What is Global Mobile Payment Systems Market?

The Global Mobile Payment Systems Market is a vast and dynamic sector that has been experiencing significant growth in recent years. This market encompasses a variety of payment methods that are used via mobile devices, such as smartphones and tablets. These systems allow consumers to make purchases, transfer money, and perform other financial transactions digitally, without the need for physical cash or cards. The convenience and efficiency of mobile payment systems have made them increasingly popular among consumers worldwide, leading to a surge in the market's value. As technology continues to evolve and more people gain access to mobile devices, the Global Mobile Payment Systems Market is expected to continue its upward trajectory.

Mobile Wallet/Bank Cards, Mobile Money in the Global Mobile Payment Systems Market:

The Global Mobile Payment Systems Market is divided into two main segments: Mobile Wallet/Bank Cards and Mobile Money. Mobile Wallet/Bank Cards are digital versions of traditional wallets that store payment card information on a mobile device. They allow users to make purchases at physical stores by simply tapping their device on a payment terminal, or at online stores by selecting the mobile wallet option at checkout. On the other hand, Mobile Money is a service that allows users to store, send, and receive money using their mobile phone. It's particularly popular in regions where access to traditional banking services is limited. Both these segments have contributed significantly to the growth of the Global Mobile Payment Systems Market, offering consumers a convenient and secure way to manage their finances.

Retail, Education, Entertainment, Healthcare, Hospitality, Other in the Global Mobile Payment Systems Market:

The usage of Global Mobile Payment Systems Market extends to various sectors including Retail, Education, Entertainment, Healthcare, Hospitality, and others. In the retail sector, mobile payment systems have revolutionized the shopping experience, enabling seamless and quick transactions. In the education sector, they have simplified the process of paying for tuition, books, and other educational resources. In the entertainment sector, mobile payment systems have made it easier for consumers to purchase tickets for movies, concerts, and other events. In the healthcare sector, they have facilitated the payment for medical services and prescriptions. In the hospitality sector, they have enhanced the guest experience by enabling easy payment for hotel bookings, dining, and other services. Other sectors that have benefited from mobile payment systems include transportation, utilities, and e-commerce.

Global Mobile Payment Systems Market Outlook:

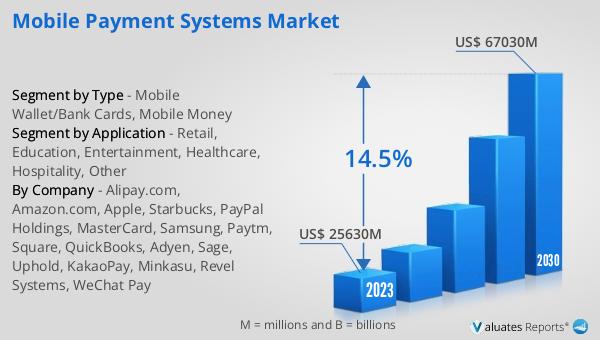

Looking at the market outlook, the Global Mobile Payment Systems Market was valued at a substantial US$ 25630 million in 2023. This figure is projected to more than double, reaching an impressive US$ 67030 million by 2030. This represents a Compound Annual Growth Rate (CAGR) of 14.5% during the forecast period from 2024 to 2030. This significant growth can be attributed to the increasing adoption of mobile payment systems by consumers and businesses worldwide, driven by the convenience, speed, and security these systems offer. As technology continues to advance and mobile device usage continues to rise, the Global Mobile Payment Systems Market is expected to maintain its strong growth momentum.

| Report Metric | Details |

| Report Name | Mobile Payment Systems Market |

| Accounted market size in 2023 | US$ 25630 million |

| Forecasted market size in 2030 | US$ 67030 million |

| CAGR | 14.5% |

| Base Year | 2023 |

| Forecasted years | 2024 - 2030 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Alipay.com, Amazon.com, Apple, Starbucks, PayPal Holdings, MasterCard, Samsung, Paytm, Square, QuickBooks, Adyen, Sage, Uphold, KakaoPay, Minkasu, Revel Systems, WeChat Pay |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |