What is Global Vanilla Beans and Extract Market?

The global vanilla beans and extract market is a dynamic and essential segment of the flavor and fragrance industry. Vanilla, derived from the pods of the vanilla orchid, is one of the most popular and widely used flavors worldwide. The market encompasses the cultivation, processing, and distribution of vanilla beans and their extracts, which are used in a variety of applications ranging from food and beverages to cosmetics and pharmaceuticals. The demand for natural and organic flavors has been a significant driver of this market, as consumers increasingly prefer products with natural ingredients over synthetic alternatives. The market is characterized by a diverse range of products, including whole vanilla beans, vanilla powder, and liquid extracts, each catering to different consumer needs and industrial applications. The cultivation of vanilla is primarily concentrated in regions with tropical climates, such as Madagascar, Indonesia, and Mexico, which are the leading producers. The market faces challenges such as fluctuating prices due to supply constraints and the labor-intensive nature of vanilla cultivation. However, the growing trend towards clean-label products and the increasing popularity of gourmet and artisanal foods continue to provide opportunities for growth in the global vanilla beans and extract market.

Short Vanilla Beans and Extract, Regular Vanilla Beans and Extract, Long Vanilla Beans and Extract in the Global Vanilla Beans and Extract Market:

In the global vanilla beans and extract market, the classification of vanilla beans into short, regular, and long categories is crucial for understanding their diverse applications and market dynamics. Short vanilla beans, typically measuring less than 12 centimeters, are often considered less desirable due to their smaller size and lower vanillin content, which is the primary compound responsible for vanilla's characteristic flavor and aroma. However, they still find use in various applications where size is not a critical factor, such as in the production of vanilla extract or in recipes where the beans are ground or blended. Regular vanilla beans, ranging from 12 to 16 centimeters, are the most commonly used type in both commercial and home cooking. They offer a balanced flavor profile and are versatile enough to be used in a wide range of culinary applications, from baking to flavoring beverages. These beans are often preferred by chefs and food manufacturers for their consistent quality and flavor. Long vanilla beans, exceeding 16 centimeters, are considered premium due to their higher vanillin content and more intense flavor. They are often used in gourmet cooking and high-end food products, where their superior quality can be showcased. The length and quality of the beans directly impact their price, with longer beans commanding a higher market value. The processing of these beans into extracts involves soaking them in a solution of alcohol and water, which extracts the flavor compounds. The resulting vanilla extract is a staple ingredient in many kitchens and food manufacturing processes. The choice between using short, regular, or long beans often depends on the specific requirements of the end product, such as the desired intensity of flavor and the target market segment. In recent years, there has been a growing trend towards sustainable and ethically sourced vanilla, with consumers and companies alike showing a preference for beans that are produced in environmentally friendly and socially responsible ways. This has led to increased interest in fair trade and organic vanilla beans, which are often available in all three size categories. The global vanilla beans and extract market continues to evolve, driven by changing consumer preferences, advancements in cultivation and processing techniques, and the ongoing demand for natural and high-quality flavoring agents.

Food Processing, Cosmetics, Medical Care, Others in the Global Vanilla Beans and Extract Market:

The global vanilla beans and extract market plays a significant role in various industries, with its applications extending beyond the culinary world. In food processing, vanilla is a key ingredient used to enhance the flavor of a wide range of products, including baked goods, dairy products, beverages, and confectionery. Its rich and complex flavor profile makes it a favorite among chefs and food manufacturers, who use it to create everything from classic vanilla ice cream to sophisticated desserts and gourmet sauces. The demand for natural and organic vanilla in food processing has been on the rise, as consumers increasingly seek out products with clean labels and recognizable ingredients. In the cosmetics industry, vanilla is valued for its soothing and aromatic properties. It is commonly used in perfumes, lotions, and skincare products, where it adds a warm and inviting scent. Vanilla's antioxidant properties also make it a popular choice in anti-aging and skin-nourishing formulations. In medical care, vanilla has been explored for its potential health benefits, including its antioxidant and anti-inflammatory properties. It is sometimes used in alternative medicine and natural remedies, where it is believed to aid in relaxation and stress relief. Additionally, vanilla is used in the production of certain pharmaceuticals, where it serves as a flavoring agent to improve the taste of oral medications. Beyond these primary applications, vanilla finds use in a variety of other industries, including aromatherapy, where its calming scent is used to promote relaxation and well-being. It is also used in the production of candles, air fresheners, and other home fragrance products. The versatility of vanilla and its widespread appeal make it a valuable commodity in the global market, with its applications continuing to expand as new uses and formulations are developed. The ongoing demand for natural and high-quality vanilla products underscores the importance of sustainable and ethical sourcing practices, as consumers and companies alike seek to support environmentally friendly and socially responsible production methods.

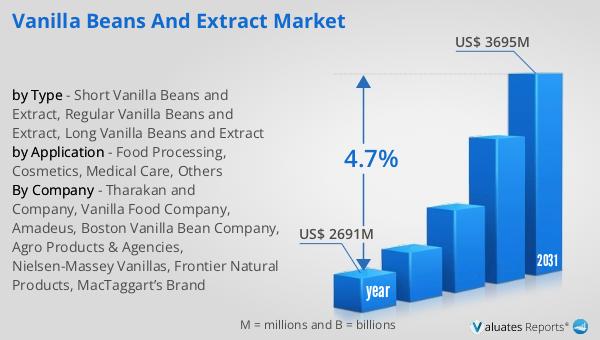

Global Vanilla Beans and Extract Market Outlook:

The global market for vanilla beans and extract was valued at approximately $2,691 million in 2024. This market is anticipated to grow steadily, reaching an estimated value of $3,695 million by 2031. This growth represents a compound annual growth rate (CAGR) of 4.7% over the forecast period. The increasing demand for natural and organic flavors, coupled with the rising popularity of gourmet and artisanal foods, is driving this growth. Consumers are becoming more conscious of the ingredients in their food and personal care products, leading to a preference for natural over synthetic flavors. This shift in consumer preferences is encouraging manufacturers to incorporate more natural ingredients, such as vanilla, into their products. Additionally, the expansion of the food and beverage industry, particularly in emerging markets, is contributing to the increased demand for vanilla beans and extract. The market is also benefiting from innovations in cultivation and processing techniques, which are helping to improve the quality and yield of vanilla beans. Despite challenges such as fluctuating prices and supply constraints, the global vanilla beans and extract market is poised for continued growth, driven by the ongoing demand for high-quality, natural flavoring agents.

| Report Metric | Details |

| Report Name | Vanilla Beans and Extract Market |

| Accounted market size in year | US$ 2691 million |

| Forecasted market size in 2031 | US$ 3695 million |

| CAGR | 4.7% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| by Type |

|

| by Application |

|

| Production by Region |

|

| Consumption by Region |

|

| By Company | Tharakan and Company, Vanilla Food Company, Amadeus, Boston Vanilla Bean Company, Agro Products & Agencies, Nielsen-Massey Vanillas, Frontier Natural Products, MacTaggart’s Brand |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |