What is Global Sell-Side Due Diligence Services Market?

The Global Sell-Side Due Diligence Services Market is a specialized sector within the broader financial services industry, focusing on providing comprehensive analysis and evaluation services to sellers in a transaction. These services are crucial for sellers who want to present their business in the best possible light to potential buyers. The process involves a thorough examination of the seller's financial records, operational processes, and strategic positioning to identify any potential risks or opportunities that could impact the transaction. By doing so, sellers can address any issues proactively, ensuring a smoother transaction process and potentially enhancing the value of the deal. This market is driven by the increasing complexity of transactions and the need for transparency and accuracy in financial reporting. As businesses continue to expand globally, the demand for sell-side due diligence services is expected to grow, providing sellers with the insights they need to make informed decisions and maximize their transaction outcomes.

Financial Due Diligence, Deal Analytics, IT Due Diligence, Cybersecurity Protection, Tax Advisory/Structuring, Others in the Global Sell-Side Due Diligence Services Market:

Financial Due Diligence is a critical component of the Global Sell-Side Due Diligence Services Market, focusing on the detailed examination of a company's financial health. This involves analyzing financial statements, cash flow, revenue streams, and profitability to ensure accuracy and identify any potential red flags. Deal Analytics, on the other hand, leverages data analytics to provide insights into the transaction, helping sellers understand market trends, pricing strategies, and competitive positioning. IT Due Diligence assesses the technological infrastructure of a company, ensuring that IT systems are robust, scalable, and secure. This is particularly important in today's digital age, where technology plays a pivotal role in business operations. Cybersecurity Protection is another vital aspect, as it evaluates the company's defenses against cyber threats, ensuring that sensitive data is protected and that there are no vulnerabilities that could be exploited during or after the transaction. Tax Advisory/Structuring involves analyzing the tax implications of a deal, helping sellers optimize their tax position and ensure compliance with relevant regulations. This can significantly impact the overall value of the transaction. Other services within this market may include legal due diligence, which examines contractual obligations and potential legal risks, and operational due diligence, which assesses the efficiency and effectiveness of business operations. Together, these services provide a comprehensive overview of the seller's business, enabling them to present a well-rounded and attractive proposition to potential buyers.

Financial Industry, Consumer & Retail, Industrial Manufacturing, Energy & Natural Resources, Real Estate, Others in the Global Sell-Side Due Diligence Services Market:

The usage of Global Sell-Side Due Diligence Services Market spans various industries, each with its unique requirements and challenges. In the Financial Industry, these services are crucial for ensuring that financial institutions are accurately represented during mergers and acquisitions. This involves a detailed analysis of financial statements, regulatory compliance, and risk management practices. In the Consumer & Retail sector, due diligence services help sellers understand consumer behavior, market trends, and competitive dynamics, enabling them to position their business effectively in the market. For Industrial Manufacturing, these services focus on evaluating production processes, supply chain efficiency, and technological capabilities, ensuring that the business is operating at optimal levels. In the Energy & Natural Resources sector, due diligence involves assessing the sustainability and environmental impact of operations, as well as evaluating the potential for future growth and profitability. Real Estate transactions require a thorough examination of property valuations, zoning regulations, and market conditions to ensure that sellers can maximize the value of their assets. Other industries, such as healthcare and technology, also benefit from sell-side due diligence services, as they provide a comprehensive understanding of the business landscape and help sellers navigate complex regulatory environments. By leveraging these services, businesses across various sectors can enhance their transaction outcomes and achieve their strategic objectives.

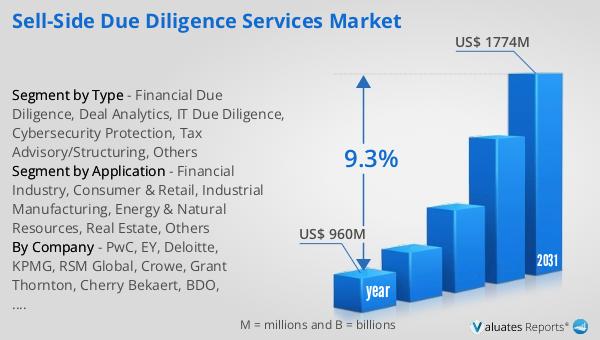

Global Sell-Side Due Diligence Services Market Outlook:

The global market for Sell-Side Due Diligence Services was valued at approximately $960 million in 2024. It is anticipated to expand significantly, reaching an estimated size of $1,774 million by 2031. This growth represents a compound annual growth rate (CAGR) of 9.3% over the forecast period. This upward trajectory highlights the increasing demand for comprehensive due diligence services as businesses seek to optimize their transaction processes and outcomes. The market's expansion is driven by the growing complexity of transactions, the need for transparency and accuracy in financial reporting, and the increasing importance of risk management in today's business environment. As companies continue to pursue mergers, acquisitions, and other strategic initiatives, the demand for sell-side due diligence services is expected to rise, providing sellers with the insights and support they need to navigate the complexities of the transaction landscape. This growth underscores the critical role that due diligence services play in facilitating successful transactions and maximizing value for sellers.

| Report Metric | Details |

| Report Name | Sell-Side Due Diligence Services Market |

| Accounted market size in year | US$ 960 million |

| Forecasted market size in 2031 | US$ 1774 million |

| CAGR | 9.3% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | PwC, EY, Deloitte, KPMG, RSM Global, Crowe, Grant Thornton, Cherry Bekaert, BDO, CohnReznick, CBIZ, CLA (CliftonLarsonAllen), EisnerAmper, Moss Adams, Kroll, Smith & Williamson, Experian, Refinitiv, RPS Group, Rödl Langford de Kock LLP |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |