What is Global Human Coagulation Factor IX Market?

The Global Human Coagulation Factor IX Market is a specialized segment within the broader pharmaceutical and biotechnology industries, focusing on the development and distribution of Factor IX, a crucial protein involved in blood coagulation. This market primarily serves individuals with hemophilia B, a genetic disorder characterized by a deficiency of Factor IX, leading to excessive bleeding. The market encompasses various products, including recombinant Factor IX, plasma-derived Factor IX, and extended half-life products, each designed to improve the quality of life for patients by reducing bleeding episodes and enhancing overall health outcomes. The demand for these products is driven by the increasing prevalence of hemophilia B, advancements in biotechnology, and a growing awareness of the disorder. Additionally, the market is influenced by regulatory approvals, pricing strategies, and the competitive landscape, which includes major pharmaceutical companies and emerging biotech firms. As research continues to advance, the market is expected to evolve with the introduction of innovative therapies and improved treatment options, ultimately aiming to provide more effective and accessible solutions for patients worldwide.

AHGB, AHFB, Others in the Global Human Coagulation Factor IX Market:

In the Global Human Coagulation Factor IX Market, AHGB, AHFB, and other products play significant roles in addressing the needs of patients with hemophilia B. AHGB, or Activated Human Coagulation Factor IX, is a recombinant product designed to mimic the natural Factor IX in the human body. It is engineered using advanced biotechnological techniques to ensure high purity and efficacy, providing a reliable option for patients requiring regular infusions to manage their condition. AHGB is particularly beneficial for individuals with inhibitors, as it can bypass the need for Factor VIII, offering a more targeted approach to treatment. On the other hand, AHFB, or Advanced Human Factor IX, represents a newer generation of Factor IX products. These are often extended half-life formulations, which means they remain active in the bloodstream for longer periods, reducing the frequency of infusions needed by patients. This advancement not only improves patient compliance but also enhances their quality of life by minimizing disruptions caused by frequent hospital visits or self-administration. The development of AHFB products involves sophisticated technologies, such as PEGylation or fusion with other proteins, to achieve prolonged activity. Beyond AHGB and AHFB, the market also includes other innovative products and therapies. These may involve gene therapy approaches, which aim to provide a long-term solution by introducing a functional copy of the Factor IX gene into the patient's cells. Such therapies hold the promise of reducing or even eliminating the need for regular infusions, offering a potential cure for hemophilia B. Additionally, plasma-derived Factor IX products continue to be a vital part of the market, especially in regions where recombinant products are less accessible. These products are derived from human plasma and undergo rigorous screening and purification processes to ensure safety and efficacy. Despite the advancements in recombinant technologies, plasma-derived products remain an essential option for many patients, particularly in low-resource settings. The Global Human Coagulation Factor IX Market is characterized by ongoing research and development efforts aimed at improving existing therapies and exploring new treatment modalities. Companies are investing heavily in clinical trials and collaborations to bring innovative products to market, addressing unmet needs and expanding the range of options available to patients. The competitive landscape is dynamic, with established pharmaceutical giants and emerging biotech firms vying for market share. This competition drives innovation and encourages the development of more effective and accessible treatments. Regulatory agencies play a crucial role in shaping the market, as they evaluate the safety and efficacy of new products before granting approval. The approval process involves rigorous testing and evaluation, ensuring that only high-quality products reach patients. Pricing strategies also influence the market, as companies strive to balance profitability with affordability, making treatments accessible to a broader population. As the market continues to evolve, the focus remains on improving patient outcomes and enhancing the quality of life for individuals with hemophilia B. The introduction of novel therapies, such as gene therapy and extended half-life products, represents significant advancements in the field, offering hope for a future where hemophilia B can be effectively managed or even cured. The Global Human Coagulation Factor IX Market is poised for growth, driven by scientific innovation, increasing awareness, and a commitment to improving the lives of patients worldwide.

Hospital, Personal Clinic, Others in the Global Human Coagulation Factor IX Market:

The usage of Global Human Coagulation Factor IX Market products spans various healthcare settings, including hospitals, personal clinics, and other medical facilities. In hospitals, Factor IX products are essential for managing acute bleeding episodes in patients with hemophilia B. Hospitals are equipped with the necessary infrastructure and expertise to administer these treatments, ensuring that patients receive timely and effective care. In emergency situations, such as trauma or surgery, hospitals rely on Factor IX products to prevent excessive bleeding and stabilize patients. The availability of a range of Factor IX products, including recombinant and plasma-derived options, allows healthcare providers to tailor treatment plans to individual patient needs, optimizing outcomes and minimizing complications. Personal clinics also play a crucial role in the management of hemophilia B, particularly for patients who require regular infusions of Factor IX products. These clinics offer a more personalized approach to care, allowing patients to receive treatment in a familiar and comfortable environment. Personal clinics often provide education and support to patients and their families, empowering them to manage their condition effectively. This includes training on self-administration techniques, enabling patients to administer Factor IX products at home, reducing the need for frequent clinic visits. The convenience and flexibility offered by personal clinics contribute to improved patient compliance and quality of life. Beyond hospitals and personal clinics, Factor IX products are used in various other settings, including specialized hemophilia treatment centers and home healthcare services. Hemophilia treatment centers are dedicated facilities that provide comprehensive care for individuals with bleeding disorders. These centers offer a multidisciplinary approach, involving hematologists, nurses, physiotherapists, and other specialists, to address the complex needs of patients with hemophilia B. Factor IX products are a cornerstone of treatment at these centers, ensuring that patients receive the highest standard of care. Home healthcare services are increasingly popular, as they allow patients to receive treatment in the comfort of their own homes. This approach is particularly beneficial for individuals with mobility challenges or those living in remote areas with limited access to healthcare facilities. Home healthcare providers work closely with patients and their families to develop personalized care plans, ensuring that Factor IX products are administered safely and effectively. The use of Factor IX products in these diverse settings highlights the importance of accessibility and flexibility in the management of hemophilia B. The Global Human Coagulation Factor IX Market is committed to providing innovative solutions that meet the evolving needs of patients and healthcare providers. As the market continues to grow, the focus remains on improving access to high-quality treatments, enhancing patient outcomes, and ultimately improving the quality of life for individuals with hemophilia B.

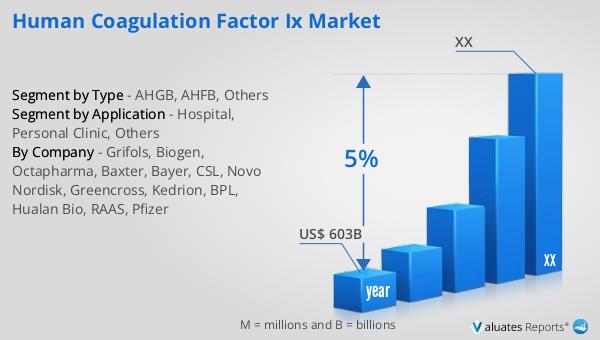

Global Human Coagulation Factor IX Market Outlook:

Based on our analysis, the worldwide market for medical devices is projected to reach approximately $603 billion in 2023, with an anticipated growth rate of 5% annually over the next six years. This growth trajectory underscores the increasing demand for medical devices across various healthcare sectors, driven by technological advancements, an aging global population, and the rising prevalence of chronic diseases. The medical device industry encompasses a wide range of products, from simple bandages and surgical instruments to complex diagnostic machines and implantable devices. As healthcare systems worldwide strive to improve patient outcomes and enhance the quality of care, the demand for innovative and efficient medical devices continues to rise. Companies operating in this market are investing heavily in research and development to introduce cutting-edge technologies that address unmet medical needs and improve patient care. Additionally, regulatory agencies play a crucial role in shaping the market landscape, as they establish guidelines and standards to ensure the safety and efficacy of medical devices. As the market evolves, companies must navigate a complex regulatory environment while also addressing pricing pressures and competition. Despite these challenges, the medical device market presents significant opportunities for growth and innovation, as companies seek to develop solutions that enhance patient care and improve healthcare delivery worldwide.

| Report Metric | Details |

| Report Name | Human Coagulation Factor IX Market |

| Accounted market size in year | US$ 603 billion |

| CAGR | 5% |

| Base Year | year |

| Segment by Type |

|

| Segment by Application |

|

| Consumption by Region |

|

| By Company | Grifols, Biogen, Octapharma, Baxter, Bayer, CSL, Novo Nordisk, Greencross, Kedrion, BPL, Hualan Bio, RAAS, Pfizer |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |