What is Global Sitagliptin Phosphate API Market?

The Global Sitagliptin Phosphate API Market revolves around the production and distribution of Sitagliptin Phosphate, an active pharmaceutical ingredient (API) primarily used in the treatment of type 2 diabetes. Sitagliptin Phosphate is a dipeptidyl peptidase-4 (DPP-4) inhibitor, which helps to increase the levels of incretin hormones, thereby enhancing the body's ability to lower blood sugar levels. This API is crucial for pharmaceutical companies that manufacture medications aimed at managing diabetes, a condition that affects millions of people worldwide. The market for Sitagliptin Phosphate API is driven by the increasing prevalence of diabetes, advancements in pharmaceutical formulations, and the growing demand for effective diabetes management solutions. As the global population continues to age and lifestyle-related health issues become more prevalent, the demand for Sitagliptin Phosphate API is expected to rise, making it a significant component of the pharmaceutical industry. The market is characterized by ongoing research and development efforts to improve the efficacy and safety of diabetes medications, as well as competitive dynamics among key players striving to capture a larger share of this expanding market.

Above 98 %, Above 99 % in the Global Sitagliptin Phosphate API Market:

In the Global Sitagliptin Phosphate API Market, the purity levels of the API play a crucial role in determining its effectiveness and safety in pharmaceutical applications. Two common purity levels are "Above 98%" and "Above 99%," which indicate the percentage of Sitagliptin Phosphate present in the API compared to other substances. The "Above 98%" purity level signifies that the API contains at least 98% Sitagliptin Phosphate, with the remaining 2% comprising impurities or other substances. This level of purity is generally considered acceptable for many pharmaceutical applications, as it ensures a high degree of efficacy while maintaining safety standards. However, the "Above 99%" purity level represents an even higher standard, with at least 99% of the API being pure Sitagliptin Phosphate. This higher purity level is often preferred for more sensitive applications or when the highest possible efficacy is required. The choice between these purity levels depends on various factors, including the specific requirements of the medication being produced, regulatory standards, and cost considerations. Pharmaceutical companies must carefully evaluate these factors to determine the most appropriate purity level for their products. The production of high-purity Sitagliptin Phosphate API involves advanced manufacturing processes and stringent quality control measures to ensure that the final product meets the desired specifications. This includes the use of sophisticated analytical techniques to detect and quantify impurities, as well as rigorous testing to confirm the API's purity and potency. The demand for high-purity Sitagliptin Phosphate API is driven by the need for effective diabetes treatments that offer consistent performance and minimal side effects. As the prevalence of diabetes continues to rise globally, the importance of high-quality APIs in the development of new and improved medications cannot be overstated. Pharmaceutical companies are investing in research and development to enhance the production processes for Sitagliptin Phosphate API, aiming to achieve higher purity levels while maintaining cost-effectiveness. This involves exploring new technologies and methodologies that can improve the efficiency and scalability of API production. Additionally, regulatory agencies play a critical role in ensuring the quality and safety of Sitagliptin Phosphate API by setting stringent standards and guidelines for its production and use. Compliance with these regulations is essential for pharmaceutical companies to gain approval for their products and maintain consumer trust. In conclusion, the purity levels of Sitagliptin Phosphate API are a key consideration in the Global Sitagliptin Phosphate API Market, influencing the quality and effectiveness of diabetes medications. The choice between "Above 98%" and "Above 99%" purity levels depends on various factors, including the specific application, regulatory requirements, and cost considerations. As the demand for effective diabetes treatments continues to grow, the importance of high-purity APIs in the pharmaceutical industry will remain a critical focus for manufacturers and researchers alike.

Tablets, Others in the Global Sitagliptin Phosphate API Market:

The Global Sitagliptin Phosphate API Market finds its primary application in the production of tablets, which are a common form of medication for managing type 2 diabetes. Sitagliptin Phosphate tablets are designed to be taken orally, providing a convenient and effective way for patients to control their blood sugar levels. The API plays a crucial role in the formulation of these tablets, ensuring that they deliver the desired therapeutic effects while maintaining safety and efficacy. The production of Sitagliptin Phosphate tablets involves a series of complex processes, including the precise measurement and mixing of the API with other excipients to create a stable and effective formulation. These excipients may include binders, fillers, and disintegrants, which help to ensure that the tablets dissolve properly in the body and release the active ingredient at the appropriate rate. Quality control is a critical aspect of tablet production, with manufacturers implementing rigorous testing procedures to ensure that each batch meets the required specifications for purity, potency, and stability. In addition to tablets, the Global Sitagliptin Phosphate API Market also encompasses other dosage forms and applications. These may include oral solutions, capsules, and combination therapies that incorporate Sitagliptin Phosphate alongside other active ingredients to enhance its therapeutic effects. The development of these alternative dosage forms is driven by the need to provide patients with a range of options for managing their diabetes, catering to different preferences and medical requirements. For instance, oral solutions may be preferred by patients who have difficulty swallowing tablets, while combination therapies can offer the convenience of multiple medications in a single dose. The versatility of Sitagliptin Phosphate API in various dosage forms highlights its importance in the pharmaceutical industry, as it enables the development of tailored treatment options that address the diverse needs of diabetes patients. The ongoing research and development efforts in this area are focused on improving the bioavailability and efficacy of Sitagliptin Phosphate, as well as exploring new delivery methods that can enhance patient adherence and outcomes. As the prevalence of diabetes continues to rise globally, the demand for innovative and effective treatment options is expected to grow, driving further advancements in the Global Sitagliptin Phosphate API Market. In conclusion, the usage of Sitagliptin Phosphate API in tablets and other dosage forms is a key aspect of the Global Sitagliptin Phosphate API Market, providing essential treatment options for patients with type 2 diabetes. The production of these medications involves complex processes and stringent quality control measures to ensure their safety and efficacy. As the demand for effective diabetes treatments continues to increase, the importance of Sitagliptin Phosphate API in the pharmaceutical industry will remain a critical focus for manufacturers and researchers alike.

Global Sitagliptin Phosphate API Market Outlook:

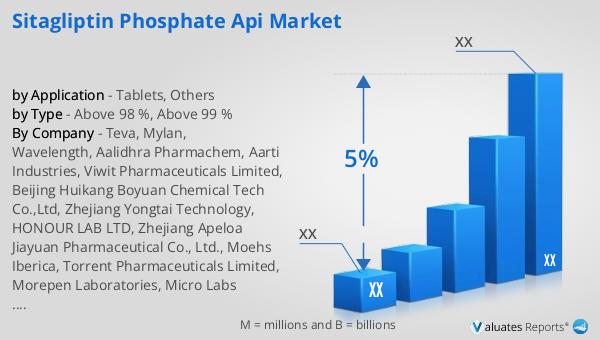

Sitagliptin Phosphate, identified by the CAS number 654671-78-0, is a dipeptidyl peptidase-4 (DPP-4) inhibitor used in the management of type 2 diabetes mellitus. This medication represents a new class of hypoglycemic drugs that work by enhancing the body's natural ability to control blood sugar levels. The global pharmaceutical market was valued at approximately 1,475 billion USD in 2022, with an expected compound annual growth rate (CAGR) of 5% over the next six years. In comparison, the chemical drug market, which includes Sitagliptin Phosphate, was estimated to grow from 1,005 billion USD in 2018 to 1,094 billion USD in 2022. This growth reflects the increasing demand for effective diabetes treatments and the expanding role of innovative pharmaceuticals in addressing global health challenges. The market outlook for Sitagliptin Phosphate API is influenced by several factors, including the rising prevalence of diabetes, advancements in drug formulations, and the need for more effective and convenient treatment options. As the global population continues to age and lifestyle-related health issues become more prevalent, the demand for Sitagliptin Phosphate and other diabetes medications is expected to rise. Pharmaceutical companies are investing in research and development to improve the efficacy and safety of these treatments, as well as exploring new delivery methods that can enhance patient adherence and outcomes. The competitive dynamics within the Sitagliptin Phosphate API market are shaped by the efforts of key players to capture a larger share of this expanding market, driven by the need to address the growing burden of diabetes worldwide.

| Report Metric | Details |

| Report Name | Sitagliptin Phosphate API Market |

| CAGR | 5% |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Teva, Mylan, Wavelength, Aalidhra Pharmachem, Aarti Industries, Viwit Pharmaceuticals Limited, Beijing Huikang Boyuan Chemical Tech Co.,Ltd, Zhejiang Yongtai Technology, HONOUR LAB LTD, Zhejiang Apeloa Jiayuan Pharmaceutical Co., Ltd., Moehs Iberica, Torrent Pharmaceuticals Limited, Morepen Laboratories, Micro Labs Limited, SMS Pharmaceuticals, Apotex Pharmachem, Jubilant Generics, Hetero Drugs, Zydus Cadila, UQUIFA, DONG BANG FUTURE TECH & LIFE CO., LTD, Jeil Pharmaceutical Co., Ltd, Anhui HaiKang Pharmaceutical, CHEMO, Optimus Pharma |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |