What is Global Tax Preparation Franchise Market?

The Global Tax Preparation Franchise Market is a dynamic and evolving sector that caters to the growing demand for tax-related services worldwide. This market involves businesses that offer tax preparation services through a franchising model, allowing entrepreneurs to operate under a recognized brand while receiving support and training from the franchisor. These franchises provide a range of services, including tax return preparation, tax planning, and advisory services for individuals and businesses. The market is driven by the increasing complexity of tax regulations, which prompts individuals and businesses to seek professional assistance to ensure compliance and optimize their tax liabilities. Additionally, the rise in self-employment and small businesses has contributed to the demand for tax preparation services. Franchises in this market benefit from established brand recognition, proven business models, and ongoing support, making it an attractive option for entrepreneurs looking to enter the tax services industry. As tax laws continue to evolve, the Global Tax Preparation Franchise Market is expected to grow, offering opportunities for both new and existing franchisees to expand their operations and meet the needs of a diverse clientele.

Beginner Franchise (Training Required), CPAs Franchise (No Training Required) in the Global Tax Preparation Franchise Market:

In the Global Tax Preparation Franchise Market, there are two primary types of franchises: Beginner Franchise (Training Required) and CPAs Franchise (No Training Required). Beginner Franchises are designed for individuals who may not have prior experience in tax preparation but are interested in entering the industry. These franchises provide comprehensive training programs that cover various aspects of tax preparation, customer service, and business management. The training ensures that franchisees are well-equipped to handle the complexities of tax regulations and deliver high-quality services to their clients. This type of franchise is ideal for entrepreneurs who are passionate about helping others with their tax needs but lack the technical expertise. The support provided by the franchisor includes ongoing training, marketing assistance, and access to proprietary software and tools, enabling franchisees to build a successful business. On the other hand, CPAs Franchises cater to certified public accountants or individuals with significant experience in tax preparation. These franchises do not require extensive training, as the franchisees already possess the necessary skills and knowledge to operate a tax preparation business. Instead, the focus is on leveraging the brand's reputation, marketing resources, and operational support to enhance the franchisee's existing practice. CPAs Franchises offer a streamlined entry into the market, allowing experienced professionals to expand their client base and increase their revenue potential. Both types of franchises benefit from the franchisor's established brand, which helps attract clients and build trust in the services offered. The choice between a Beginner Franchise and a CPAs Franchise depends on the individual's background, experience, and business goals. For those new to the industry, a Beginner Franchise provides the necessary training and support to succeed, while experienced professionals can capitalize on their expertise with a CPAs Franchise. Regardless of the type, franchisees in the Global Tax Preparation Franchise Market have the opportunity to tap into a growing demand for tax services and build a profitable business.

Personal Investment, Corporate Investment in the Global Tax Preparation Franchise Market:

The Global Tax Preparation Franchise Market plays a significant role in both personal and corporate investment strategies. For personal investment, individuals often seek the expertise of tax preparation franchises to ensure they are maximizing their tax benefits and minimizing liabilities. These franchises provide valuable advice on tax-efficient investment strategies, helping individuals make informed decisions about their portfolios. By understanding the tax implications of various investment options, individuals can optimize their returns and achieve their financial goals. Tax preparation franchises also assist with retirement planning, estate planning, and other long-term financial strategies, ensuring that individuals are well-prepared for the future. On the corporate side, businesses rely on tax preparation franchises to navigate the complex landscape of corporate taxation. These franchises offer services such as tax compliance, tax planning, and advisory services, helping businesses manage their tax obligations effectively. By leveraging the expertise of tax professionals, businesses can identify opportunities for tax savings and ensure compliance with ever-changing tax regulations. This is particularly important for multinational corporations, which face additional challenges due to varying tax laws across different jurisdictions. Tax preparation franchises provide the necessary support to manage these complexities, allowing businesses to focus on their core operations. Additionally, these franchises assist with mergers and acquisitions, helping companies understand the tax implications of such transactions and develop strategies to minimize tax liabilities. Overall, the Global Tax Preparation Franchise Market is an essential component of both personal and corporate investment strategies, providing the expertise and support needed to navigate the intricacies of taxation and achieve financial success.

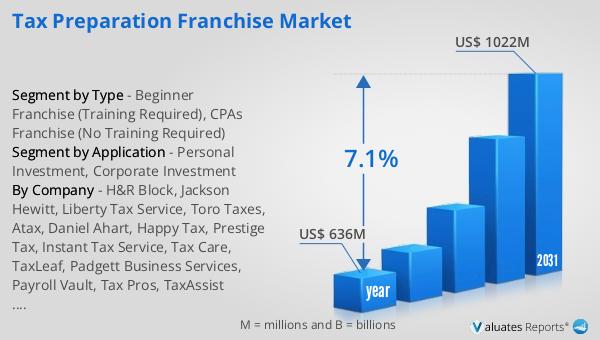

Global Tax Preparation Franchise Market Outlook:

The outlook for the Global Tax Preparation Franchise Market indicates a promising future, with significant growth expected over the coming years. In 2024, the market was valued at approximately US$ 636 million, reflecting the substantial demand for tax preparation services worldwide. This demand is driven by the increasing complexity of tax regulations and the need for professional assistance to ensure compliance and optimize tax liabilities. As the market continues to evolve, it is projected to reach a revised size of US$ 1022 million by 2031, representing a compound annual growth rate (CAGR) of 7.1% during the forecast period. This growth is attributed to several factors, including the rise in self-employment and small businesses, which require expert tax services to manage their financial obligations. Additionally, the expansion of the global economy and the increasing number of multinational corporations contribute to the demand for tax preparation franchises. These businesses rely on the expertise of tax professionals to navigate the complexities of international tax laws and ensure compliance across different jurisdictions. The franchising model offers a unique advantage, providing entrepreneurs with the support and resources needed to succeed in the competitive tax services industry. As a result, the Global Tax Preparation Franchise Market is poised for continued growth, offering opportunities for both new and existing franchisees to expand their operations and meet the needs of a diverse clientele.

| Report Metric | Details |

| Report Name | Tax Preparation Franchise Market |

| Accounted market size in year | US$ 636 million |

| Forecasted market size in 2031 | US$ 1022 million |

| CAGR | 7.1% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | H&R Block, Jackson Hewitt, Liberty Tax Service, Toro Taxes, Atax, Daniel Ahart, Happy Tax, Prestige Tax, Instant Tax Service, Tax Care, TaxLeaf, Padgett Business Services, Payroll Vault, Tax Pros, TaxAssist Accountants, Trans Canada Tax Service |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |