What is Global Mobile Payment Data Protection System Market?

The Global Mobile Payment Data Protection System Market is a rapidly evolving sector that focuses on safeguarding sensitive financial information during mobile transactions. As mobile payments become increasingly popular, the need for robust data protection systems has grown significantly. These systems are designed to secure personal and financial data from unauthorized access and cyber threats, ensuring that transactions are safe and reliable. They employ advanced encryption technologies, tokenization, and secure authentication methods to protect data integrity and confidentiality. The market encompasses a wide range of solutions, including software and hardware components, aimed at preventing data breaches and fraud. With the proliferation of smartphones and the convenience of mobile payments, businesses and consumers alike are prioritizing data security. This market is driven by the increasing adoption of mobile payment solutions across various industries, including retail, banking, and telecommunications. As regulatory requirements for data protection become more stringent, companies are investing in advanced security measures to comply with standards and protect their customers' information. The Global Mobile Payment Data Protection System Market is poised for significant growth as it continues to adapt to the evolving landscape of digital transactions and cybersecurity challenges.

Contact Payments, Remote Payments, Others in the Global Mobile Payment Data Protection System Market:

In the realm of mobile payments, there are several key categories that define how transactions are conducted and protected: Contact Payments, Remote Payments, and Others. Contact Payments refer to transactions that occur when a mobile device is physically present at the point of sale. This typically involves technologies like Near Field Communication (NFC) or QR codes, where the user taps or scans their device to complete a payment. The data protection systems in this category focus on securing the communication between the device and the payment terminal, ensuring that sensitive information is encrypted and transmitted safely. These systems also incorporate authentication methods such as biometrics or PIN codes to verify the user's identity, adding an extra layer of security. Remote Payments, on the other hand, involve transactions where the payer and payee are not in the same physical location. This includes online shopping, mobile banking, and peer-to-peer transfers. Data protection in this category is crucial as it deals with the transmission of sensitive information over the internet. Encryption plays a vital role in securing these transactions, along with secure socket layer (SSL) protocols and multi-factor authentication to prevent unauthorized access. The systems are designed to detect and mitigate potential threats such as phishing attacks, malware, and data breaches. The "Others" category encompasses a variety of mobile payment methods that do not fit neatly into the contact or remote categories. This includes emerging technologies like blockchain-based payments, which offer decentralized and secure transaction methods. Data protection systems in this area are focused on ensuring the integrity and authenticity of transactions, leveraging cryptographic techniques to safeguard information. Additionally, mobile wallets and in-app payments fall under this category, where data protection systems work to secure stored payment information and facilitate secure transactions within mobile applications. Across all these categories, the Global Mobile Payment Data Protection System Market is driven by the need to protect consumer data and maintain trust in mobile payment solutions. As mobile payment technologies continue to evolve, so too do the methods and systems designed to protect them, ensuring that users can transact with confidence and security.

Telecom & Information Technology, Banking & Financial Service, Government, Transportation, Retail, Entertainment and Media, Others in the Global Mobile Payment Data Protection System Market:

The Global Mobile Payment Data Protection System Market finds its application across various sectors, each with unique requirements and challenges. In the Telecom & Information Technology sector, these systems are crucial for securing mobile transactions related to bill payments, mobile recharges, and digital services. The integration of data protection systems ensures that customer information is safeguarded against unauthorized access and cyber threats, maintaining the integrity of telecom services. In the Banking & Financial Service industry, mobile payment data protection is paramount as it deals with highly sensitive financial information. Banks and financial institutions employ advanced encryption and authentication technologies to secure mobile banking apps and transactions, preventing fraud and data breaches. The Government sector also benefits from mobile payment data protection systems, particularly in areas like tax payments, fines, and public service transactions. These systems help protect citizens' personal and financial data, ensuring secure and efficient government services. In the Transportation sector, mobile payment systems are used for ticketing, toll payments, and ride-sharing services. Data protection systems ensure that payment information is securely transmitted and stored, preventing unauthorized access and fraud. The Retail industry relies heavily on mobile payments for point-of-sale transactions, online shopping, and loyalty programs. Data protection systems in this sector focus on securing customer information and transaction data, enhancing consumer trust and satisfaction. The Entertainment and Media industry utilizes mobile payment systems for subscriptions, ticketing, and in-app purchases. Data protection systems ensure that payment information is secure, allowing consumers to enjoy digital content without concerns about data breaches. Other sectors, such as healthcare and education, also benefit from mobile payment data protection systems, ensuring secure transactions for services like telemedicine and online courses. Across all these sectors, the Global Mobile Payment Data Protection System Market plays a vital role in enabling secure and reliable mobile transactions, fostering trust and confidence among consumers and businesses alike.

Global Mobile Payment Data Protection System Market Outlook:

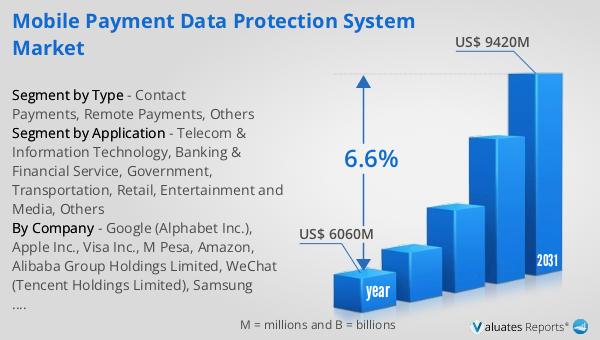

The global market for Mobile Payment Data Protection Systems is on a growth trajectory, with its valuation standing at approximately US$ 6,060 million in 2024. This market is anticipated to expand significantly, reaching an estimated size of US$ 9,420 million by 2031. This growth is driven by a compound annual growth rate (CAGR) of 6.6% over the forecast period. The increasing adoption of mobile payment solutions across various industries, coupled with the rising concerns over data security, is fueling this market expansion. As more consumers and businesses embrace the convenience of mobile payments, the demand for robust data protection systems is becoming more pronounced. These systems are essential for safeguarding sensitive financial information and ensuring secure transactions, thereby enhancing consumer trust and confidence. The market's growth is also supported by advancements in encryption technologies, authentication methods, and regulatory requirements for data protection. Companies are investing in innovative solutions to comply with these standards and protect their customers' information. As the digital landscape continues to evolve, the Global Mobile Payment Data Protection System Market is poised to play a crucial role in enabling secure and reliable mobile transactions, driving its growth and development in the coming years.

| Report Metric | Details |

| Report Name | Mobile Payment Data Protection System Market |

| Accounted market size in year | US$ 6060 million |

| Forecasted market size in 2031 | US$ 9420 million |

| CAGR | 6.6% |

| Base Year | year |

| Forecasted years | 2025 - 2031 |

| Segment by Type |

|

| Segment by Application |

|

| By Region |

|

| By Company | Google (Alphabet Inc.), Apple Inc., Visa Inc., M Pesa, Amazon, Alibaba Group Holdings Limited, WeChat (Tencent Holdings Limited), Samsung Electronics Co. Ltd., American Express Company, Money Gram International, PayPal Holdings Inc., Mastercard, Stripe, Paytm, Braintree |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |