What is Global Travel Delay Insurance Market?

The Global Travel Delay Insurance Market is a specialized segment of the insurance industry that provides coverage for unexpected delays during travel. This type of insurance is designed to offer financial protection and peace of mind to travelers who may encounter unforeseen disruptions such as flight delays, cancellations, or missed connections. These delays can result from various factors, including adverse weather conditions, technical issues, or even strikes by airline staff. The insurance typically covers expenses incurred due to these delays, such as additional accommodation, meals, and transportation costs. As travel becomes increasingly globalized, the demand for travel delay insurance has grown, reflecting the need for travelers to safeguard their plans and finances against potential disruptions. This market is characterized by a range of products tailored to different types of travelers, from business professionals to leisure tourists, and is offered by numerous insurance providers worldwide. The growth of this market is driven by the increasing frequency of travel, the complexity of travel itineraries, and the rising awareness among travelers about the benefits of having such insurance coverage.

Oversea Travel Insurance, Domestic Travel Insurance in the Global Travel Delay Insurance Market:

Overseas travel insurance and domestic travel insurance are two key components of the Global Travel Delay Insurance Market, each catering to different travel needs and scenarios. Overseas travel insurance is designed for individuals traveling outside their home country. It provides coverage for a wide range of potential issues that may arise during international travel, including medical emergencies, trip cancellations, lost luggage, and, importantly, travel delays. The coverage for travel delays under overseas travel insurance typically includes reimbursement for additional expenses incurred due to delayed flights or other transportation issues, such as hotel accommodations, meals, and alternative travel arrangements. This type of insurance is crucial for international travelers who may face language barriers, unfamiliar legal systems, and higher costs in foreign countries. On the other hand, domestic travel insurance is tailored for travelers within their own country. While it may not cover medical emergencies to the same extent as overseas travel insurance, it still provides valuable protection against travel delays and other disruptions. Domestic travel insurance often includes coverage for trip cancellations, interruptions, and delays, ensuring that travelers can recover some of the costs associated with unexpected changes to their travel plans. Both overseas and domestic travel insurance play a vital role in the Global Travel Delay Insurance Market by offering tailored solutions to meet the diverse needs of travelers. As travel becomes more accessible and affordable, the demand for these insurance products continues to grow, driven by the increasing awareness of the potential risks and financial implications of travel disruptions. Insurance providers in this market are continually innovating and expanding their offerings to cater to the evolving needs of travelers, providing comprehensive coverage options that address a wide range of potential issues. The Global Travel Delay Insurance Market is thus a dynamic and essential component of the broader travel insurance industry, ensuring that travelers can embark on their journeys with confidence and peace of mind.

Online, Offline in the Global Travel Delay Insurance Market:

The usage of the Global Travel Delay Insurance Market can be categorized into two primary areas: online and offline. Online usage of travel delay insurance has become increasingly popular due to the convenience and accessibility it offers. Travelers can easily compare different insurance products, read reviews, and purchase policies directly from the comfort of their homes or on the go using their smartphones or other devices. Online platforms often provide detailed information about the coverage options available, allowing travelers to make informed decisions based on their specific needs and preferences. Additionally, online insurance providers often offer competitive pricing and discounts, making it an attractive option for cost-conscious travelers. The digital nature of online insurance also allows for quick and efficient claims processing, with many providers offering online claim submission and tracking, further enhancing the customer experience. On the other hand, offline usage of travel delay insurance involves purchasing policies through traditional channels such as travel agencies, insurance brokers, or directly from insurance company offices. While this method may not offer the same level of convenience as online purchasing, it provides a more personalized experience for travelers who prefer face-to-face interactions and guidance from insurance professionals. Offline channels can be particularly beneficial for travelers who have complex itineraries or specific coverage needs that require expert advice and customization. Insurance agents can help travelers navigate the various options available, ensuring that they select the most appropriate policy for their trip. Despite the growing trend towards online insurance, offline channels remain an important part of the Global Travel Delay Insurance Market, catering to travelers who value personalized service and expert guidance. Both online and offline usage of travel delay insurance play a crucial role in the market, providing travelers with the flexibility and choice to select the purchasing method that best suits their needs. As technology continues to evolve, the integration of digital tools and platforms into the offline insurance process is likely to enhance the overall customer experience, bridging the gap between the two channels and ensuring that travelers have access to comprehensive and convenient insurance solutions.

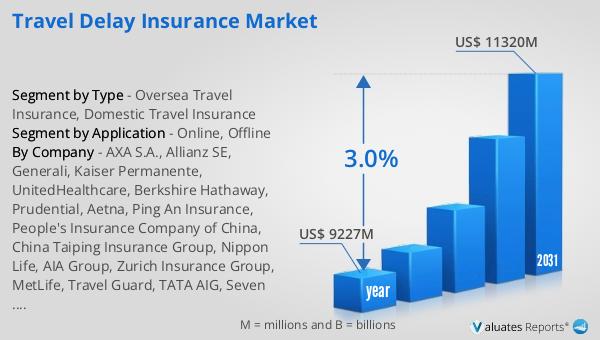

Global Travel Delay Insurance Market Outlook:

The global market for Travel Delay Insurance was valued at $9,227 million in 2024 and is anticipated to expand to a revised size of $11,320 million by 2031, reflecting a compound annual growth rate (CAGR) of 3.0% over the forecast period. This growth trajectory underscores the increasing importance and demand for travel delay insurance as more individuals and businesses recognize the value of safeguarding their travel plans against unforeseen disruptions. The steady growth rate indicates a robust market with opportunities for both established insurance providers and new entrants to innovate and capture market share. As travel continues to be an integral part of personal and professional life, the need for reliable and comprehensive travel delay insurance is expected to remain strong. The market's expansion is driven by several factors, including the rising frequency of travel, the complexity of travel itineraries, and the growing awareness among travelers about the potential financial implications of travel delays. Insurance providers are likely to continue developing and refining their products to meet the evolving needs of travelers, ensuring that they offer competitive and comprehensive coverage options. The projected growth of the Global Travel Delay Insurance Market highlights the critical role that this type of insurance plays in the broader travel industry, providing travelers with the confidence and peace of mind to embark on their journeys.

| Report Metric | Details |

| Report Name | Travel Delay Insurance Market |

| Accounted market size in year | US$ 9227 million |

| Forecasted market size in 2031 | US$ 11320 million |

| CAGR | 3.0% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | AXA S.A., Allianz SE, Generali, Kaiser Permanente, UnitedHealthcare, Berkshire Hathaway, Prudential, Aetna, Ping An Insurance, People's Insurance Company of China, China Taiping Insurance Group, Nippon Life, AIA Group, Zurich Insurance Group, MetLife, Travel Guard, TATA AIG, Seven Corners, Travelex, Cover-More |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |