, Contract Research and Manufacturing Organizations (CROs and CMOs), and others is transforming the landscape of production and quality assurance. In the pharmaceutical industry, PAT is instrumental in ensuring the consistent quality and safety of drugs. By providing real-time data on critical process parameters, PAT enables pharmaceutical manufacturers to optimize their production processes, reduce variability, and ensure compliance with stringent regulatory standards. This not only enhances product quality but also reduces the risk of costly recalls and rejections. In the biopharmaceutical sector, where the complexity of biologics presents unique challenges, PAT offers valuable insights into the production process, enabling manufacturers to monitor and control critical quality attributes. This is particularly important in the production of monoclonal antibodies, vaccines, and other biologics, where even minor variations can significantly impact efficacy and safety. Contract Research and Manufacturing Organizations (CROs and CMOs) also benefit from the adoption of PAT, as it allows them to offer high-quality, reliable services to their clients. By integrating PAT into their workflows, these organizations can ensure the consistency and quality of their products, enhancing their reputation and competitiveness in the market. Additionally, PAT is increasingly being adopted in other industries, such as food and beverage, chemicals, and petrochemicals, where it is used to optimize production processes, improve product quality, and ensure compliance with regulatory standards. The ability to monitor and control processes in real-time is a significant advantage, enabling manufacturers to respond quickly to changes and maintain high standards of quality and efficiency. As the demand for precision and reliability continues to grow, the adoption of PAT across various sectors is set to increase, driving innovation and progress in the Global Process Analytical Technology Market.

Global Process Analytical Technology Market Outlook:

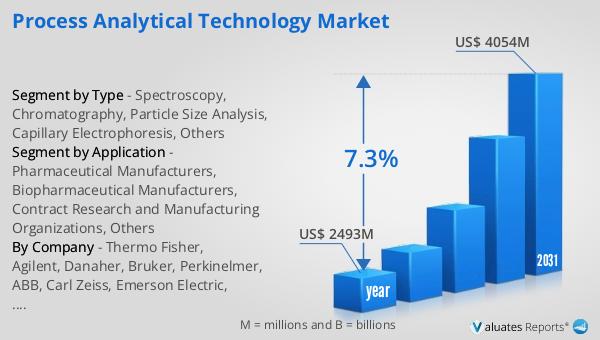

The global market for Process Analytical Technology was valued at approximately $2.493 billion in 2024, and it is anticipated to expand to a revised size of around $4.054 billion by 2031. This growth trajectory represents a compound annual growth rate (CAGR) of 7.3% over the forecast period. The increasing adoption of PAT across various industries, driven by the need for enhanced quality assurance and regulatory compliance, is a key factor contributing to this growth. As manufacturers strive to optimize their production processes and ensure the highest standards of quality, the demand for advanced analytical tools and techniques is on the rise. The integration of PAT into manufacturing workflows not only enhances product quality but also reduces waste and improves efficiency, offering significant cost savings and competitive advantages. With advancements in technology and the growing emphasis on precision and accuracy, the Global Process Analytical Technology Market is poised for substantial growth, offering innovative solutions that cater to the evolving needs of various industries. As companies continue to invest in PAT to maintain their competitive edge and meet stringent regulatory standards, the market is expected to witness significant expansion in the coming years.

| Report Metric | Details |

| Report Name | Process Analytical Technology Market |

| Accounted market size in year | US$ 2493 million |

| Forecasted market size in 2031 | US$ 4054 million |

| CAGR | 7.3% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Thermo Fisher, Agilent, Danaher, Bruker, Perkinelmer, ABB, Carl Zeiss, Emerson Electric, Mettler-Toledo International, Shimadzu |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |