What is Global Oil and Gas Industry Distributed Control System Market?

The Global Oil and Gas Industry Distributed Control System (DCS) Market is a crucial component in the automation and control of oil and gas operations worldwide. Distributed Control Systems are integrated systems used to monitor and control complex processes in industries like oil and gas, where precision and reliability are paramount. These systems help in managing the intricate processes involved in the extraction, refining, and distribution of oil and gas. By providing real-time data and control capabilities, DCS enhances operational efficiency, safety, and decision-making. The market for these systems is driven by the increasing demand for energy, the need for efficient and safe operations, and the integration of advanced technologies like IoT and AI. As the oil and gas industry continues to evolve, the role of DCS becomes even more significant, ensuring that operations are streamlined and risks are minimized. The global market for these systems is poised for growth, reflecting the ongoing advancements and investments in the oil and gas sector.

Hardware, Software, Services in the Global Oil and Gas Industry Distributed Control System Market:

In the Global Oil and Gas Industry Distributed Control System Market, hardware, software, and services play pivotal roles in ensuring the seamless operation of distributed control systems. Hardware components in DCS include controllers, input/output modules, and communication devices that form the backbone of the system. These components are designed to withstand harsh industrial environments, ensuring durability and reliability. Controllers are the brain of the DCS, executing control algorithms and managing data flow. Input/output modules facilitate the interaction between the physical processes and the control system, enabling accurate data acquisition and control actions. Communication devices ensure the seamless transfer of data across the network, maintaining the integrity and speed of operations. On the software front, DCS software provides the interface for monitoring and controlling industrial processes. It includes Human-Machine Interface (HMI) software, which offers a graphical representation of the processes, allowing operators to monitor and control operations efficiently. Advanced software solutions also incorporate data analytics, enabling predictive maintenance and optimization of processes. These software solutions are crucial for enhancing operational efficiency, reducing downtime, and improving decision-making. Services in the DCS market encompass a wide range of offerings, including system integration, maintenance, and support. System integration services ensure that the DCS is seamlessly integrated with existing infrastructure, minimizing disruptions and maximizing efficiency. Maintenance services are essential for ensuring the longevity and reliability of the system, with regular inspections and updates to prevent failures. Support services provide technical assistance and troubleshooting, ensuring that any issues are promptly addressed. Additionally, training services are offered to equip personnel with the necessary skills to operate and maintain the DCS effectively. The integration of hardware, software, and services in the DCS market is essential for the successful implementation and operation of distributed control systems in the oil and gas industry. These components work in tandem to provide a comprehensive solution that enhances operational efficiency, safety, and reliability. As the industry continues to evolve, the demand for advanced DCS solutions is expected to grow, driven by the need for efficient and safe operations in the oil and gas sector.

Small Size, Medium Size, Large Size in the Global Oil and Gas Industry Distributed Control System Market:

The usage of the Global Oil and Gas Industry Distributed Control System Market varies significantly across small, medium, and large-sized operations, each with its unique requirements and challenges. In small-sized operations, DCS is primarily used to streamline processes and enhance operational efficiency. These operations often have limited resources, making it crucial to optimize processes and reduce waste. DCS provides real-time data and control capabilities, enabling operators to make informed decisions and improve productivity. The scalability of DCS allows small operations to implement cost-effective solutions that can grow with their needs, ensuring long-term sustainability. Medium-sized operations benefit from DCS by enhancing process control and safety. These operations typically have more complex processes and require robust systems to manage them effectively. DCS provides the necessary tools to monitor and control these processes, ensuring that operations run smoothly and safely. The integration of advanced technologies like IoT and AI in DCS further enhances the capabilities of medium-sized operations, enabling predictive maintenance and process optimization. This results in reduced downtime, improved safety, and increased profitability. Large-sized operations in the oil and gas industry rely heavily on DCS to manage their extensive and complex processes. These operations require sophisticated systems to ensure the seamless integration and control of various processes across multiple locations. DCS provides the necessary infrastructure to monitor and control these processes, ensuring that operations are efficient, safe, and compliant with regulations. The scalability and flexibility of DCS allow large operations to adapt to changing demands and integrate new technologies seamlessly. Additionally, DCS enables large operations to implement advanced analytics and optimization strategies, resulting in significant cost savings and improved performance. In summary, the usage of DCS in the oil and gas industry varies across different operation sizes, with each benefiting from the enhanced control, efficiency, and safety that these systems provide. As the industry continues to evolve, the demand for advanced DCS solutions is expected to grow, driven by the need for efficient and safe operations across all sizes of operations.

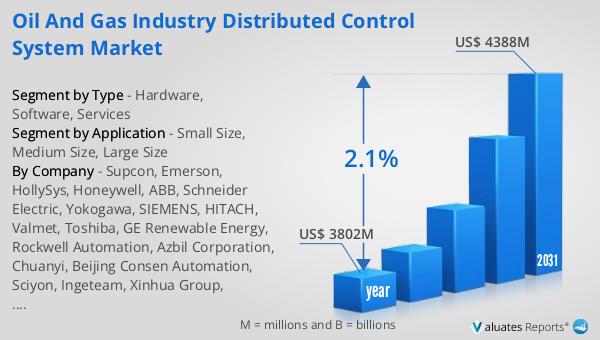

Global Oil and Gas Industry Distributed Control System Market Outlook:

The global market for Distributed Control Systems in the Oil and Gas Industry was valued at approximately $3,802 million in 2024. It is anticipated to expand to a revised size of about $4,388 million by 2031, reflecting a compound annual growth rate (CAGR) of 2.1% over the forecast period. This growth underscores the increasing importance of DCS in enhancing operational efficiency and safety in the oil and gas sector. The market dynamics are influenced by the rising demand for energy, technological advancements, and the need for efficient and safe operations. In comparison, the global server market, as reported by IDC, was estimated at $110 billion in 2022. This market is characterized by a high level of competition, with the top five players holding approximately 45% of the market share. The competitive landscape in both the DCS and server markets highlights the importance of innovation and strategic positioning for companies to maintain and grow their market presence. As industries continue to evolve, the role of DCS in the oil and gas sector becomes increasingly significant, driving the demand for advanced solutions that enhance operational efficiency and safety.

| Report Metric | Details |

| Report Name | Oil and Gas Industry Distributed Control System Market |

| Accounted market size in year | US$ 3802 million |

| Forecasted market size in 2031 | US$ 4388 million |

| CAGR | 2.1% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Supcon, Emerson, HollySys, Honeywell, ABB, Schneider Electric, Yokogawa, SIEMENS, HITACH, Valmet, Toshiba, GE Renewable Energy, Rockwell Automation, Azbil Corporation, Chuanyi, Beijing Consen Automation, Sciyon, Ingeteam, Xinhua Group, Shanghai Automation, Luneng, Mitsubishi Electric Corporation, ANDRITZ, Nanjing Delto Technology, ZAT Company |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |