What is Global Farm Vehicle Insurance Market?

The Global Farm Vehicle Insurance Market is a specialized sector within the insurance industry, focusing on providing coverage for vehicles used in agricultural operations. This market caters to the unique needs of farmers and agricultural businesses by offering insurance policies that protect against the various risks associated with farm vehicle operations. These vehicles, including tractors, combines, harvesters, and other machinery, are vital for the productivity and efficiency of farms. However, they also represent a significant investment and can be prone to accidents, damage, or loss due to their heavy use and the challenging environments in which they operate. The insurance coverage available in this market is designed to mitigate the financial impact of such incidents, ensuring that farmers can repair or replace their essential machinery without bearing the full cost themselves. As agriculture continues to be a critical sector globally, the demand for farm vehicle insurance is expected to grow, reflecting the need to protect these valuable assets and ensure the continuity of farming operations.

Liability Insurance, Personal Injury Insurance, Others in the Global Farm Vehicle Insurance Market:

Liability Insurance, Personal Injury Insurance, and other types of coverage play crucial roles in the Global Farm Vehicle Insurance Market, offering a safety net for farmers and agricultural businesses. Liability Insurance is essential as it protects against the legal and financial repercussions that can arise if a farm vehicle causes injury to others or damages their property. This type of insurance is particularly important given the potential for accidents involving large and powerful farm machinery that can result in significant harm or damage. Personal Injury Insurance, on the other hand, provides coverage for the driver and any passengers in the event of an accident, ensuring that medical costs and other related expenses are taken care of. This is vital in the agricultural sector, where the use of farm vehicles is frequent and often involves navigating challenging terrain or conditions that can increase the risk of accidents. Other insurance types available in this market may include coverage for theft, fire, natural disasters, and more, each designed to address the specific risks associated with operating farm vehicles. These insurance products collectively offer comprehensive protection, helping to secure the financial stability of farms and agricultural businesses by safeguarding against a wide range of potential losses.

Farm Truck, Farm Trailer, Agricultural Motorcycle, Others in the Global Farm Vehicle Insurance Market:

In the Global Farm Vehicle Insurance Market, the usage of insurance varies significantly across different types of farm vehicles, including Farm Trucks, Farm Trailers, Agricultural Motorcycles, and others. Farm Trucks, being pivotal for transporting goods and materials, require insurance that covers both the vehicle and its cargo, protecting against accidents, theft, and other risks during transit. Farm Trailers, which are used to carry heavy loads and equipment, need insurance that covers damage or loss to both the trailer itself and its contents, considering the potential for overturning or detachment incidents. Agricultural Motorcycles, used for a variety of tasks on the farm, from herding to surveying land, necessitate insurance that covers personal injury and liability, given their higher risk of accidents. Other farm vehicles, which can include specialized machinery like sprayers or harvesters, require tailored insurance solutions that address the specific risks associated with their use, such as mechanical failure or damage during operation. The insurance coverage for these vehicles is crucial in ensuring that farmers can continue their operations without facing crippling financial losses in the event of unforeseen incidents.

Global Farm Vehicle Insurance Market Outlook:

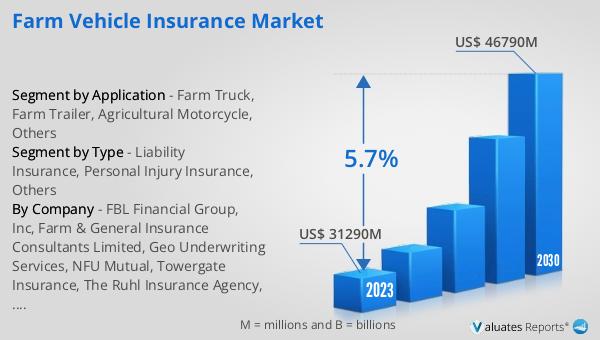

The market outlook for the Global Farm Vehicle Insurance sector presents a promising future, with the market's value estimated at US$ 31,290 million in 2023, and projections suggesting it will climb to US$ 46,790 million by 2030. This growth trajectory, marked by a Compound Annual Growth Rate (CAGR) of 5.7% from 2024 to 2030, underscores the increasing recognition of the importance of insurance in the agricultural sector. As farming operations continue to evolve and expand, the reliance on vehicles and machinery becomes more pronounced, driving the demand for comprehensive insurance solutions that can mitigate the financial risks associated with their use. This growth is indicative of a broader trend towards greater protection and risk management in agriculture, reflecting the sector's critical role in the global economy and the need to safeguard its assets against a range of potential threats. The anticipated expansion of the Global Farm Vehicle Insurance Market is a positive sign for both the insurance industry and the agricultural sector, highlighting the growing awareness and adoption of insurance as a vital tool for financial stability and resilience.

| Report Metric | Details |

| Report Name | Farm Vehicle Insurance Market |

| Accounted market size in 2023 | US$ 31290 million |

| Forecasted market size in 2030 | US$ 46790 million |

| CAGR | 5.7% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | FBL Financial Group, Inc, Farm & General Insurance Consultants Limited, Geo Underwriting Services, NFU Mutual, Towergate Insurance, The Ruhl Insurance Agency, Marsh Ltd, County Insurance Services Limited, Alan Boswell Group, Howden UK Brokers Limited, Rowett Insurance Broking Group Ltd, Brown & Brown Insurance Brokers (UK) Limited |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |