What is Global Ultrapure Water Purification Systems Market?

The Global Ultrapure Water Purification Systems Market is a specialized segment within the broader water treatment industry, focusing on the production of water that is free from impurities to an extremely high degree. This ultrapure water is essential for industries where even the smallest contaminants can cause significant issues, such as in semiconductor manufacturing, pharmaceuticals, and power generation. The market for these systems is driven by the increasing demand for high-quality water in these sectors, as well as the growing awareness of the importance of water purity in ensuring product quality and operational efficiency. Ultrapure water systems employ advanced technologies to remove contaminants, including dissolved and particulate matter, organic compounds, and microorganisms. The systems are designed to meet stringent standards and are often customized to meet the specific needs of different industries. As industries continue to advance technologically, the demand for ultrapure water systems is expected to grow, making this market a critical component of the global industrial landscape.

Reverse Osmosis, EDI, Ion Exchange in the Global Ultrapure Water Purification Systems Market:

Reverse Osmosis (RO), Electrodeionization (EDI), and Ion Exchange are three pivotal technologies in the Global Ultrapure Water Purification Systems Market, each playing a crucial role in ensuring the production of water with the highest purity levels. Reverse Osmosis is a widely used technology that involves forcing water through a semipermeable membrane to remove ions, molecules, and larger particles. This process is highly effective in eliminating a wide range of contaminants, including salts and organic materials, making it a cornerstone in ultrapure water production. RO systems are valued for their efficiency and ability to produce high-purity water consistently, which is essential for industries like electronics and pharmaceuticals where even minute impurities can lead to significant problems. Electrodeionization, or EDI, is another advanced technology used in ultrapure water systems. It combines ion exchange resins and electricity to remove ionized species from water. EDI is particularly effective in polishing water to achieve the highest purity levels after initial treatment by RO. The continuous operation of EDI systems without the need for chemical regeneration makes them an environmentally friendly option, aligning with the growing emphasis on sustainable industrial practices. Ion Exchange, on the other hand, involves the exchange of ions between the water and a resin. This process is particularly effective in removing specific ions, such as calcium and magnesium, which are responsible for water hardness. Ion exchange is often used in conjunction with other purification methods to achieve the desired water quality. Each of these technologies has its strengths and is selected based on the specific requirements of the application, the quality of the feed water, and the desired purity level of the output water. The integration of these technologies in ultrapure water systems ensures that the water produced meets the stringent standards required by industries that rely on ultrapure water for their operations. As the demand for ultrapure water continues to grow, the development and refinement of these technologies will remain a key focus for manufacturers and researchers in the field.

Electronics, Pharmaceuticals, Power in the Global Ultrapure Water Purification Systems Market:

The usage of Global Ultrapure Water Purification Systems is critical in several key industries, including electronics, pharmaceuticals, and power generation, each of which has unique requirements for water purity. In the electronics industry, ultrapure water is essential for the manufacturing of semiconductors and microchips. The presence of even the smallest impurities can lead to defects in these components, which are integral to a wide range of electronic devices. Ultrapure water is used in various stages of semiconductor manufacturing, including wafer cleaning and rinsing, where it helps to remove contaminants without leaving any residues. The stringent purity requirements in this industry drive the demand for advanced water purification systems that can consistently produce water of the highest quality. In the pharmaceutical industry, ultrapure water is used in the production of medications and other healthcare products. Water used in pharmaceutical manufacturing must meet strict regulatory standards to ensure the safety and efficacy of the final products. Ultrapure water is used in the formulation of drugs, as well as in cleaning and sterilization processes. The ability to produce water that meets these stringent standards is critical for pharmaceutical companies, making ultrapure water systems an essential component of their operations. In the power generation sector, ultrapure water is used in steam generation and cooling processes. The presence of impurities in water used in these processes can lead to scaling and corrosion, which can reduce the efficiency of power plants and increase maintenance costs. Ultrapure water systems help to prevent these issues by providing water that is free from contaminants, ensuring the efficient and reliable operation of power plants. The demand for ultrapure water in these industries is driven by the need to maintain high standards of quality and efficiency, as well as by regulatory requirements that mandate the use of high-purity water in certain applications. As these industries continue to grow and evolve, the demand for ultrapure water systems is expected to increase, highlighting the importance of this market in the global industrial landscape.

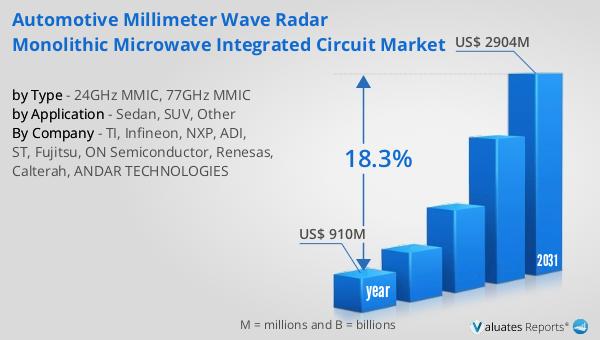

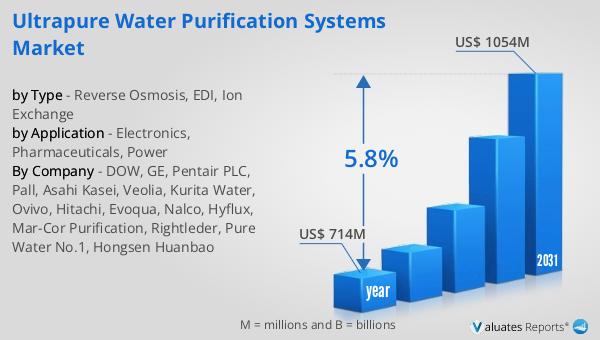

Global Ultrapure Water Purification Systems Market Outlook:

The global market for Ultrapure Water Purification Systems was valued at $714 million in 2024 and is anticipated to expand to a revised size of $1,054 million by 2031, reflecting a compound annual growth rate (CAGR) of 5.8% over the forecast period. Leading players in this market include DOW, GE, Pentair PLC, Pall, and Asahi Kasei, collectively holding approximately 39% of the market share. China emerges as the largest consumer region, accounting for the highest market share at 22%, followed by North America and Europe. North America stands out as the largest supply area globally, contributing about 27% of the supply value. This growth trajectory underscores the increasing demand for ultrapure water systems across various industries, driven by the need for high-quality water in sectors such as electronics, pharmaceuticals, and power generation. The market dynamics are shaped by technological advancements, regulatory requirements, and the growing emphasis on sustainability and efficiency in industrial operations. As the market continues to evolve, key players are likely to focus on innovation and strategic partnerships to enhance their competitive edge and meet the diverse needs of their customers.

| Report Metric | Details |

| Report Name | Ultrapure Water Purification Systems Market |

| Accounted market size in year | US$ 714 million |

| Forecasted market size in 2031 | US$ 1054 million |

| CAGR | 5.8% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | DOW, GE, Pentair PLC, Pall, Asahi Kasei, Veolia, Kurita Water, Ovivo, Hitachi, Evoqua, Nalco, Hyflux, Mar-Cor Purification, Rightleder, Pure Water No.1, Hongsen Huanbao |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |