What is Global Data Analytics in Insurance Market?

The Global Data Analytics in Insurance Market is a rapidly evolving field that leverages data to make informed decisions in the insurance industry. It involves the use of statistical techniques, algorithms, and technology to analyze vast amounts of data from various sources. This data is then used to predict future trends, identify opportunities, and make strategic decisions. The goal is to improve business operations, enhance customer service, and increase profitability. The use of data analytics in insurance is becoming increasingly important as the industry becomes more competitive and the need for efficient decision-making processes becomes more critical. The ability to analyze and interpret data quickly and accurately can provide a significant competitive advantage in the insurance market.

Service, Software in the Global Data Analytics in Insurance Market:

The Global Data Analytics in Insurance Market is divided into two main categories: service and software. Service-based data analytics involves the use of third-party service providers to analyze data and provide insights. These services can include data collection, data processing, data analysis, and data visualization. On the other hand, software-based data analytics involves the use of software tools and applications to analyze data. These tools can include data mining tools, predictive analytics tools, and data visualization tools. Both service and software-based data analytics have their advantages and disadvantages, and the choice between the two depends on the specific needs and resources of the insurance company.

Pricing Premiums, Prevent and Reduce Fraud, and Waste, Gain Customer Insight in the Global Data Analytics in Insurance Market:

The Global Data Analytics in Insurance Market is used in various areas of the insurance industry. One of the main uses is in pricing premiums. By analyzing data on risk factors, insurance companies can accurately price their premiums to reflect the level of risk associated with each policy. This can help to ensure that premiums are priced fairly and accurately. Another use of data analytics in insurance is in the prevention and reduction of fraud and waste. By analyzing patterns and trends in claims data, insurance companies can identify potential fraudulent activity and take steps to prevent it. Finally, data analytics can be used to gain customer insight. By analyzing data on customer behavior and preferences, insurance companies can better understand their customers and tailor their products and services to meet their needs.

Global Data Analytics in Insurance Market Outlook:

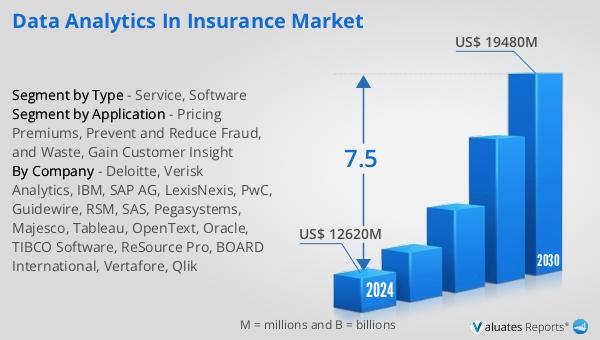

Looking at the market outlook, the Global Data Analytics in Insurance Market was valued at a substantial US$ 11670 million in 2023. The market is expected to experience significant growth, with projections estimating it to reach a value of US$ 19480 million by 2030. This represents a compound annual growth rate (CAGR) of 7.5% during the forecast period from 2024 to 2030. This growth can be attributed to the increasing adoption of data analytics in the insurance industry, driven by the need for more efficient decision-making processes and the desire to gain a competitive advantage in the market.

| Report Metric | Details |

| Report Name | Data Analytics in Insurance Market |

| Accounted market size in 2023 | US$ 11670 million |

| Forecasted market size in 2030 | US$ 19480 million |

| CAGR | 7.5% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Deloitte, Verisk Analytics, IBM, SAP AG, LexisNexis, PwC, Guidewire, RSM, SAS, Pegasystems, Majesco, Tableau, OpenText, Oracle, TIBCO Software, ReSource Pro, BOARD International, Vertafore, Qlik |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |